Question: Based on what you calculated in question 7, are one-month interest rates expected to go up or down in one month's time, based on the

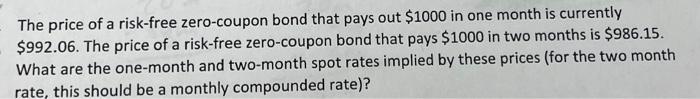

Based on what you calculated in question 7, are one-month interest rates expected to go up or down in one month's time, based on the "expectations hypothesis" of short-term interest rates? The price of a risk-free zero-coupon bond that pays out $1000 in one month is currently $992.06. The price of a risk-free zero-coupon bond that pays $1000 in two months is $986.15. What are the one-month and two-month spot rates implied by these prices (for the two month rate, this should be a monthly compounded rate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts