Question: Based on your new sophisticated algorithm, there is an 85% chance that the S & P will fall over the next half hour, so you

Based on your new sophisticated algorithm, there is an 85% chance that the S & P will fall over

the next half hour, so you go all in by selling 6 June contracts. The market rises 5 tics, and then

plunges 50 tics when you flatten your position (buy to close them all). What was your gross

profit or loss for the day?

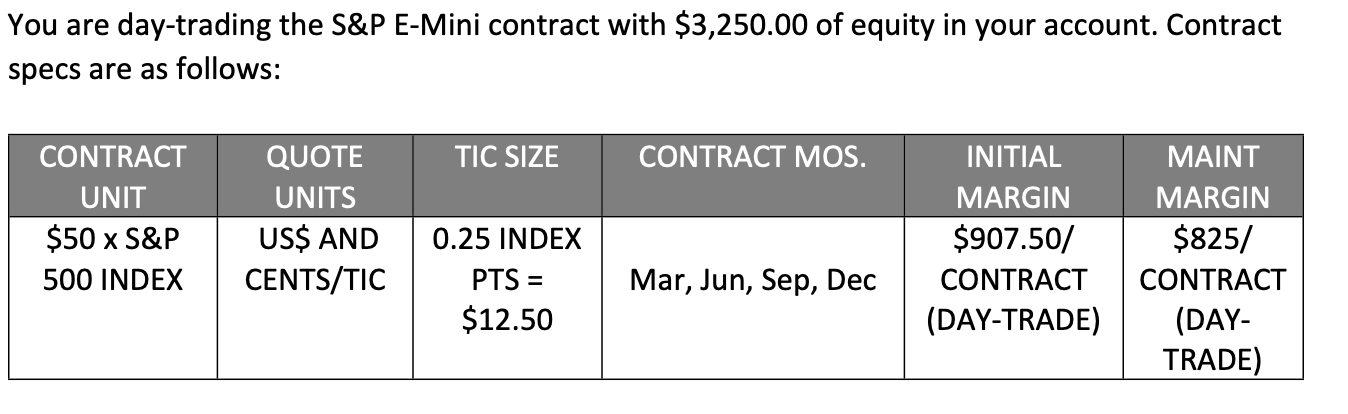

You are day-trading the S&P E-Mini contract with $3,250.00 of equity in your account. Contract specs are as follows: CONTRACT QUOTE TIC SIZE CONTRACT MOS. UNIT $50 x S&P 500 INDEX UNITS US$ AND CENTS/TIC 0.25 INDEX PTS = $12.50 INITIAL MARGIN $907.50/ CONTRACT (DAY-TRADE) MAINT MARGIN $825/ CONTRACT (DAY- TRADE) Mar, Jun, Sep, Dec You are day-trading the S&P E-Mini contract with $3,250.00 of equity in your account. Contract specs are as follows: CONTRACT QUOTE TIC SIZE CONTRACT MOS. UNIT $50 x S&P 500 INDEX UNITS US$ AND CENTS/TIC 0.25 INDEX PTS = $12.50 INITIAL MARGIN $907.50/ CONTRACT (DAY-TRADE) MAINT MARGIN $825/ CONTRACT (DAY- TRADE) Mar, Jun, Sep, Dec

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts