Question: Below is how to solve a similar problem but i cant seem to get the right answer for the problem above so please help Suppose

Below is how to solve a similar problem but i cant seem to get the right answer for the problem above so please help

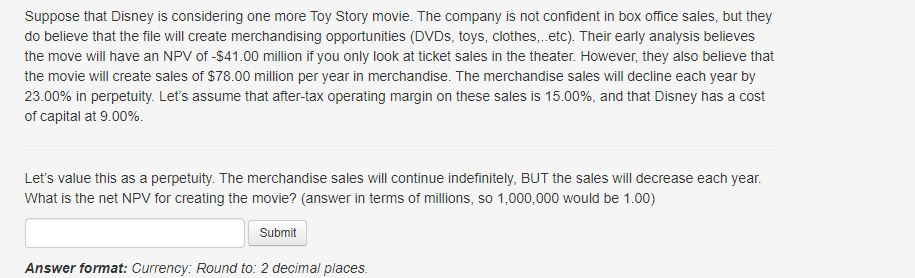

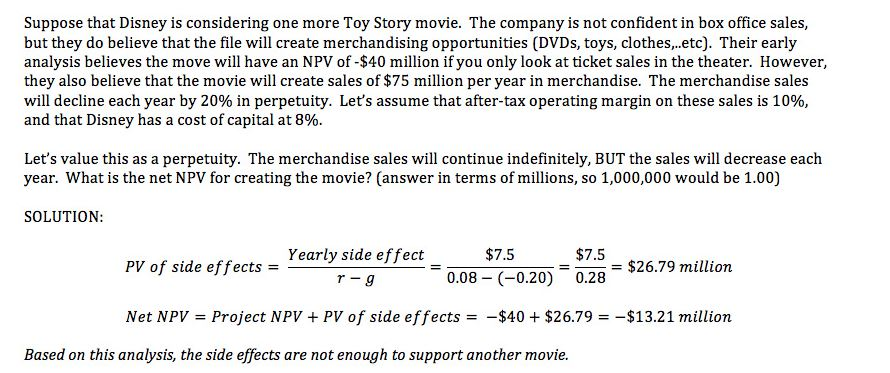

Suppose that Disney is considering one more Toy Story movie. The company is not confident in box office sales, but they do believe that the file will create merchandising opportunities (DVDs, toys, clothes...etc). Their early analysis believes the move will have an NPV of -S41.00 million if you only look at ticket sales in the theater. However, they also believe that the movie will create sales of $78.00 million per year in merchandise. The merchandise sales will decline each year by 23.00% in perpetuity. Let's assume that after-tax operating margin on these sales is 15.00%, and that Disney has a cost of capital at 9.00% Let's value this as a perpetuity. The merchandise sales will continue indefinitely, BUT the sales will decrease each year. What is the net NPV for creating the movie? (answer in terms of millions, so 1,000,000 would be 1.00) Submit Answer format: Currency: Round to: 2 decimal places. Suppose that Disney is considering one more Toy Story movie. The company is not confident in box office sales, but they do believe that the file will create merchandising opportunities (DVDs, toys, clothes...etc). Their early analysis believes the move will have an NPV of - $40 million if you only look at ticket sales in the theater. However, they also believe that the movie will create sales of $75 million per year in merchandise. The merchandise sales will decline each year by 20% in perpetuity. Let's assume that after-tax operating margin on these sales is 10%, and that Disney has a cost of capital at 8%. Let's value this as a perpetuity. The merchandise sales will continue indefinitely, BUT the sales will decrease each year. What is the net NPV for creating the movie? (answer in terms of millions, so 1,000,000 would be 1.00) SOLUTION: PV of side effects = Yearly side effect rag $7.5 0.08 - (-0.20) = $7.5 0.28 20 = $26.79 million Net NPV = Project NPV + PV of side effects = -$40 + $26.79 = -$13.21 million Based on this analysis, the side effects are not enough to support another movie

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts