Question: Based on the data in case Exhibits 1 ans 4, is Costco's financial performance superior to that at Sams Club or BJ's Wholesale? why or

Based on the data in case Exhibits 1 ans 4, is Costco's financial performance superior to that at Sams Club or BJ's Wholesale? why or why not? As well as what recommendations would you make to Costco top management regarding how best to sustain the company's growth and improve its funancial performance?

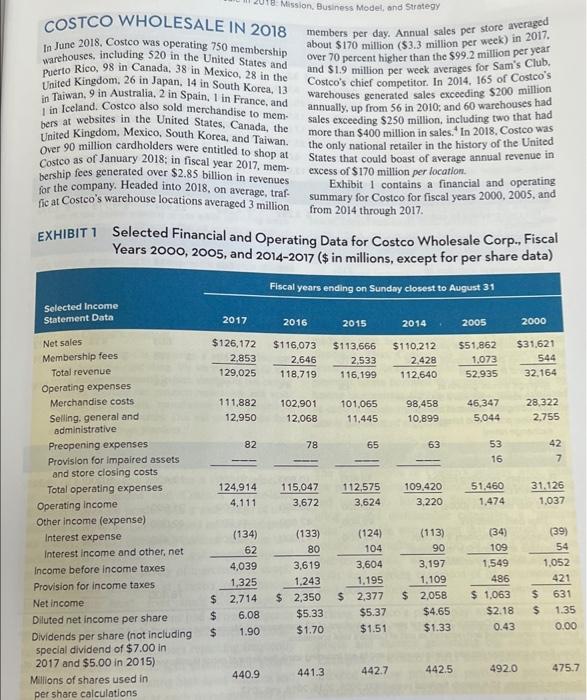

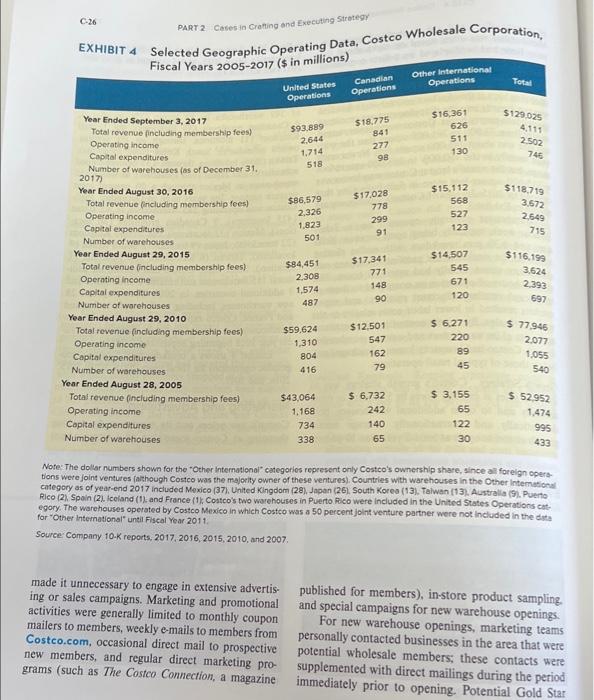

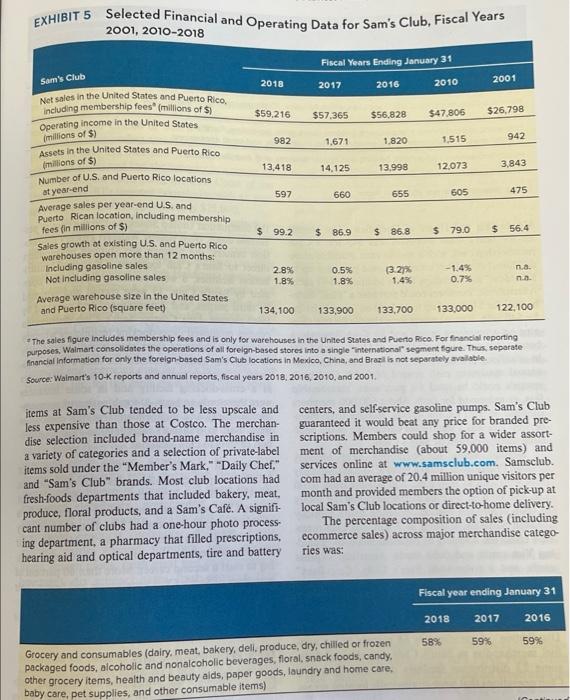

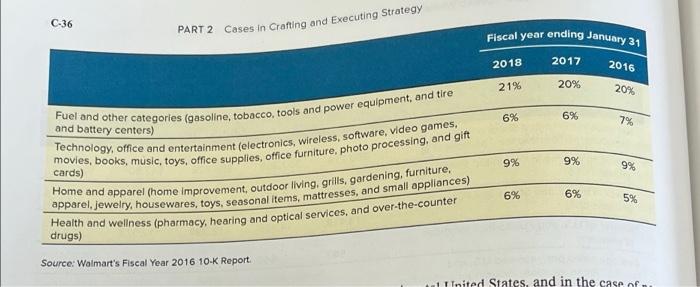

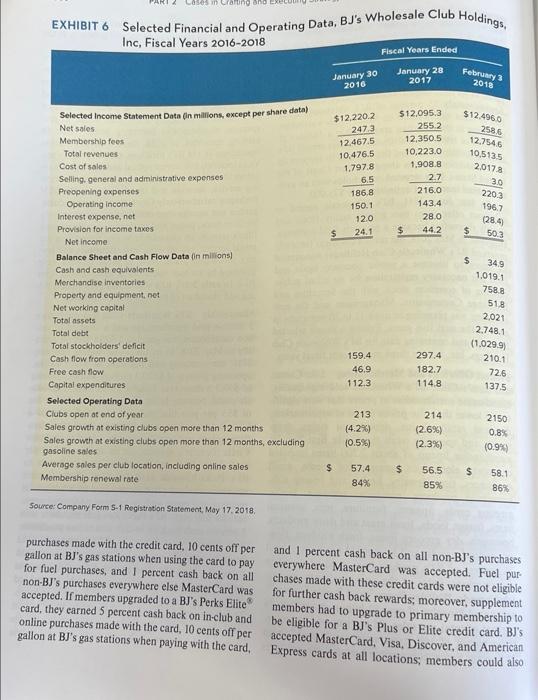

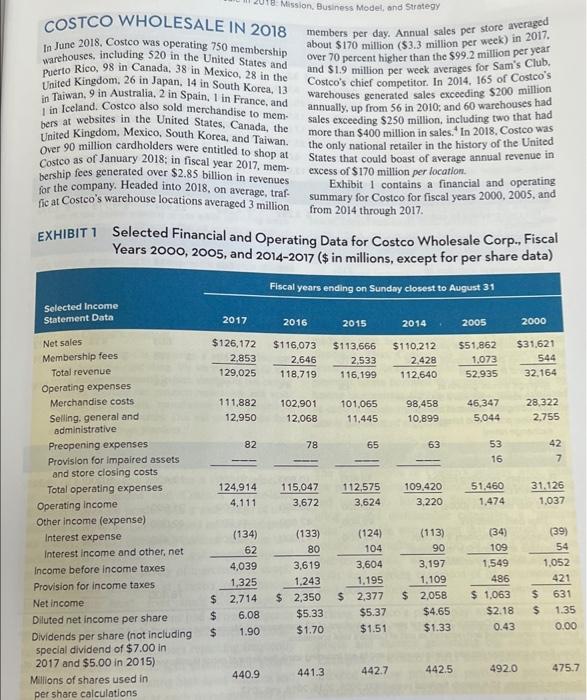

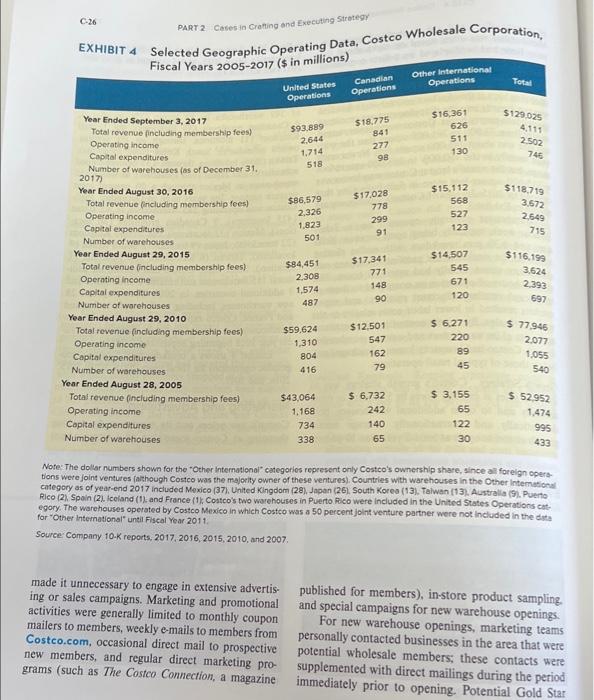

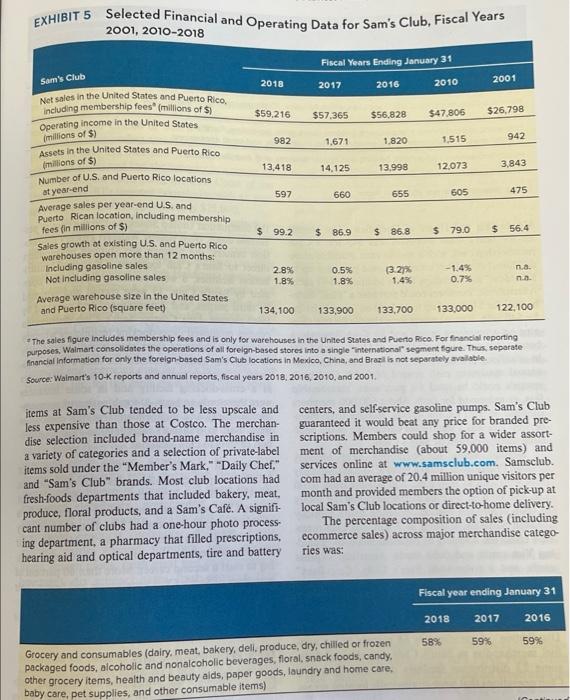

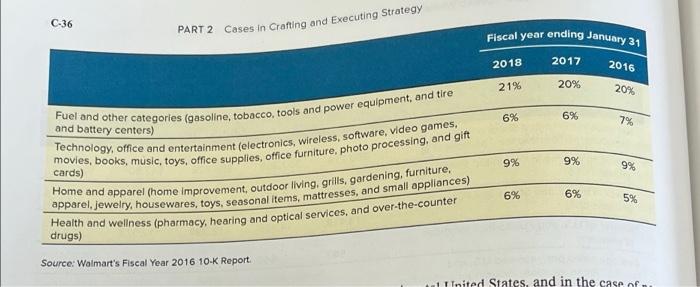

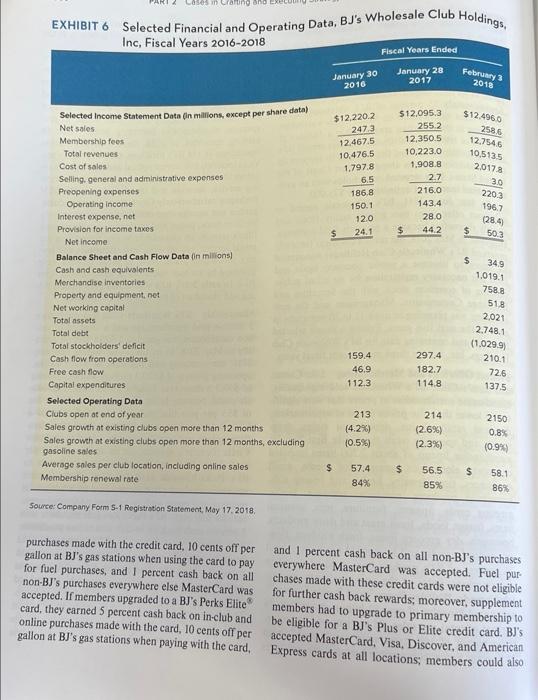

Mission Business Model, and Strategy COSTCO WHOLESALE IN 2018 members per day. Annual sales per store averaged warehouses, including 520 in the United States and In June 2018, Costco was operating 750 membership about $170 million ($3.3 million per week) in 2017. over 70 percent higher than the $99.2 million per year Puerto Rico, 98 in Canada, 38 in Mexico, 28 in the and $1.9 million per week averages for Sam's Club, United Kingdom, 26 in Japan, 14 in South Korea, 13 Costco's chief competitor. In 2014, 165 of Costco's in Taiwan, 9 in Australia, 2 in Spain, 1 in France, and Warehouses generated sales exceeding $200 million 1 in Iceland. Costco also sold merchandise to mem- annually, up from 56 in 2010 and 60 warehouses had bers at websites in the United States, Canada, the sales exceeding $250 million, including two that had United Kingdom, Mexico, South Korea, and Taiwan. more than $400 million in sales. In 2018, Costco was Over 90 million cardholders were entitled to shop at the only national retailer in the history of the United Costco as of January 2018; in fiscal year 2017, mem- States that could boast of average annual revenue in bership fees generated over $2.85 billion in revenues excess of $170 million per location. for the company. Headed into 2018, on average, traf- Exhibit 1 contains a financial and operating fic at Costco's warehouse locations averaged 3 million summary for Costco for fiscal years 2000, 2005, and 3 from 2014 through 2017 EXHIBIT 1 Selected Financial and Operating Data for Costco Wholesale Corp., Fiscal Years 2000, 2005, and 2014-2017 ($ in millions, except for per share data) Fiscal years ending on Sunday closest to August 31 Selected Income Statement Data 2017 2016 2015 2014 2005 2000 $126.172 2.853 129,025 $116,073 2,646 118,719 $113,666 2.533 116,199 $110.212 2,428 112,640 $51,862 1,073 52.935 $31,621 544 32,164 111.882 12.950 102.901 12,068 101,065 11.445 98,458 10,899 46,347 5.044 28.322 2.755 82 78 65 63 53 16 42 7 124,914 4.111 115,047 3,672 112,575 3.624 109,420 3,220 51,460 1.474 31.126 1,037 Net sales Membership fees Total revenue Operating expenses Merchandise costs Selling, general and administrative Preopening expenses Provision for impaired assets and store closing costs Total operating expenses Operating Income Other Income (expense) Interest expense Interest Income and other net Income before income taxes Provision for income taxes Net income Diluted net income per share Dividends per share (not including special dividend of $7.00 in 2017 and $5.00 in 2015) Millions of shares used in per share calculations (134) 62 4,039 1,325 $ 2,714 $ 6.08 $ 1.90 (133) 80 3,619 1.243 $ 2,350 $5.33 $1.70 (124) 104 3,604 1,195 2.377 $5.37 $1.51 (113) 90 3,197 1,109 $ 2,058 $4.65 $1.33 (34) 109 1,549 486 $ 1,063 $2.18 0.43 (39) 54 1.052 421 $ 631 $ 1.35 0.00 $ 441.3 442.7 4425 440.9 492.0 475.7 C-26 EXHIBIT 4 PART 2 Cases in Crotting and executing Strategy Selected Geographic Operating Data, Costco Wholesale Corporation, Fiscal Years 2005-2017 ($ in millions) United States Canadian Other International Operations Operations Operations Total $93.889 2.644 1,714 518 $18.775 841 277 98 $ 16,361 626 511 130 $129025 4,111 2.502 745 $15,112 568 $118.719 3,672 2,549 $86,579 2.326 1.823 501 $17,028 778 299 91 527 123 715 Year Ended September 3, 2017 Total revenue including membership fees) Operating income Capital expenditures Number of warehouses (as of December 31. 2017) Year Ended August 30, 2016 Total revenue (including membership fees) Operating income Capital expenditures Number of warehouses Year Ended August 29, 2015 Total revenue including membership fees) Operating income Capital expenditures Number of warehouses Year Ended August 29, 2010 Total revenue (including membership fees) Operating income Capital expenditures Number of warehouses Year Ended August 28, 2005 Total revenue (including membership fees) Operating income Capital expenditures Number of warehouses $84,451 2 303 1,574 $17,341 771 148 $14.507 545 671 120 $116,199 3,624 2.393 697 487 90 $59.624 1,310 804 416 $12.501 547 162 79 $ 6.271 220 89 45 $77.946 2.077 1055 540 $43,064 1.168 734 338 $ 6,732 242 140 65 $ 3,155 65 122 30 $ 52.952 1.474 995 433 Note: The dollar numbers shown for the Other International Categories represent only Costco's ownership share, since a foreign opere tions were joint ventures (although Costco was the majority owner of these ventures). Countries with warehouses in the Other Interation Category as of year-end 2017 included Mexico (37), United Kingdom (28) Japan (26). South Korea (13). Talwan (13). Australia 19). Puerto Rico (2) Spain (21. Iceland (1) and France (1) Costco's two warehouses in Puerto Rico were included in the United States Operations cat egory. The warehouses operated by Costco Mexico in which Costco was a 50 percent joint venture partner were not included in the data for "Other International until Fiscal Year 2011 Source Company 10K reports, 2017, 2016, 2015, 2010, and 2007 made it unnecessary to engage in extensive advertis- published for members), in-store product sampling, ing or sales campaigns. Marketing and promotional and special campaigns for new warehouse openings activities were generally limited to monthly coupon For new warehouse openings, marketing teams mailers to members, weekly e-mails to members from personally contacted businesses in the area that were Costco.com, occasional direct mail to prospective potential wholesale members, these contacts were new members, and regular direct marketing pro- supplemented with direct mailings during the period grams (such as The Costco Connection, a magazine immediately prior to opening. Potential Gold Star EXHIBIT 5 Selected Financial and Operating Data for Sam's Club, Fiscal Years 2001, 2010-2018 Fiscal Years Ending January 31 Sam's Club 2018 2017 2016 2010 2001 Net sales in the United States and Puerto Rico including membership fees (millions of $) Operating income in the United States $59.216 $57.365 $26,798 $56,828 $47,806 millions of $) 982 1.671 942 1.820 1.515 Assets in the United States and Puerto Rico millions of $) 13,418 14.125 13,998 12073 3.843 597 660 655 605 475 $ 99.2 $ 86.9 $ 86,8 $ 79.0 $ 56.4 Number of U.S. and Puerto Rico locations at year-end Average sales per year-end U.S. and Puerto Rican location, including membership fees (in millions of $) Sales growth of existing U.S. and Puerto Rico warehouses open more than 12 months: Including gasoline sales Not including gasoline sales Average warehouse size in the United States and Puerto Rico (square feet) na. 2.8% 1.89 0.5% 1.8% (3.2733 1.43 -1.4% 0.7% 134,100 133,900 133,700 133,000 122,100 The sales figure includes membership fees and is only for warehouses in the United States and Puerto Rico. For financial reporting purposes, Walmart consolidates the operations of all foreign-based stores into a single international" segment figure. Thus, separate financial Information for only the foreign-based Sam's Club locations in Mexico, China, and Brazil is not separately available. Source: Waimart's 10-K reports and annual reports, fiscal years 2018, 2016, 2010 and 2001. items at Sam's Club tended to be less upscale and less expensive than those at Costco. The merchan- dise selection included brand-name merchandise in a variety of categories and a selection of private-label items sold under the "Member's Mark." "Daily Chef." and "Sam's Club" brands. Most club locations had fresh-foods departments that included bakery, meat, produce, floral products, and a Sam's Caf. A signifi- cant number of clubs had a one-hour photo process ing department, a pharmacy that filled prescriptions, hearing aid and optical departments, tire and battery centers, and self-service gasoline pumps. Sam's Club guaranteed it would beat any price for branded pre- scriptions. Members could shop for a wider assort- ment of merchandise (about 59.000 items) and services online at www.samsclub.com. Samsclub. com had an average of 20.4 million unique visitors per month and provided members the option of pick-up at local Sam's Club locations or direct-to-home delivery. The percentage composition of sales (including ecommerce sales) across major merchandise catego- ries was: Fiscal year ending January 31 2018 2017 2016 58% 59% 59% Grocery and consumables (dairy, meat, bakery, deli. produce, dry, chilled or frozen packaged foods, alcoholic and nonalcoholic beverages, floral, snack foods, candy, other grocery items, health and beauty alds, paper goods, laundry and home care, baby care, pet supplies, and other consumable items) C-36 PART 2 Cases in Crafting and Executing Strategy Fiscal year ending January 31 2018 2017 2016 21% 20% 20% 6% 6% 7% and battery centers) Fuel and other categories (gasoline, tobacco, tools and power equipment, and tire movies, books, music, toys, office supplies, office furniture, photo processing, and gift Technology, office and entertainment (electronics, wireless, software, video games, 9% 9% 9% cards) ) Home and apparel (home Improvement, outdoor living. grills, gardening, furniture, 6% 6% 5% 5 Health and wellness (pharmacy, hearing and optical services, and over-the-counter Source: Walmart's Fiscal Year 2016 10 K Report Iloited States, and in the case of rating and EXHIBIT 6 Selected Financial and Operating Data, BJ's Wholesale Club Holdings, Inc, Fiscal Years 2016-2018 Fiscal Years Ended January 28 2017 January 30 2016 February 3 2018 $12.220-2 2473 12 467.5 10.476.5 1.797.8 6.5 186.8 150.1 12.0 $ 24 $12.095.3 255.2 12,350.5 10,2230 1.908.8 2.7 216.0 143.4 28.0 $ 44.2 $12.4960 258.6 12.7545 10,5935 2.017.8 30 2203 196.7 (28.4 503 $ $ Selected Income Statement Data (in millons, except per share data) Net Sales Membership fees Total revenues Cost of sales Selling general and administrative expenses Preopening expenses Operating income Interest expense, net Provision for income taxes Net income Balance Sheet and Cash Flow Data (in millions) Cash and cash equivalents Merchandise Inventories Property and equipment, net Net working capital Total assets Total debt Total stockholders deficit Cash flow from operations Free cash flow Capital expenditures Selected Operating Data Clubs open at end of year Sales growth at existing clubs open more than 12 months Sales growth at existing clubs open more than 12 months, excluding gasoline sales Average sales per club location, including online sales Membership renewal rate 349 1,019.1 758.8 518 2021 2.748.1 (1.029.9 210.1 726 1375 159.4 46.9 112.3 297.4 182.7 114.8 213 (4.2%) (0.5%) 214 (2.6%) (2.3%) 2150 0.8% (0.94 $ $ 57.4 84% $ 56.5 85% 58.1 86% Source: Company Form 5-1 Registration Statement, May 17.2018 purchases made with the credit card, 10 cents ofl per gallon at BJ's gas stations when using the card to pay for fuel purchases, and I percent cash back on all non-BJ's purchases everywhere else MasterCard was accepted. If members upgraded to a BJ's Perks Elite card, they earned 5 percent cash back on in-club and online purchases made with the card, 10 cents off per gallon at BJ's gas stations when paying with the card, and 1 percent cash back on all non-BJ's purchases everywhere MasterCard was accepted. Fuel pur- chases made with these credit cards were not eligible for further cash back rewards, moreover, supplement members had to upgrade to primary membership to be eligible for a BJ's Plus or Elite credit card. BJ's accepted MasterCard, Visa, Discover, and American Express cards at all locations, members could also

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock