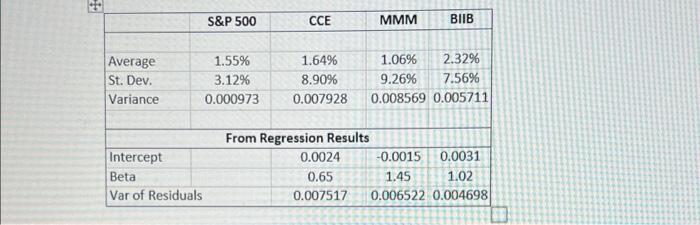

Question: S&P 500 CCE MMM BIIB Average St. Dev. Variance 1.55% 3.12% 0.000973 1.64% 8.90% 0.007928 1.06% 2.32% 9.26% 7.56% 0.008569 0.005711 Intercept Beta Var of

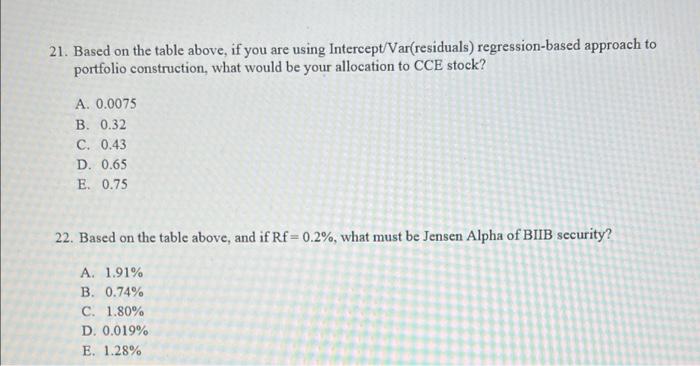

S&P 500 CCE MMM BIIB Average St. Dev. Variance 1.55% 3.12% 0.000973 1.64% 8.90% 0.007928 1.06% 2.32% 9.26% 7.56% 0.008569 0.005711 Intercept Beta Var of Residuals From Regression Results 0.0024 -0.0015 0.0031 0.65 1.45 1.02 0.007517 0.006522 0.004698 21. Based on the table above, if you are using Intercept/Var(residuals) regression-based approach to portfolio construction, what would be your allocation to CCE stock? A. 0.0075 B. 0.32 C. 0.43 D. 0.65 E. 0.75 22. Based on the table above, and if Rf = 0.2%, what must be Jensen Alpha of BIIB security? A. 1.91% B. 0.74% C. 1.80% D. 0.019% E. 1.28%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts