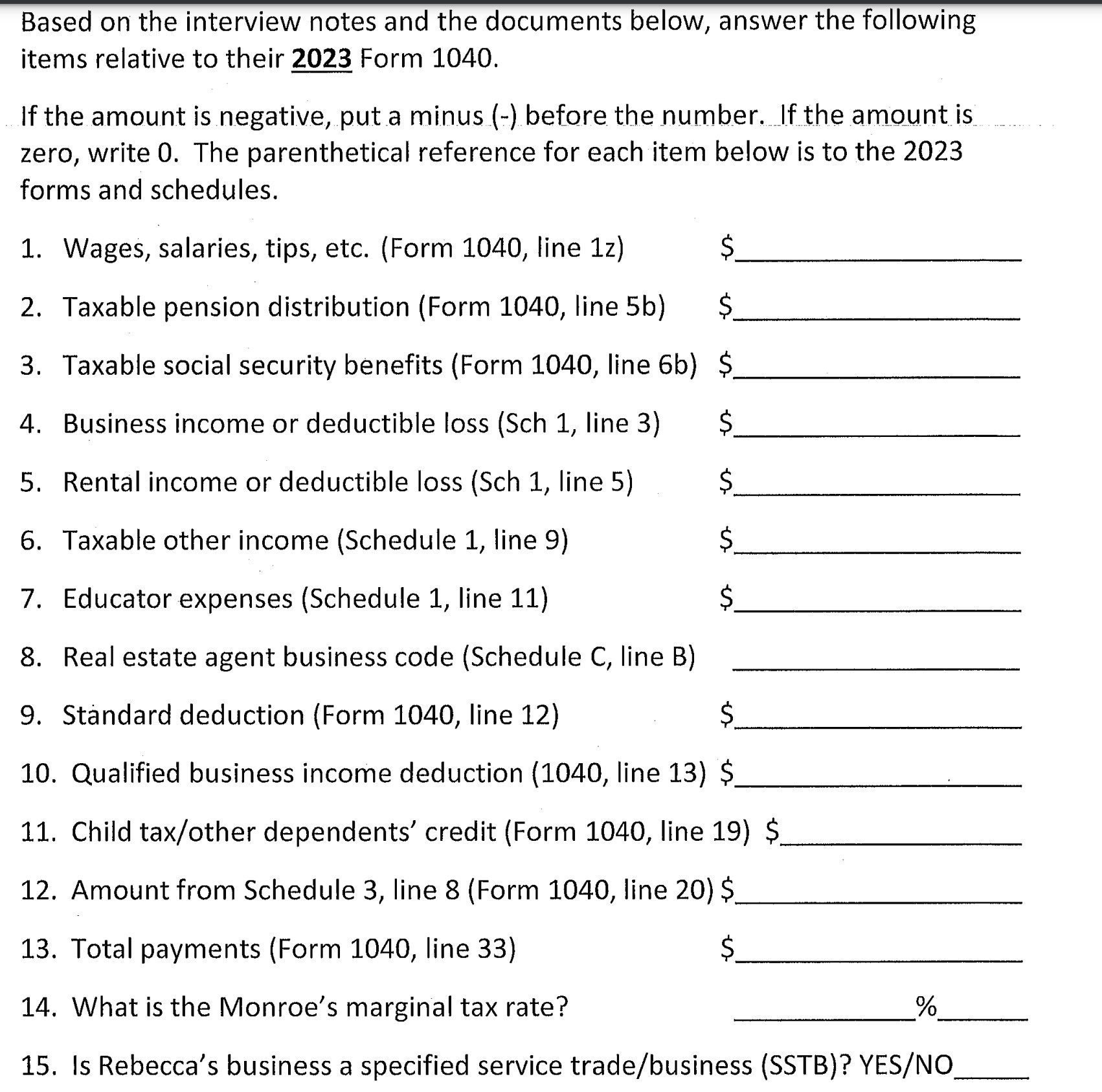

Question: Based on the interview notes and the documents below, answer the following items relative to their ( underline { 2 0 2 3

Based on the interview notes and the documents below, answer the following items relative to their underline Form

If the amount is negative, put a minus before the number. If the amount is zero, write The parenthetical reference for each item below is to the forms and schedules.

Wages, salaries, tips, etc. Form line z$

Taxable pension distribution Form line b$

Taxable social security benefits Form line b$

Business income or deductible loss Sch line $

Rental income or deductible loss Sch line $

Taxable other income Schedule line $

Educator expenses Schedule line $

Real estate agent business code Schedule C line B

Standard deduction Form line

Qualified business income deduction line $

Child taxother dependents' credit Form line $

Amount from Schedule line Form line $

Total payments Form line

What is the Monroe's marginal tax rate?

Is Rebecca's business a specified service tradebusiness SSTB YESNO

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock