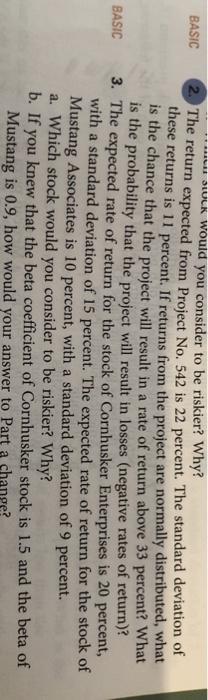

Question: BASIC BASIC .. we would you consider to be riskier? Why? 2 The return expected from Project No. 542 is 22 percent. The standard deviation

BASIC BASIC .. we would you consider to be riskier? Why? 2 The return expected from Project No. 542 is 22 percent. The standard deviation of these returns is 11 percent. If returns from the project are normally distributed, what is the chance that the project will result in a rate of return above 33 percent? What is the probability that the project will result in losses (negative rates of return)? 3. The expected rate of return for the stock of Cornhusker Enterprises is 20 percent, with a standard deviation of 15 percent. The expected rate of return for the stock of Mustang Associates is 10 percent, with a standard deviation of 9 percent. a. Which stock would you consider to be riskier? Why? b. If you knew that the beta coefficient of Cornhusker stock is 1.5 and the beta of Mustang is 0.9, how would your answer to Part a change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts