Question: Based on the interview notes and the documents below, calculate the following amount which would be reported on her 2018 Form 1040. If the amount

Based on the interview notes and the documents below, calculate the following amount which would be reported on her 2018 Form 1040. If the amount is negative, put a minus before the number. If the amount is zero, write 0.

| 1 | Wages, Salaries, Tips | |

| 2 | Taxable 401k distribution | |

| 3 | Business income or deductible loss | |

| 4 | rental real estate income (or deductible loss) | |

| 5 | taxable unemployment compensation | |

| 6 | taxable other income | |

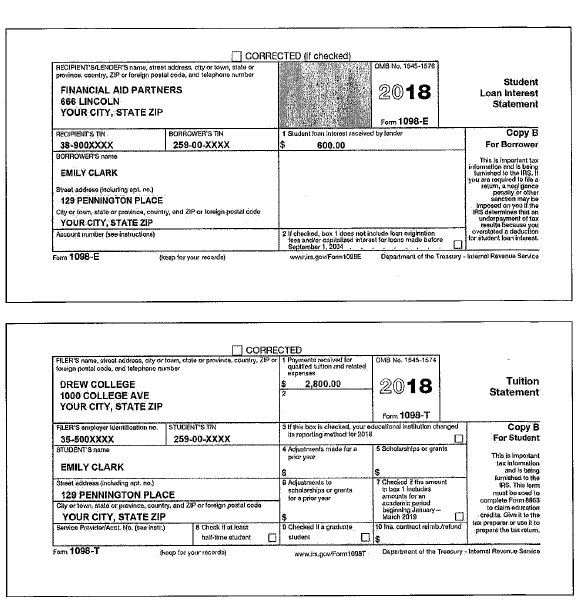

| 7 | student loan interest deduction | |

| 8 | Qualified Business income (QBI) Deduction | |

| 9 | Lifetime learning credit after limitations | |

| 10 | child tax credit | |

| 11 | additional tax on qualified retirement plan | |

| 12 | filing status |

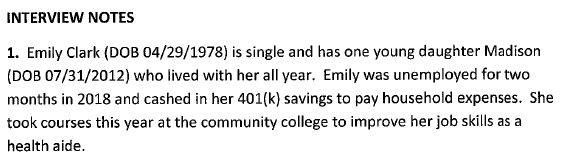

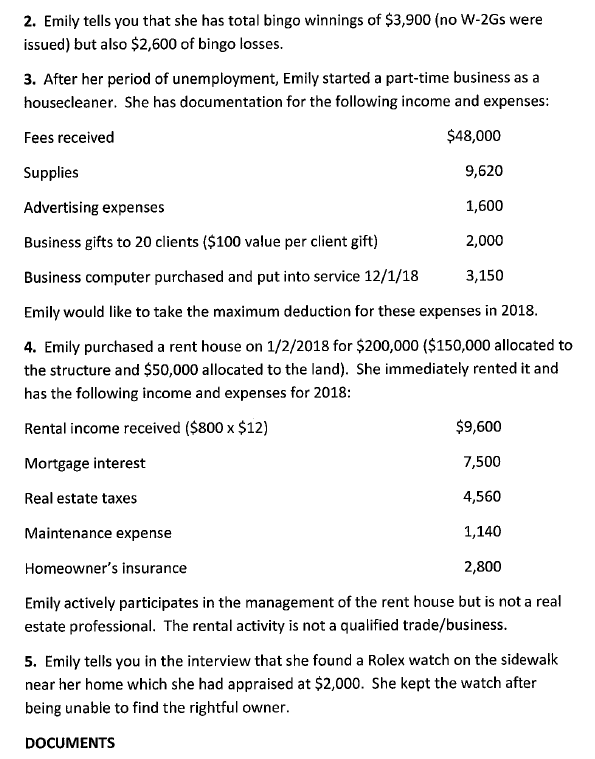

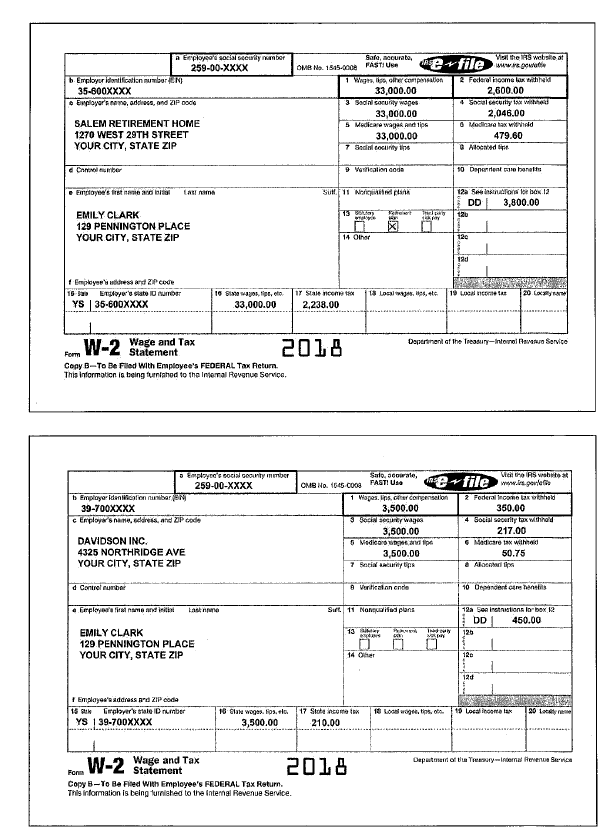

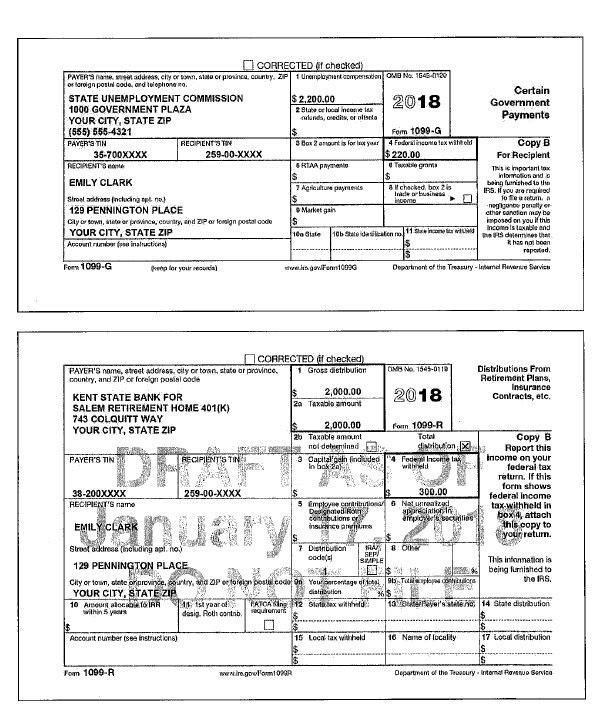

INTERVIEW NOTES 1. Emily Clark (DOB 04/29/1978) is single and has one young daughter Madison (DOB 07/31/2012) who lived with her all year. Emily was unemployed for two months in 2018 and cashed in her 401(k) savings to pay household expenses. She took courses this year at the community college to improve her job skills as a health aide. 2. Emily tells you that she has total bingo winnings of $3,900 (no W-2Gs were issued) but also $2,600 of bingo losses. 3. After her period of unemployment, Emily started a part-time business as a housecleaner. She has documentation for the following income and expenses: Fees received $48,000 Supplies 9,620 Advertising expenses 1,600 Business gifts to 20 clients ($100 value per client gift) 2,000 Business computer purchased and put into service 12/1/18 3,150 Emily would like to take the maximum deduction for these expenses in 2018. 4. Emily purchased a rent house on 1/2/2018 for $200,000 ($150,000 allocated to the structure and $50,000 allocated to the land). She immediately rented it and has the following income and expenses for 2018: Rental income received ($800 x $12) $9,600 Mortgage interest 7,500 Real estate taxes 4,560 Maintenance expense 1,140 Homeowner's insurance 2,800 Emily actively participates in the management of the rent house but is not a real estate professional. The rental activity is not a qualified trade/business. 5. Emily tells you in the interview that she found a Rolex watch on the sidewalk near her home which she had appraised at $2,000. She kept the watch after being unable to find the rightful owner. DOCUMENTS Sada, noraba e file ww 259-00-XXXX b. Employur identification number EN 35-600XXXX Employer's name, address, and ZIP Doda Well the website at OMAN 155.CO FASTI USA P hewww 1 Wh erowo Federal nome latih 33,000.00 2.600.00 3 anny wages 33,000.00 2.046.00 Medleare wagenis & Mediawalax withild 33,000.00 479.60 7 i city in Allocated in SALEM RETIREMENT HOME 1270 WEST 29TH STREET YOUR CITY, STATE ZIP e Carter 9 Vasification code 10 Deporneal hone Erness LAN SUH 11 Nexicana 12 Senosione bax 12 DD 3,800.00 EMILY CLARK 129 PENNINGTON PLACE YOUR CITY, STATE ZIP Code 1 Employee' dress and 15 Etoyota stato YS 35-600XXXX 19 13 Locales, los 19 LCD o ctor Stale non ti 33,000.00 2,238.00 Ospertinent of the Treasury-Intermalt a Service W .2 Wage and Tax 2018 From WV Statement Copy B-To Be Filed with Employee's FEDERAL Tax Return This information is being furnished to the Internal Rovenue Service liber OMB No 166 coa Salo, acowale, FASTI Use e Employee BOSS G T 259-00-XXXX t Employer identication bar EN 39-700XXXX C Employs a ddress, and IP code f Mai l HS Nh il file www.lespole 12 Federalnomat 350.00 14 Social Secerit tan who 217.00 to Wacang tan with 50.75 . Alps 3,500.00 3 SONG Waga 3,500.00 G Vedico Malpe 3.500.00 7 Serial Actions DAVIDSON INC. 4325 NORTHRIDGE AVE YOUR CITY, STATE ZIP d Control de Vertel on ende 10 Ornontorenensis a Employer fit Lasknu Surt. 11 Novie plans 12a Sen DD ns lorbox 450.00 13 11 EMILY CLARK 129 PENNINGTON PLACE YOUR CITY, STATE ZIP F Employee's address Ad ZIP code 15 stk Cipapers that ID number YS 1 39-700XXXX . 13 Lor , tins. 13 Gare wogas. Fos. 3.500.00 17 Stobencome tax 210.00 1 Dagu Tema RS . Wage and Tax W -2 2018 For WLS+ Statement Cory -To Be Fited With Employee's FEDERAL Tax Return This information is being u sed to the internal Revenue Service. Certain Government Payments CORRECTED Of checked) PAYER' S e t address, ciyern, or province, county. ZP1 Unangan compensation OMB No. 1743-020 or foroign postcode, and tolophone STATE UNEMPLOYMENT COMMISSION $ 2.200.00 2018 1000 GOVERNMENT PLAZA YOUR CITY, STATE ZIP calunds, Gredits, or lite (555) 555-4321 Form 1099-G PAYER'S TIN RECIPIENTS IN Basamorts for your 4 Fodoralinolex white 35-700XXXX 259-00-XXXX $220.00 RECENT GRTAAN Tom EMILY CLARK 7 Agroture payments Schackrd, bris Strosi atraso including op na 129 PENNINGTON PLACE Market gain cay or town, stere er prowince, country, and Z or fondin postal code YOUR CITY, STATE ZIP 1110 100 Gate 10 hodation Incore Apsou doprinalructions For Recipient This important to being inished to the IRS. you are required cthor conaten may be imposed on you if this income is lobe and S emines a has not been reported Porn 1099-G na flor you ) w gwenn 10026 Department of the Treasury - Intard Revenue Services 2018 CORRECTED if checked PAYER'S name, atreet address, oily or toran, state or province. Gross distribution ON No. 1545-0119 Distributions From country, and ZIP or foreign posode Retirement Plans 2,000.00 Insurance KENT STATE BANK FOR Contracts, etc. SALEM RETIREMENT HOME 401(K) 2a Taxable amount 743 COLQUITT WAY YOUR CITY, STATE ZIP 2,000.00 fourn 1099-R 26 Taxable amount Total Copy B Bhe ls nol determinad dsbution Roport this PAYER'S TING 13 Oapital gain findivided RECIPIENT'S TIN indem ince pod income on your In bok 2013 with federal tax do return. If this form shows 38-200XXXX 259-00-XXXX 300.00 federal income RECIPIENT'S nano 5 Employee como o Naturresized tax-withheld in Degrated on woreciation in chibutions or airporaculis box , attach this copy to $ 16 your retum Strast adrese (including aplno . 7 Distribution & codes SRAPLE 129 PENNINGTON PLACE This infannation is being furnished to City or town, thee or province, country, a Pectoralon postal code On You ariage , 90 Talling op tydla na IRS. YOUR CITY STATE ZIP dialo g 10 Amouale ISIRRA 1st year of THCA ing. 112 Slot sex with Ta i 's Milena 14 State distribution desig. Roth contrib u irement EMILY CLARKS MILY CLARK " E Account number (Se instructions) 15 Locat tax with held 16 Name of locality 17 Local dimribution Tom 1099-R eiro golom1070R Departem of the Troury normaln o Service O N 154-157 CORRECTED (f checked RECIPIENT MOERS , sott o Porty ZP s ebe FINANCIAL AID PARTNERS 666 LINCOLN YOUR CITY, STATE ZIP 2018 Student Loan Interest Statement Form 1098-E od bye Copy B For Borrower STIN BORROWER STIN 38-900XXXX 259-00-XXXX BCPIROWERS EMILY CLARK we add i ng ) 129 PENNINGTON PLACE Chyern state or pronountry, and Performiga postal code YOUR CITY, STATE ZIP Aecouri er bepihatruction This pertanto ce and be you are copied to a 1. rekoled ooduction rufern en 2 checked. bon 1 does not include loon enginnon een anderen tar for loose mi bufore Separber 2004.. www.gou For OBE Ouma of the roy Farm 1098-E per model al Revenue Brice 2018 COPRECTED FILERS , Broat andros, oily or own, cale or pres.country, Port P ortocador OM3 No. 1945.1876 orion powalowdeephone number quitted tution and related DREW COLLEGE $ 2,800.00 Tuition 1000 COLLEGE AVE Statement YOUR CITY, STATE ZIP Form 1099-T PER' S ployer STUNT SIIN sof his best check your educational in h ond Copy B 35.500XXXX 259.00-XXXX sporting od 2018 For Student STUDENTS els made fora 15 Sai son gratis EMILY CLARK Congo) Adjustments to 17 Chether undhed shares W. Thom 129 PENNINGTON PLACE for a prior Gyer p o urtand Parang pasal Code Gorgeous ose YOUR CITY, STATE ZIP Wh19 loredate the ATL ) The a Checa la gradite na cor o nd 1 vote Os Fame 1098-T hop for your foren INTERVIEW NOTES 1. Emily Clark (DOB 04/29/1978) is single and has one young daughter Madison (DOB 07/31/2012) who lived with her all year. Emily was unemployed for two months in 2018 and cashed in her 401(k) savings to pay household expenses. She took courses this year at the community college to improve her job skills as a health aide. 2. Emily tells you that she has total bingo winnings of $3,900 (no W-2Gs were issued) but also $2,600 of bingo losses. 3. After her period of unemployment, Emily started a part-time business as a housecleaner. She has documentation for the following income and expenses: Fees received $48,000 Supplies 9,620 Advertising expenses 1,600 Business gifts to 20 clients ($100 value per client gift) 2,000 Business computer purchased and put into service 12/1/18 3,150 Emily would like to take the maximum deduction for these expenses in 2018. 4. Emily purchased a rent house on 1/2/2018 for $200,000 ($150,000 allocated to the structure and $50,000 allocated to the land). She immediately rented it and has the following income and expenses for 2018: Rental income received ($800 x $12) $9,600 Mortgage interest 7,500 Real estate taxes 4,560 Maintenance expense 1,140 Homeowner's insurance 2,800 Emily actively participates in the management of the rent house but is not a real estate professional. The rental activity is not a qualified trade/business. 5. Emily tells you in the interview that she found a Rolex watch on the sidewalk near her home which she had appraised at $2,000. She kept the watch after being unable to find the rightful owner. DOCUMENTS Sada, noraba e file ww 259-00-XXXX b. Employur identification number EN 35-600XXXX Employer's name, address, and ZIP Doda Well the website at OMAN 155.CO FASTI USA P hewww 1 Wh erowo Federal nome latih 33,000.00 2.600.00 3 anny wages 33,000.00 2.046.00 Medleare wagenis & Mediawalax withild 33,000.00 479.60 7 i city in Allocated in SALEM RETIREMENT HOME 1270 WEST 29TH STREET YOUR CITY, STATE ZIP e Carter 9 Vasification code 10 Deporneal hone Erness LAN SUH 11 Nexicana 12 Senosione bax 12 DD 3,800.00 EMILY CLARK 129 PENNINGTON PLACE YOUR CITY, STATE ZIP Code 1 Employee' dress and 15 Etoyota stato YS 35-600XXXX 19 13 Locales, los 19 LCD o ctor Stale non ti 33,000.00 2,238.00 Ospertinent of the Treasury-Intermalt a Service W .2 Wage and Tax 2018 From WV Statement Copy B-To Be Filed with Employee's FEDERAL Tax Return This information is being furnished to the Internal Rovenue Service liber OMB No 166 coa Salo, acowale, FASTI Use e Employee BOSS G T 259-00-XXXX t Employer identication bar EN 39-700XXXX C Employs a ddress, and IP code f Mai l HS Nh il file www.lespole 12 Federalnomat 350.00 14 Social Secerit tan who 217.00 to Wacang tan with 50.75 . Alps 3,500.00 3 SONG Waga 3,500.00 G Vedico Malpe 3.500.00 7 Serial Actions DAVIDSON INC. 4325 NORTHRIDGE AVE YOUR CITY, STATE ZIP d Control de Vertel on ende 10 Ornontorenensis a Employer fit Lasknu Surt. 11 Novie plans 12a Sen DD ns lorbox 450.00 13 11 EMILY CLARK 129 PENNINGTON PLACE YOUR CITY, STATE ZIP F Employee's address Ad ZIP code 15 stk Cipapers that ID number YS 1 39-700XXXX . 13 Lor , tins. 13 Gare wogas. Fos. 3.500.00 17 Stobencome tax 210.00 1 Dagu Tema RS . Wage and Tax W -2 2018 For WLS+ Statement Cory -To Be Fited With Employee's FEDERAL Tax Return This information is being u sed to the internal Revenue Service. Certain Government Payments CORRECTED Of checked) PAYER' S e t address, ciyern, or province, county. ZP1 Unangan compensation OMB No. 1743-020 or foroign postcode, and tolophone STATE UNEMPLOYMENT COMMISSION $ 2.200.00 2018 1000 GOVERNMENT PLAZA YOUR CITY, STATE ZIP calunds, Gredits, or lite (555) 555-4321 Form 1099-G PAYER'S TIN RECIPIENTS IN Basamorts for your 4 Fodoralinolex white 35-700XXXX 259-00-XXXX $220.00 RECENT GRTAAN Tom EMILY CLARK 7 Agroture payments Schackrd, bris Strosi atraso including op na 129 PENNINGTON PLACE Market gain cay or town, stere er prowince, country, and Z or fondin postal code YOUR CITY, STATE ZIP 1110 100 Gate 10 hodation Incore Apsou doprinalructions For Recipient This important to being inished to the IRS. you are required cthor conaten may be imposed on you if this income is lobe and S emines a has not been reported Porn 1099-G na flor you ) w gwenn 10026 Department of the Treasury - Intard Revenue Services 2018 CORRECTED if checked PAYER'S name, atreet address, oily or toran, state or province. Gross distribution ON No. 1545-0119 Distributions From country, and ZIP or foreign posode Retirement Plans 2,000.00 Insurance KENT STATE BANK FOR Contracts, etc. SALEM RETIREMENT HOME 401(K) 2a Taxable amount 743 COLQUITT WAY YOUR CITY, STATE ZIP 2,000.00 fourn 1099-R 26 Taxable amount Total Copy B Bhe ls nol determinad dsbution Roport this PAYER'S TING 13 Oapital gain findivided RECIPIENT'S TIN indem ince pod income on your In bok 2013 with federal tax do return. If this form shows 38-200XXXX 259-00-XXXX 300.00 federal income RECIPIENT'S nano 5 Employee como o Naturresized tax-withheld in Degrated on woreciation in chibutions or airporaculis box , attach this copy to $ 16 your retum Strast adrese (including aplno . 7 Distribution & codes SRAPLE 129 PENNINGTON PLACE This infannation is being furnished to City or town, thee or province, country, a Pectoralon postal code On You ariage , 90 Talling op tydla na IRS. YOUR CITY STATE ZIP dialo g 10 Amouale ISIRRA 1st year of THCA ing. 112 Slot sex with Ta i 's Milena 14 State distribution desig. Roth contrib u irement EMILY CLARKS MILY CLARK " E Account number (Se instructions) 15 Locat tax with held 16 Name of locality 17 Local dimribution Tom 1099-R eiro golom1070R Departem of the Troury normaln o Service O N 154-157 CORRECTED (f checked RECIPIENT MOERS , sott o Porty ZP s ebe FINANCIAL AID PARTNERS 666 LINCOLN YOUR CITY, STATE ZIP 2018 Student Loan Interest Statement Form 1098-E od bye Copy B For Borrower STIN BORROWER STIN 38-900XXXX 259-00-XXXX BCPIROWERS EMILY CLARK we add i ng ) 129 PENNINGTON PLACE Chyern state or pronountry, and Performiga postal code YOUR CITY, STATE ZIP Aecouri er bepihatruction This pertanto ce and be you are copied to a 1. rekoled ooduction rufern en 2 checked. bon 1 does not include loon enginnon een anderen tar for loose mi bufore Separber 2004.. www.gou For OBE Ouma of the roy Farm 1098-E per model al Revenue Brice 2018 COPRECTED FILERS , Broat andros, oily or own, cale or pres.country, Port P ortocador OM3 No. 1945.1876 orion powalowdeephone number quitted tution and related DREW COLLEGE $ 2,800.00 Tuition 1000 COLLEGE AVE Statement YOUR CITY, STATE ZIP Form 1099-T PER' S ployer STUNT SIIN sof his best check your educational in h ond Copy B 35.500XXXX 259.00-XXXX sporting od 2018 For Student STUDENTS els made fora 15 Sai son gratis EMILY CLARK Congo) Adjustments to 17 Chether undhed shares W. Thom 129 PENNINGTON PLACE for a prior Gyer p o urtand Parang pasal Code Gorgeous ose YOUR CITY, STATE ZIP Wh19 loredate the ATL ) The a Checa la gradite na cor o nd 1 vote Os Fame 1098-T hop for your foren

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts