Question: Document Review Simulation - Jeff and Claire Pickens - FALL 2023 Answer the 15 items below on Canvas in the Document Review Simulation Fall 2023

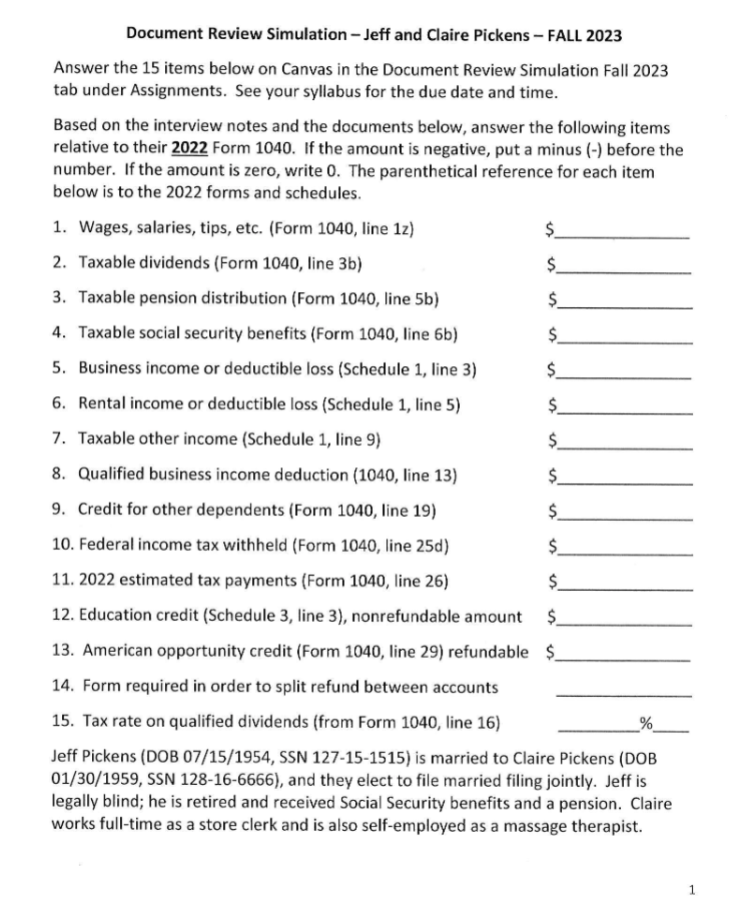

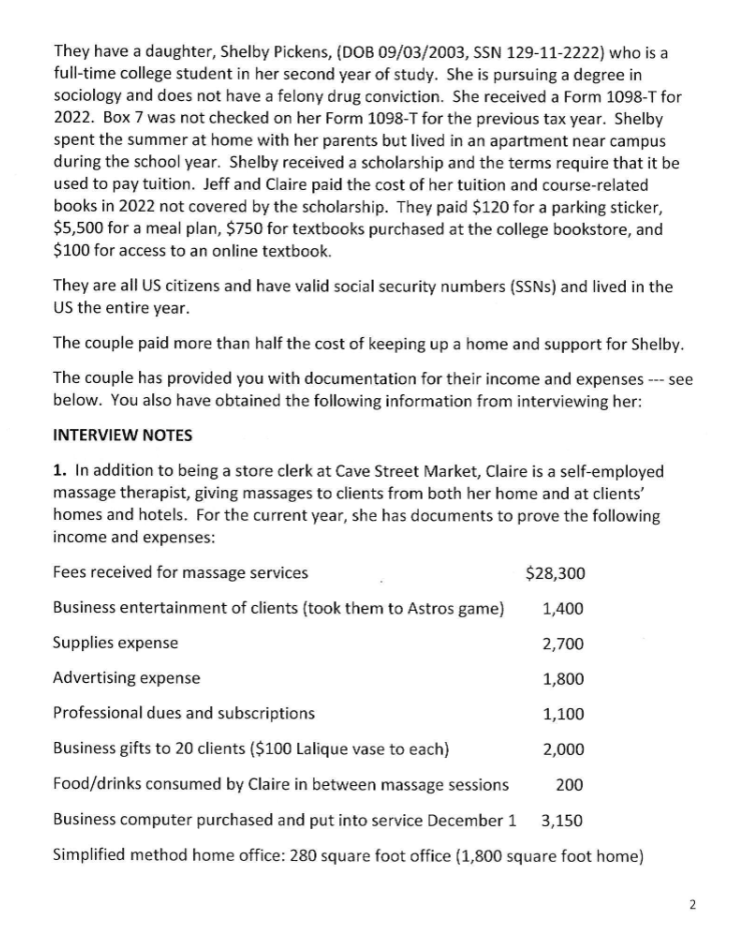

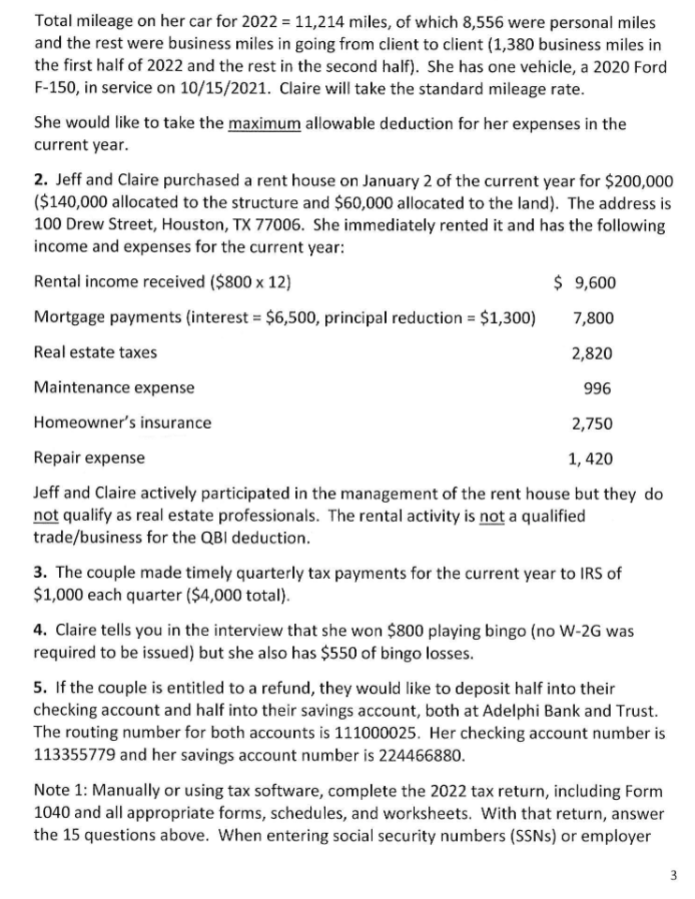

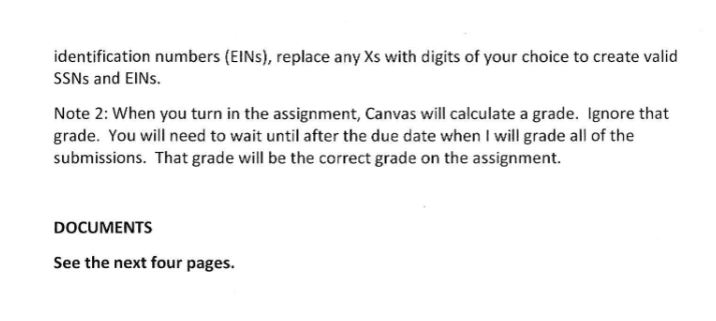

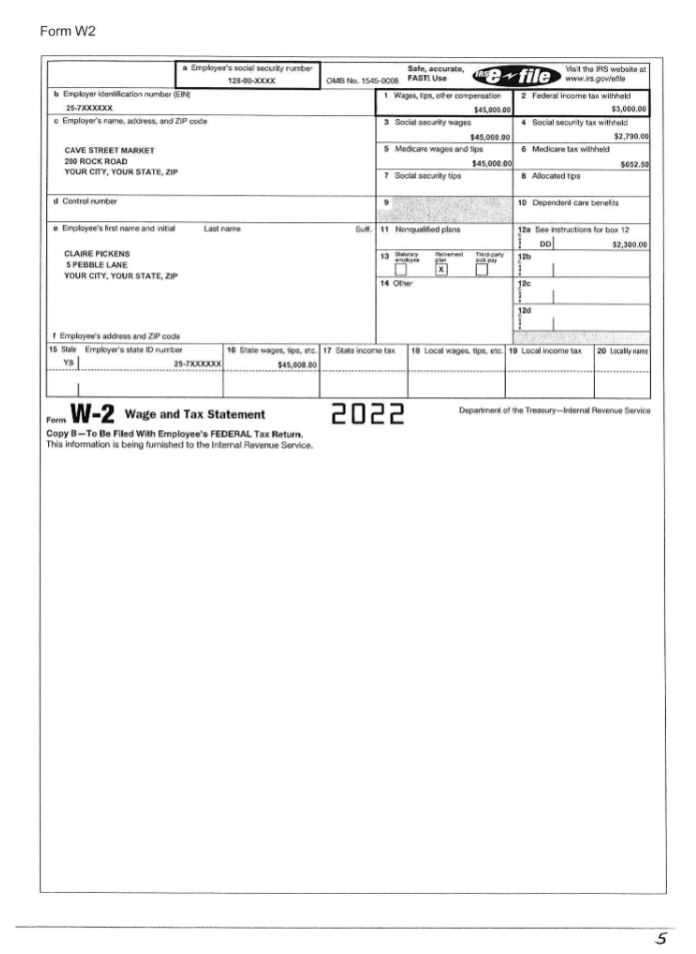

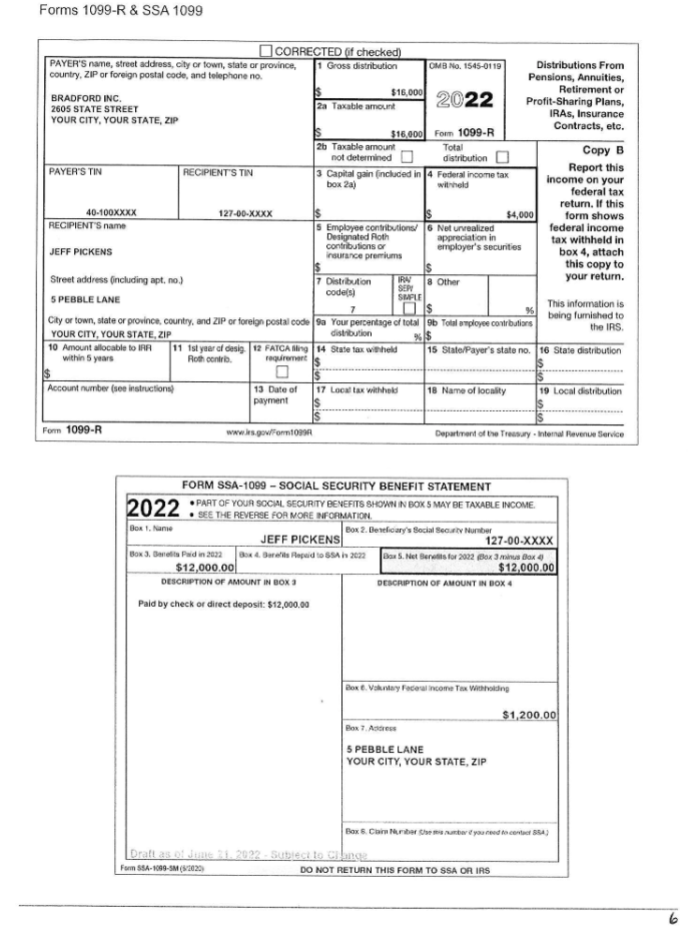

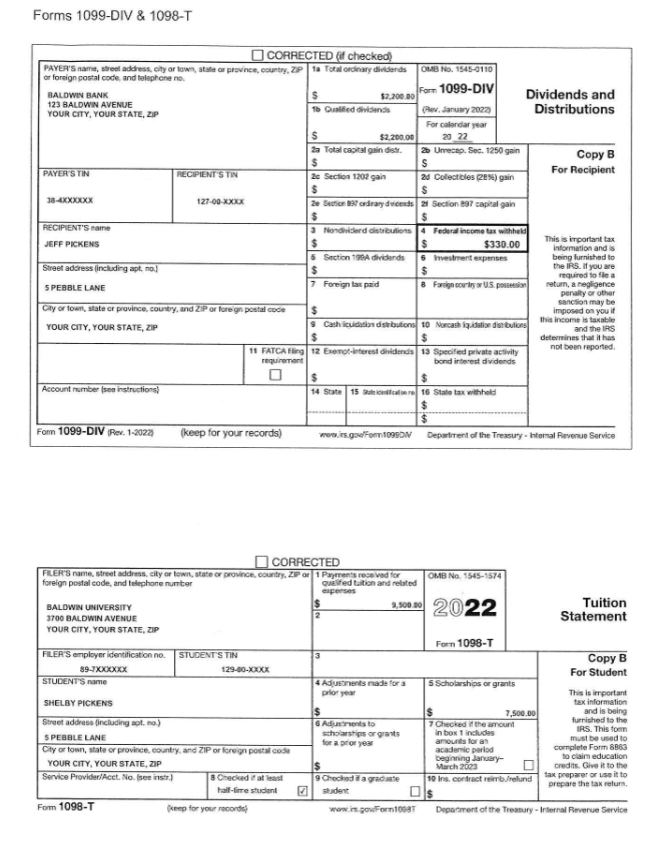

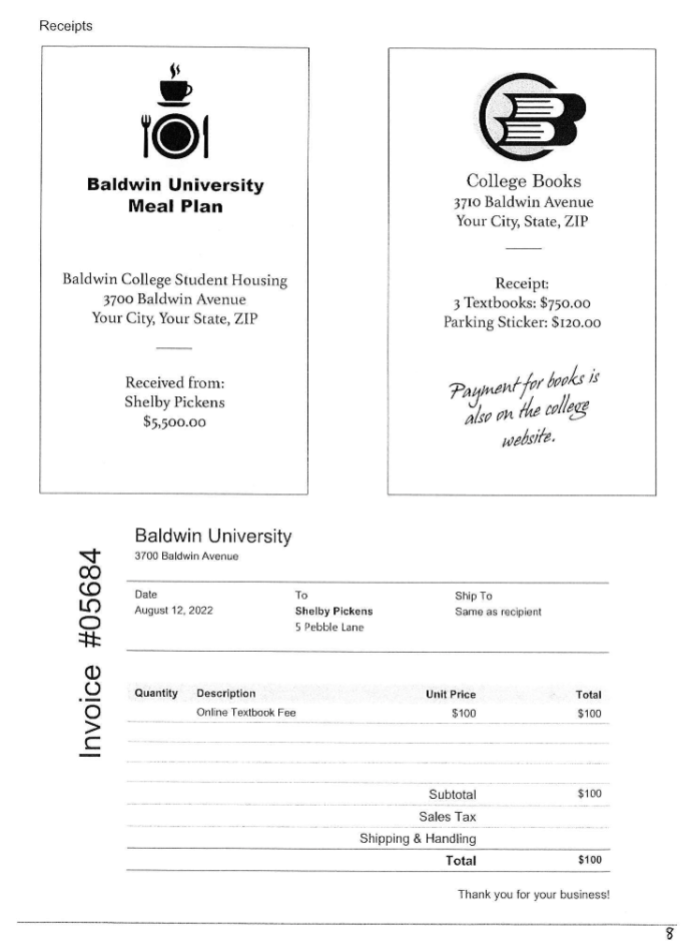

Document Review Simulation - Jeff and Claire Pickens - FALL 2023 Answer the 15 items below on Canvas in the Document Review Simulation Fall 2023 tab under Assignments. See your syllabus for the due date and time. Based on the interview notes and the documents below, answer the following items relative to their 2022 Form 1040. If the amount is negative, put a minus (-) before the number. If the amount is zero, write 0. The parenthetical reference for each item below is to the 2022 forms and schedules. 1. Wages, salaries, tips, etc. (Form 1040, line 1z) 2. Taxable dividends (Form 1040, line 3b) 3. Taxable pension distribution (Form 1040, line 5b) 4. Taxable social security benefits (Form 1040, line 6b) 5. Business income or deductible loss (Schedule 1, line 3) 6. Rental income or deductible loss (Schedule 1, line 5) 7. Taxable other income (Schedule 1, line 9) 8. Qualified business income deduction (1040, line 13) 9. Credit for other dependents (Form 1040, line 19) 10. Federal income tax withheld (Form 1040, line 25d) 11. 2022 estimated tax payments (Form 1040, line 26) 12. Education credit (Schedule 3, line 3), nonrefundable amount 13. American opportunity credit (Form 1040, line 29) refundable $ 14. Form required in order to split refund between accounts 15. Tax rate on qualified dividends (from Form 1040, line 16) % Jeff Pickens (DOB 07/15/1954, SSN 127-15-1515) is married to Claire Pickens (DOB 01/30/1959, SSN 128-16-6666), and they elect to file married filing jointly. Jeff is legally blind; he is retired and received Social Security benefits and a pension. Claire works full-time as a store clerk and is also self-employed as a massage therapist.They have a daughter, Shelby Pickens, {DUB 03f03!2003, SShI 123412222] who is a full-time college student in her second year of study. She is pursuing a degree in sociology and does not have a felony drug conviction. She received a Form 1093-T for 2022. Box Ir' was not checked on her Form 1033T for the previous tax year. Shelby spent the summer at home with her parents but lived in an apartment near campus during the school year. Shelby received a scholarship and the terms require that it be used to pay tuition. Jeff and Claire paid the cost of her tuition and course-related books in 2022 not covered by the scholarship. They paid $120 for a parking sticker, $5,500 for a meal plan, $3030 for textbooks purchased at the college bookstore, and $100 for access to a n online textbook. 'l'hey are all US citizens and have valid social security numbers [SSNs] and lived in the US the entire year. fhe couple paid more than half the cost of keeping up a home and support for Shelby. The couple has provided you with documentation for their income and expenses see below. You also have obtained the following information from interviewing her: INTERVIEW NOTES 1. In addition to being a store clerk at Cave Street Market, Claire is a selfemployed massage therapist, giving massages to clients from both her home and at clients' homes and hotels. For the current year, she has documents to prove the following income and expenses: Fees received for massage services $23,300 Business entertainment of clients {took them to Astros game} 1,400 Supplies expense 2,?00 Advertising expense 1,300 Professional dues and subscriptions 1,100 Business gifts to 20 clients {$100 Lalique vase to each} 2,000 Foodfd rinks consumed by Claire in between massage sessions 200 Business computer purchased and put into service December 1 3,150 Simplied method home office: 230 square foot office {1,300 square foot home] Totai mileage on her car for 2022 = 11,214 miles, of which 8.555 were personal miles and the rest were business miles in going from client to client {1,330 business miles in the first half of 2022 and the rest in the second half]. She has one vehicle; a 2020 Ford F-150, in service on 10.!15g'2021. Claire will take the standard mileage rate. She would like to ta ice the maximum allowable deduction for her expenses in the current year. 2. Jeff and Claire purchased a rent house on January 2 of the current year for $200,000 ($140,000 allocated to the structure and 550,000 allocated to the land}. The address is 100 Drew Street. Houston, TX 22006. She immediately rented it and has the following income and expenses for the current year: Rental income received [$000x 12] 5 9.600 Mortgage payments {interest = $6,500, principal reduction = $1,300} 2,800 Real estate taxes 2.320 Maintenance expense 995 Homeowner's insurance 2,250 Repair expense 1. 420 Jeff and Claire actively participated in the management of the rent house but they do n_ot quaiify as real estate professionals. The rental activity is n_ot a qualified tradefbusiness for the Bi deduction. 3. The couple made timely quarterly tax payments for the current year to IRS of $1,000 each quarter (54,000 total]. 4. Claire tells you in the interview that she won 3300 playing bingo [no W-2G was required to be issued} but she also has 5550 of bingo losses. 5. If the couple is entitled to a refund, they would like to deposit half into their checking account and half into their savings account. both at Adelphi Bank and Trust. The routing number for both accounts is 111000025. Her checking account number is 113355229 and her savings account number is 224455330. Note 1'. Manually or using tax software. complete the 2022 tax return. including Form 1040 and all appropriate forms, schedules, and worksheets. With that return, answer the 15 questions above. 1When entering social security numbers [SSNsi or employer identification numbers (EINs), replace any Xs with digits of your choice to create valid SSNs and EINs. Note 2: When you turn in the assignment, Canvas will calculate a grade. Ignore that grade. You will need to wait until after the due date when I will grade all of the submissions. That grade will be the correct grade on the assignment. DOCUMENTS See the next four pages.Form W2 a Employed's social security rumbe Sale, accurate, I:5 website at 128-00-JACK DUIB No. 1545-0008 FAST! Use e~ file www.is.powell b Employer idonilication number (EIN 1 Wayis, Ops, offer compensator Federal income tax withhold $45,008.00 43,000.00 c Employer's name, address, and ZIP code jopial security tax withhold 145,008.00 $2,790,09 CAVE STREET MARKET 5 Medicaw we pes and tips 6 Medicare tax withhe'd 210 ROCK ROAD $45,000.00 $652.50 YOUR CITY, YOUR STATE, ZIP 7 Social security bigs 8 Allocated tips Control rumber 10 Dependent care benefit e Employee's first name and initial Last name Gulf. 11 Nongunified plans Pa See Instructions for box 12 DD $2,300.00 CLAIRE PICKENS S PEBBLE LANE YOUR CITY, YOUR STATE, ZIP 14 Other Employee's address and ZIP code 15 Stain Employer's state ID purrber 18 State wages, tips, etc. 17 Stale income tax 18 Local wages, tips, etc. 19 Local income tax 20 Licalily name YS 25-7XXXXXX 145,008 80 Form WV-2 Wage and Tax Statement 2022 Department of the Treasury-Internal Revenue Service Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. 5Forms 1099-R & SSA 1099 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, 1 Gross distribution OMB No. 1545-01 19 Distributions From country, ZIP or foreign postal code, and telephone no. Pensions, Annuities, $16,000 Retirement or BRADFORD INC. la Taxable amount 2022 Profit-Sharing Plans, 2605 STATE STREET IRAs, Insurance YOUR CITY, YOUR STATE, ZIP Contracts, etc. $16.000 Form 1099-R 2b Taxable amount Total not determined distribution Copy B Report this PAYER'S TIN RECIPIENT'S TIN 3 Capital gain (included in |4 Federal income tax Income on your bou 24) willhold federal tax return. If this 40-100XXXX 127-00-XXXX $4,000 form shows RECIPIENT'S name Employee contributions/ 6 Nel urvealiced federal income Designated Roth appreciation in tax withheld in contributions or employer's securities JEFF PICKENS insurance premiums box 4, attach this copy to your return. Street address (including apt, no.) Distribution 8 Other codes 5 PEBBLE LANE This information is being fumished to City or town, state or province, country, and ZIP or foreign postal code Sa Your percentage of total |96 Told employee contribulis the IRS. YOUR CITY, YOUR STATE, ZIP distribution 10 Amount silocable to IFA 11 Ist year of desig 12 FATCA iling 14 State tax withheld 15 State/Payer's state no. |16 State distribution within 5 years Roth coniria. Account number (see instructions) 13 Date of 17 Local tax withhold 18 Name of locality 19 Local distribution payment For 1099-R Department of the Treasury . Internal Revenue Service FORM SSA-1099 - SOCIAL SECURITY BENEFIT STATEMENT 2022 . PART OF YOUR SOCIAL SECURITY BENEFITS SHOWN IN BOX S MAY BE TAXABLE INCOME SEE THE REVERSE FOR MORE INFORMATION Box 2. Deseliciary's Social Security Number JEFF PICKENS 127-00-XXXX Box 3. Danella Paid in 2023 Dan S. Not Benefits for 2022 Blax 3 minus Bax $12,000.00 $12,000.00 DESCRIPTION OF AMOUNT IN BOX DESCRIPTION OF AMOUNT IN BOX 4 Paid by check or direct deposit: $12,000.00 Box . Vskning Federal Income Tax Withholding $1,200.00 Box 7. Andoes 5 PEBBLE LANE YOUR CITY, YOUR STATE, ZIP Box 6. Chin Moriber Cor man Draft as of June 21. 2922 - Subject to CI ange For 594-1099-5M (13020) DO NOT RETURN THIS FORM TO SSA OR IRSForms 1099-DIV & 1098-T CORRECTED (if checked) PAYER'S name, street address, ofty or town, state or province, country, ZIP 1a Total ordinary dividends OMB No. 1545-0110 or forsign postal code, and telephone na. Fort 1099-DIV BALDWIN BANK 67.200.00 Dividends and 123 BALDWIN AVENUE How. January 2027) Distributions YOUR CITY, YOUR STATE, ZIP For polandar real S $1.200.00 20 22 a Total capital gain distr 26 Unecap. Sec. 1250 gain Copy B S RECIPIENT'S TIN For Recipient PAYER'S TIN 24 Colectibles 2814) gain 18 4XXXXXX 127-00-XXXX RECIPIENT'S name Federal income tax withhold JEFF PICKENS $330.00 This is important Lax information and is Investment expenses being furnished to the IRS. If you are Street address (including apt. no. inquired to in a 7 Foreign tax paid aturn, a nog pence 5 PERBLE LANE peruity or other sanction may be Cly of town, state or province, country, and ZIP or foreign postal code imposed on you if this income is taxable YOUR CITY, YOUR STATE, ZIP and the IRS determines that it has not been reported 11 FATCAFIng 12 Evernot-Intercal dinedends 3 Speciled private activity requirement 0 S Account number (see instructions) 14 State 16 State tax with Form 1099-DIV (Rev. 1-2027) (keep for your records) Department of the Treasury . Internal Revenue Service CORRECTED FILER'S name, Street address, city or town, state or province, country, ZIP or |1 Payevents received for OMB No. 1545-1574 foreign postal code, and telephone number qualified tuition and related BALDWIN UNIVERSITY 2022 Tuition 1700 BALDWIN AVENUE Statement YOUR CITY, YOUR STATE, ZIP Form 1098-T FILER'S employer identification no. STUDENT'S TIN Copy B 89-7XXXXXX For Student STUDENT'S name 4 Adjustments made for a 5 Scholarships or grants prior year This is important SHELBY PICKENS tax information 7,500.00 and is being Adjustrimb ta urrished to the Street address (including mot. na) 7 Checked if the around IRS. This form scholarships or grants In box 1 includes S PEBBLE LANE amounts for at must be used to for a prior roar City or town, state or province. country, and ZIP or foreign postal code academic period mplete Form 6063 beginning January- to claim education YOUR CITY, YOUR STATE, ZIP March 2023 credits. Give it to the Cracked if at board 10 Ins. contract nimb./relund tax preparer or use it to Service Provider/Acct. No. (see insir.] prepare the tax relum. Fall-fine student Form 1098-T keep for your records now.it powForm1084T Department of the Treasury . Internal Revenue ServiceReceipts Baldwin University College Books Meal Plan 3710 Baldwin Avenue Your City, State, ZIP Baldwin College Student Housing Receipt: 3700 Baldwin Avenue 3 Textbooks: $750.00 Your City, Your State, ZIP Parking Sticker: $120.00 Received from: Payment for books is Shelby Pickens $5,500.00 also on the college website. Baldwin University 3700 Baldwin Avenue Date To Ship To August 12, 2022 Shelby Pickens Same as recipient 5 Pebble Lane Invoice #05684 Quantity Description Unit Price Total Online Textbook Fee $100 $100 Subtotal $100 Sales Tax Shipping & Handling Total $100 Thank you for your business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts