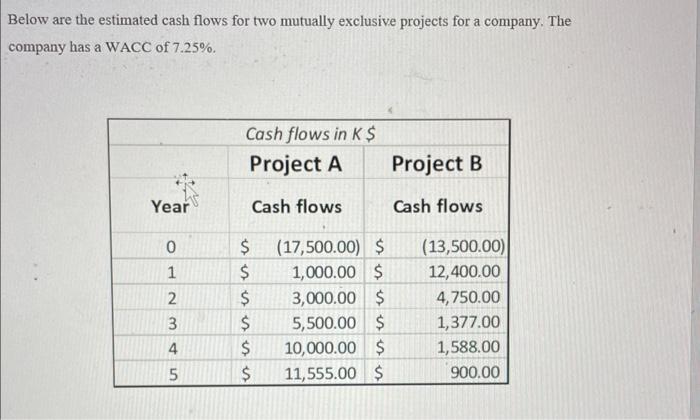

Question: Below are the estimated cash flows for two mutually exclusive projects for a company. The company has a WACC of 7.25% Use the data from

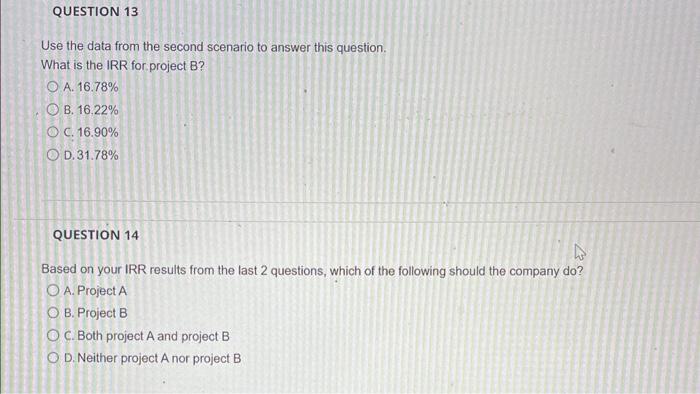

Below are the estimated cash flows for two mutually exclusive projects for a company. The company has a WACC of 7.25% Use the data from the second scenario to answer this question. What is the IRR for project B? A. 16.78% B. 16,22% C. 16.90% D. 31.78% QUESTION 14 Based on your IRR results from the last 2 questions, which of the following should the company do? A. Project A B. Project B C. Both project A and project B D. Neither project A nor project B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts