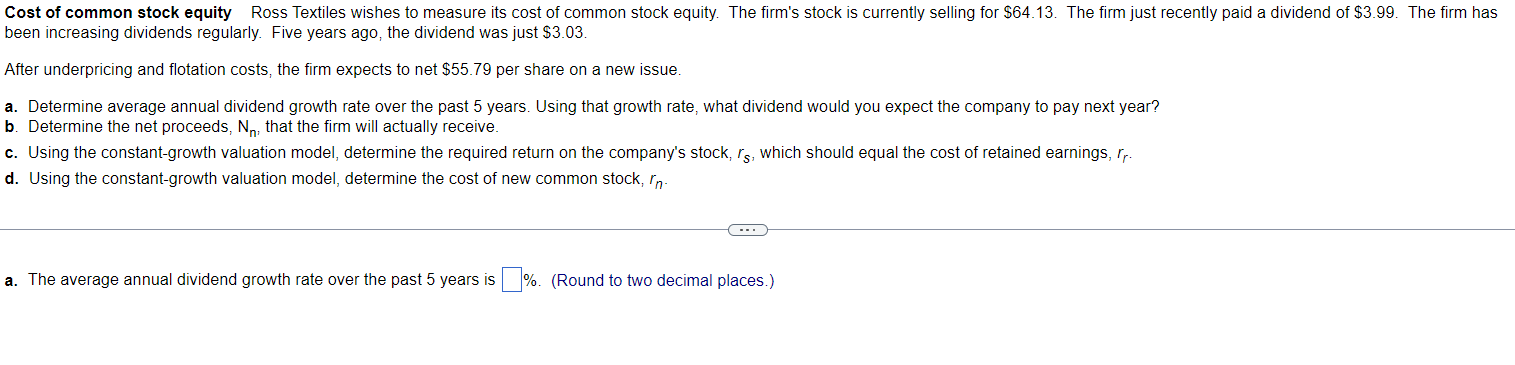

Question: been increasing dividends regularly. Five years ago, the dividend was just ( $ 3.03 ). After underpricing and flotation costs, the firm expects to net

been increasing dividends regularly. Five years ago, the dividend was just \\( \\$ 3.03 \\). After underpricing and flotation costs, the firm expects to net \\( \\$ 55.79 \\) per share on a new issue. a. Determine average annual dividend growth rate over the past 5 years. Using that growth rate, what dividend would you expect the company to pay next year? b. Determine the net proceeds, \\( \\mathrm{N}_{\\mathrm{n}} \\), that the firm will actually receive. c. Using the constant-growth valuation model, determine the required return on the company's stock, \\( r_{s} \\), which should equal the cost of retained earnings, \\( r_{r} \\). d. Using the constant-growth valuation model, determine the cost of new common stock, \\( r_{n} \\). a. The average annual dividend growth rate over the past 5 years is (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts