Question: based on this question Pantai Timur Sdn. Bhd. (PT) is a well-established transportation company. The company is based in Kuala Nerus and actively provides services

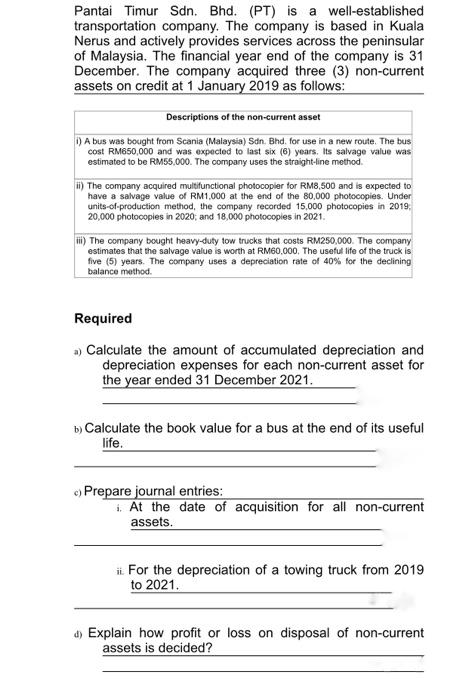

Pantai Timur Sdn. Bhd. (PT) is a well-established transportation company. The company is based in Kuala Nerus and actively provides services across the peninsular of Malaysia. The financial year end of the company is 31 December. The company acquired three (3) non-current assets on credit at 1 January 2019 as follows: Descriptions of the non-current asset i) A bus was bought from Scania (Malaysia) Sdn. Bhd. for use in a new route. The bus cost RM650,000 and was expected to last six (6) years. Its salvage value was estimated to be RM55,000. The company uses the straight-line method. ii) The company acquired multifunctional photocopier for RM8,500 and is expected to have a salvage value of RM1,000 at the end of the 80.000 photocopies. Under units-of-production method, the company recorded 15,000 photocopies in 2019, 20,000 photocopies in 2020; and 18,000 photocopies in 2021. ii) The company bought heavy-duty tow trucks that costs RM250,000. The company estimates that the salvage value is worth at RM60,000. The useful life of the truck is five (5) years. The company uses a depreciation rate of 40% for the declining balance method. Required a) Calculate the amount of accumulated depreciation and depreciation expenses for each non-current asset for the year ended 31 December 2021. b) Calculate the book value for a bus at the end of its useful life. c) Prepare journal entries: i. At the date of acquisition for all non-current assets. ii. For the depreciation of a towing truck from 2019 to 2021. d) Explain how profit or loss on disposal of non-current assets is decided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts