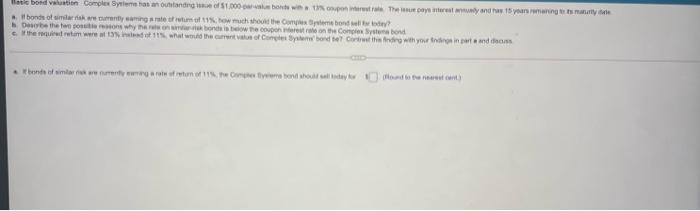

Question: Basic bond valuation Complex Systems has an outstanding issue of $1,000-par-value bonds with a 13% coupon interest rate. The issue pays interest annually and has

Betle bond valuation Complex Syriemos notando 1.000 bar The Wand your maring #bonds of menyang rate of 11% how much to the Commons be the two why thankbonds woon on the Complex Systenbond e. Where were not what would the current of Comeborder with in with your input and door bende waarmee word of honors. The competere born on a toy food and cant)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts