Question: Below is the 2022 U.S Rate Schedule for single persons, showing taxes owed for given income levels: 10% of the first $10,275 earned 12% of

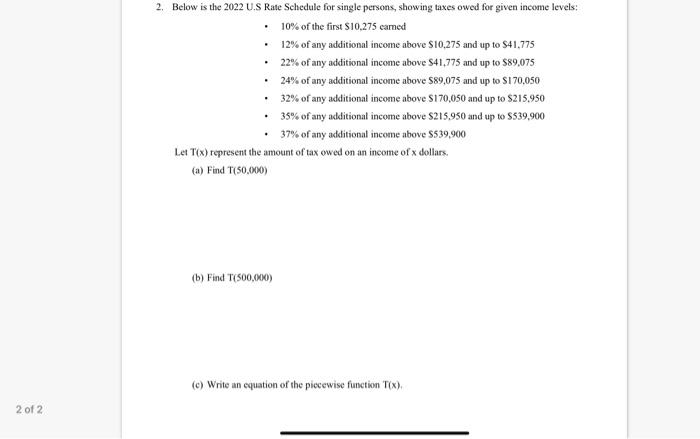

2. Below is the 2022 U.S Rate Sehedule for single persons, showing taxes owed for given income levels: - 10% of the first $10,275 earned - 12% of any additional income above \$10,275 and up to \$41,775 - 22% of any additional incone above $41,775 and up to $89,075 - 24% of any additional income above $89,075 and up to $170,050 - 32% of any additional income above $170,050 and up to $215,950 - 35% of any additional income above $215,950 and up to $539,900 - 37% of any additional income above $539,900 Let T(x) represent the amount of tax owed on an income of x dollars. (a) Find T(50,000) (b) Find T(500,000) (c) Write an equation of the piecewise function T(x)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts