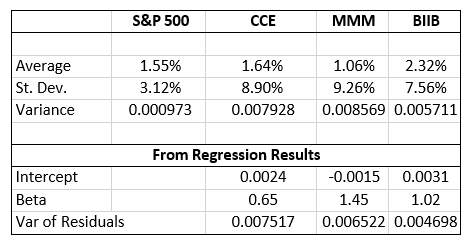

Question: Based on the table above, if you are using Intercept/Var(residuals) regression-based approach to portfolio construction, would you have to sell short any one of the

- Based on the table above, if you are using Intercept/Var(residuals) regression-based approach to portfolio construction, would you have to sell short any one of the securities?

- Yes, CCE

- Yes, MMM

- Yes, BIIB

- No

- Cannot tell

Average St. Dev. Variance Intercept Beta Var of Residuals S&P 500 1.55% 3.12% 0.000973 CCE MMM BIIB 1.64% 1.06% 2.32% 8.90% 9.26% 7.56% 0.007928 0.008569 0.005711 -0.0015 0.0031 1.45 1.02 0.006522 0.004698 From Regression Results 0.0024 0.65 0.007517 Average St. Dev. Variance Intercept Beta Var of Residuals S&P 500 1.55% 3.12% 0.000973 CCE MMM BIIB 1.64% 1.06% 2.32% 8.90% 9.26% 7.56% 0.007928 0.008569 0.005711 -0.0015 0.0031 1.45 1.02 0.006522 0.004698 From Regression Results 0.0024 0.65 0.007517

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts