Question: Document Review Simulation - Monica Montgomery - SUMMER 2 0 2 4 Answer the 1 5 items below on Canvas in the Document Review Simulation

Document Review Simulation Monica Montgomery SUMMER

Answer the items below on Canvas in the Document Review Simulation Summer tab under Assignments. See your syllabus for the due date and time.

Based on the interview notes and the documents below, answer the following items relative to their Form If the amount is negative, put a minus before the number. If the amount is zero, write The parenthetical reference for each item below is to the forms and schedules.

Wages, salaries, tips, etc. Form line z

Taxable IRA distribution Form line b

Business income or deductible loss Schedule line $

Rentalroyalty income or loss Schedule line $

Taxable other income Schedule line $

Educator expenses Schedule line

Student loan interest deduction Schedule line

Qualified business income deduction line

Federal income tax withheld Form line d

Child tax credit Form line

Additional tax on IRA distribution Schedule line

Dependent care credit Schedule line

Most advantageous filing status Single SS MFJ or MFS

Form required in order to split refund between accounts

Is tutoring business a specified service tradebusiness SSTB YESNO

Monica Montgomery DOB SSN was married to Mike Montgomery DOB SSN who passed away on February Their daughter, Emma Montgomery, DOB SSN has lived with Monica the entire year and Monica paid more than half

the cost of keeping up a home and support for Emma. They are all US citizens and have valid social security numbers SSNs and lived in the US the entire year.

Monica was a fulltime high school teacher and purchased supplies for her class out of her own pocket totaling $ She received a G from the local casino, but also has documented gambling losses totaling $

Monica paid child and dependent care expenses for Emma while she worked.

She has provided you with documentation for her income and expenses see below. You also have obtained the following information from interviewing her:

INTERVIEW NOTES

In addition to being a high school teacher at Wilcox School District, Monica is also a selfemployed college tutor. For the current year, she has documents to prove the following income and expenses:

Fees received for tutoring services $

Business entertainment clients them Astros game

Supplies expense

Professional dues and subscriptions

Business gifts clients $ Lalique vase each

Business computer purchased and put into service December

Simplified method home office: square foot office square foot home

Total mileage on her car for miles, of which were personal miles and the rest were business miles in going from client to client of the business miles were in the first half of the year, the rest were in the second half She has one vehicle, a Ford F in service on Monica will take the standard mileage rate.

She would like to take the maximum allowable deduction for her expenses in the current year.

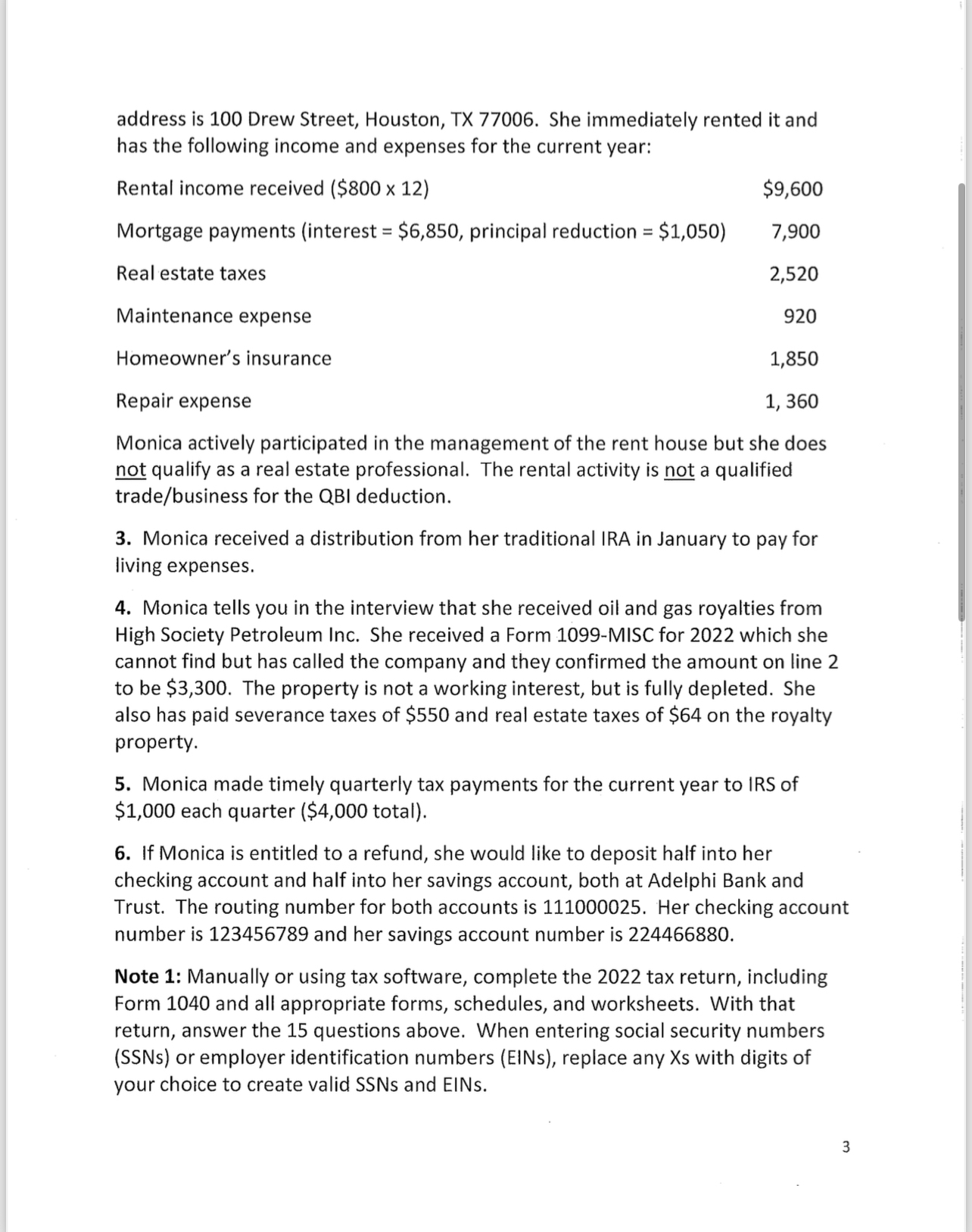

Monica purchased a rent house on January of the current year for $ $ allocated to the structure and $ allocated to the land The

address is Drew Street, Houston, TX She immediately rented it and has the following income and expenses for the current year:

Rental income received $

$

Mortgage payments interest $ principal reduction $

Real estate taxes

Maintenance expense

Homeowner's insurance

Repair expense

Monica actively participated in the management of the rent house but she does not qualify as a real estate professional. The rental activity is not a qualified tradebusiness for the QBI deduction.

Monica received a distribution from her traditional IRA in January to pay for living expenses.

Monica tells you in the interview that she received oil and gas royalties from High Society Petroleum Inc. She received a Form MISC for which she cannot find but has called the company and they confirmed the amount on line to be $ The property is not a working interest, but is fully depleted. She also has paid severance taxes of $ and real estate taxes of $ on the royalty property.

Monica made timely quarterly tax payments for the

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock