Question: On January 2, 2019, Flint Corporation issued $1,950,000 of 10% bonds to yield 11% due December 31, 2028. Interest on the bonds is payable

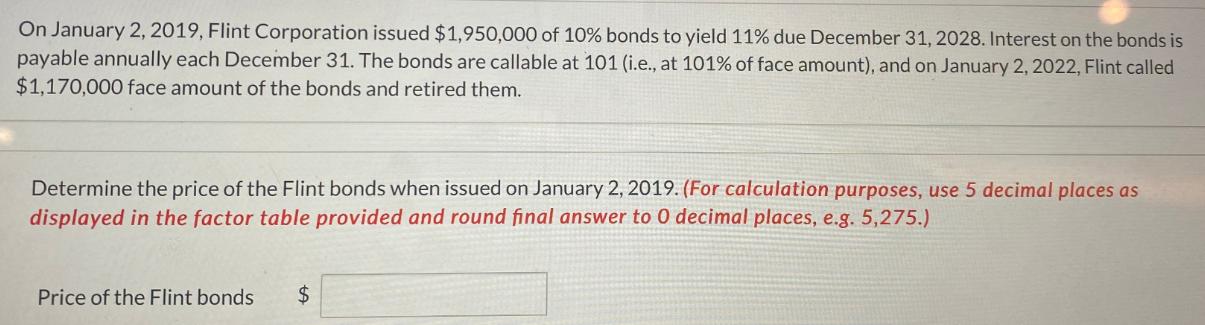

On January 2, 2019, Flint Corporation issued $1,950,000 of 10% bonds to yield 11% due December 31, 2028. Interest on the bonds is payable annually each December 31. The bonds are callable at 101 (i.e., at 101% of face amount), and on January 2, 2022, Flint called $1,170,000 face amount of the bonds and retired them. Determine the price of the Flint bonds when issued on January 2, 2019. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to O decimal places, e.g. 5,275.) Price of the Flint bonds $

Step by Step Solution

There are 3 Steps involved in it

To determine the price of the Flint bonds when issued on January 2 2019 we need to calculate the pre... View full answer

Get step-by-step solutions from verified subject matter experts