Question: Best Buy: Creating Winning Customer Experience in Consumer Electronics 1.What were Competitive and Customers trends in 2014 and How were they adversely affecting Best Buy's

"Best Buy: Creating Winning Customer Experience in Consumer Electronics"

1.What were Competitive and Customers trends in 2014 and How were they adversely affecting Best Buy's market position?

a.Research 2014 timeframe and main competitors discussed in the Case; only consumer electronics; change in their market positions, etc.

b.Supplement Case data with additional Research (2014 timeframe) to discuss customer trends, specifically shifts in demographics and impact of mobile devices

c. analyze Exhibits 1 and 2 data and comment in your response

4.Evaluate the Best Buy customer experience with a focus on the expectations of millennial customers. How does the omnichannel experience that Best Buy seeks to create stack up against traditional and online retail competition?

a.based on (Exhibits 3, 4 and 5) with additional research (2014) millennials shopping behaviors how does that differ from previous generation(s), e.g. Baby Boomers and Gen X

b.use hard data and evidence?

Describe millennials, buying preferences, how did they get information (TV vs social media); immune to technological transformation, have experienced all of advances; believe in company responsibilities

BB was not able to satisfy millennials needs

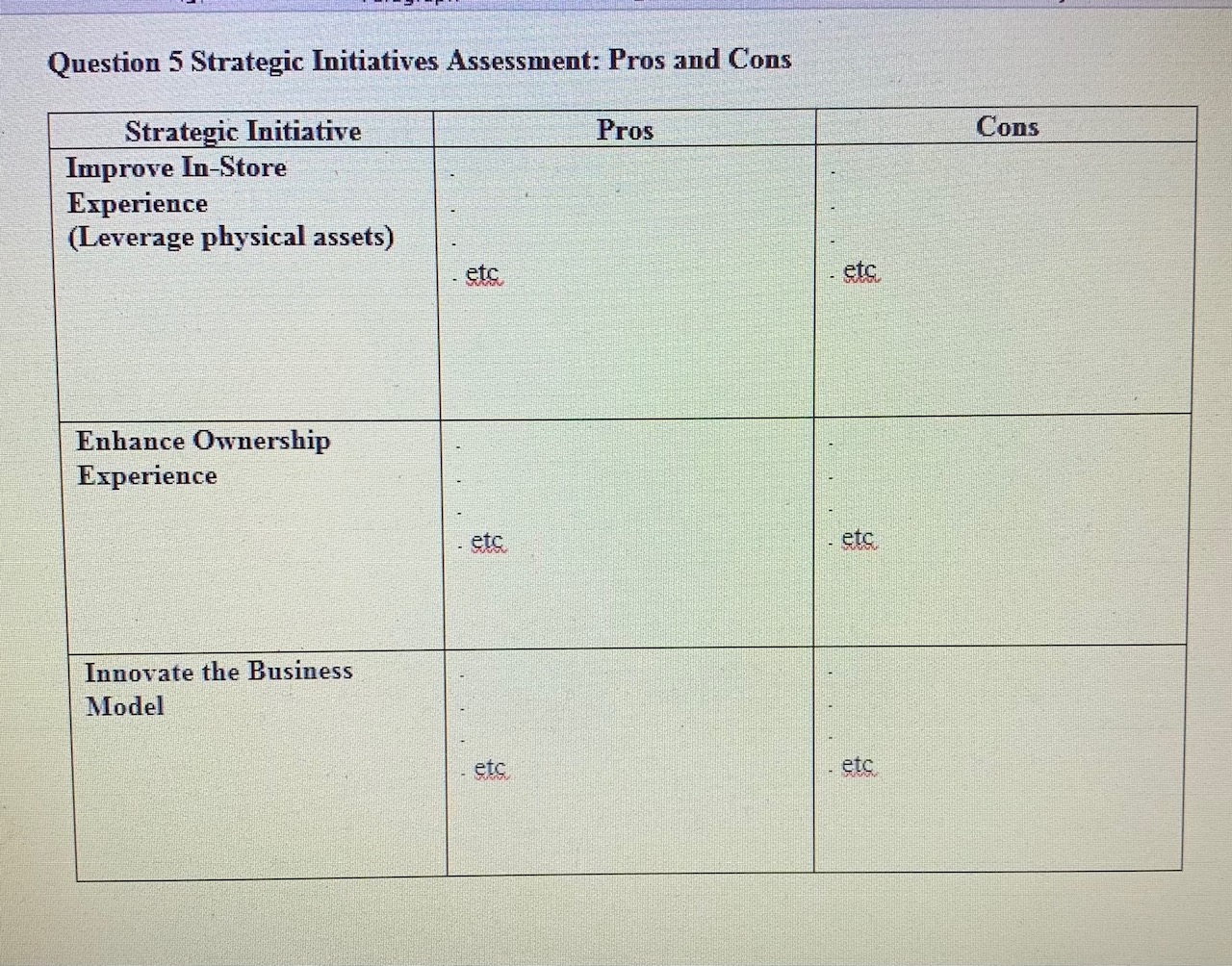

5.List, discuss and asses the strategic initiatives Best But developed and implemented, focusing on their ability to address the challenge facing them. How would prioritize the initiatives based on strategic considerations?

a.Describe each of these 3 strategic initiatives: i) Improve In-Store Experience (leveraging physical assets); ii) Enhance Ownership Experience; iii) Innovate the Business Model

b. a Table to evaluate each with Pros and Cons (see below)

c.Summarize your observations

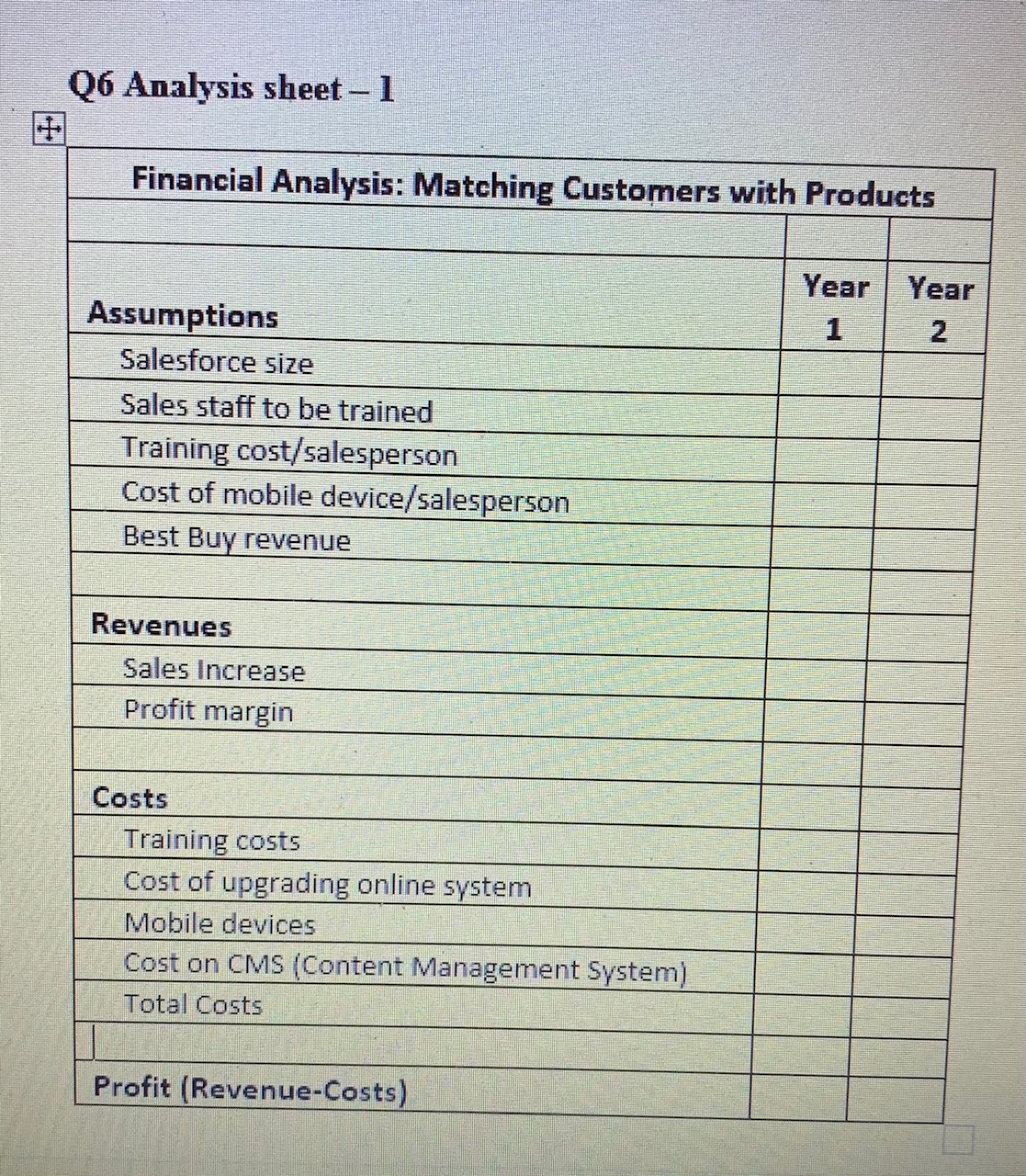

6.Using Case data, conduct a financial evaluation of the initiative to match customers with products. This includes training sales associates and related technology investments. What is the net contributions that Best Buy can expect from this initiative in Years 1 and 2?

a.See below Analysis Sheet - 1

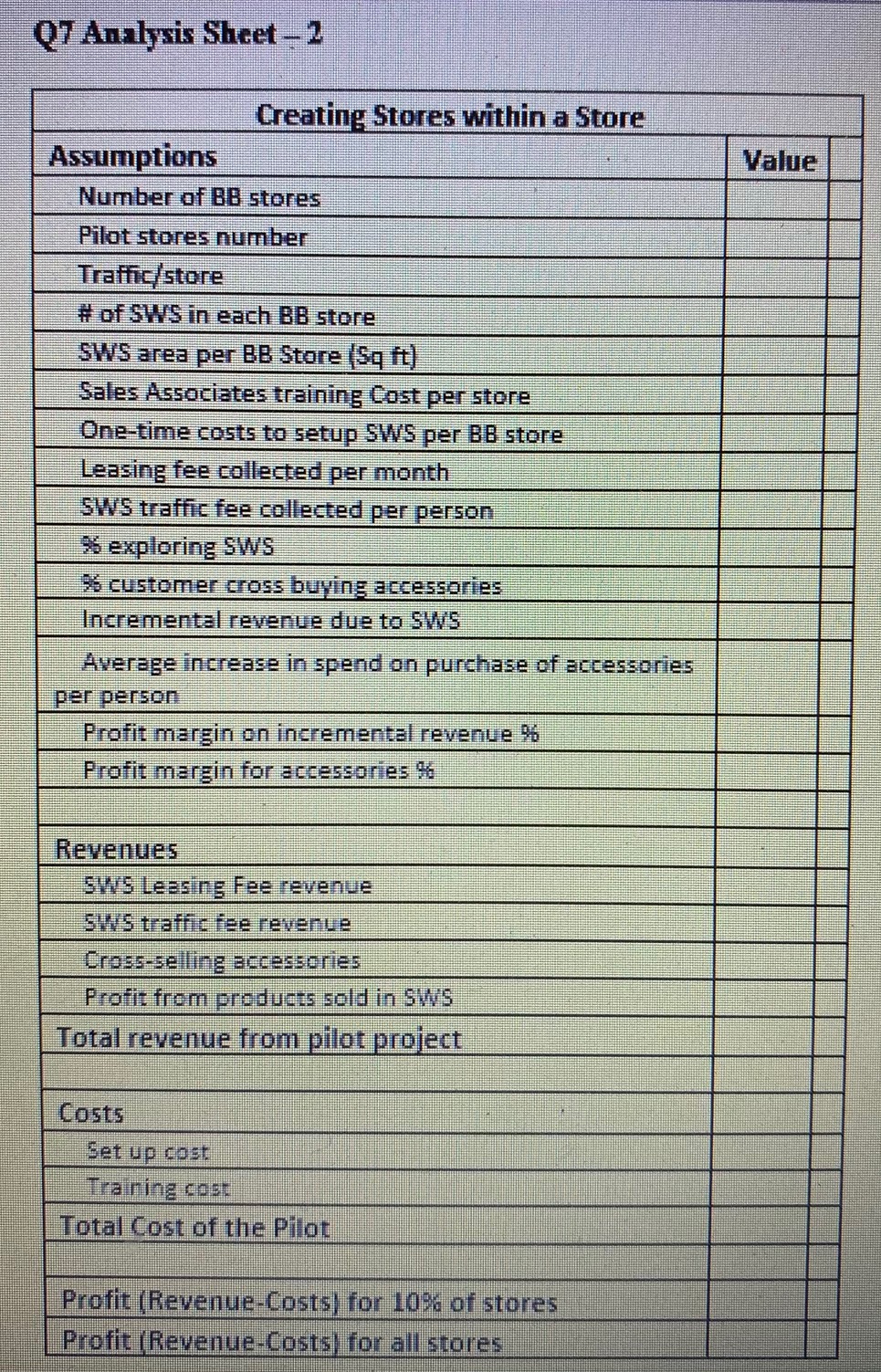

7.Calculate the net contribution of the SWS initiative by estimating its incremental costs and incremental revenue streams. Remember that SWS would be piloted in 10% of Best Buy's 1,400 stores. (2 slides)

a.See below Analysis Sheet - 2

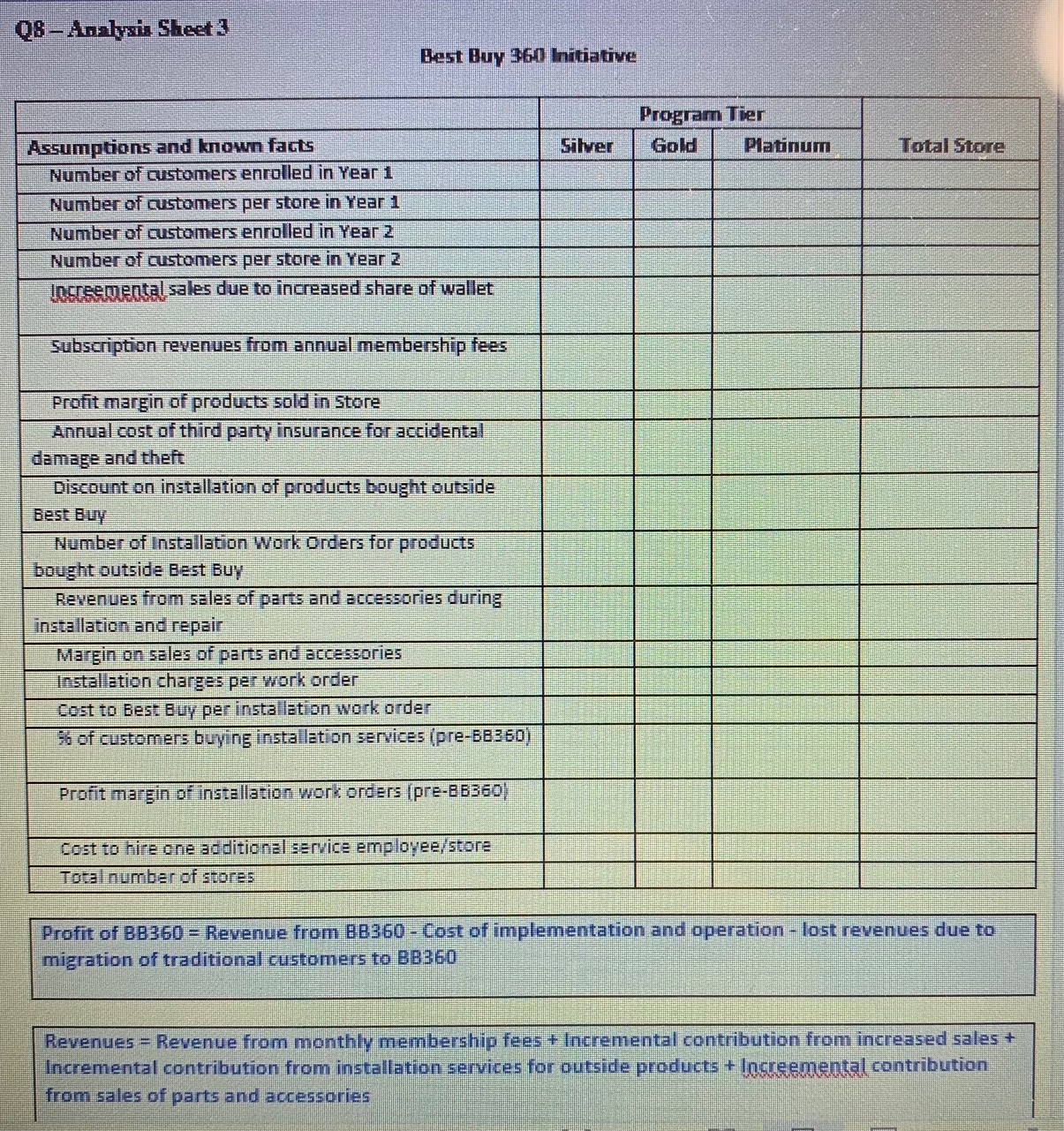

8.I need a model to estimate revenue, costs and profits for the BB360 initiative on a per store basis. Refer to Exhibit 7 for costs and margins.

a.See below Analysis Sheet - 3

9.Consider RTO model. Calculate revenues for Years 1, 2 and 3 for each of the scenarios (scenario 1 - phone is bought; scenario 2 - phone is returned; scenario 3 - phone is leased for 24 months)

a.See below Analysis Sheet - 4

10.What conclusions can you draw from the financial analysis What initiatives should Greg Revelle and his team recommend to Hubert Jolly? (

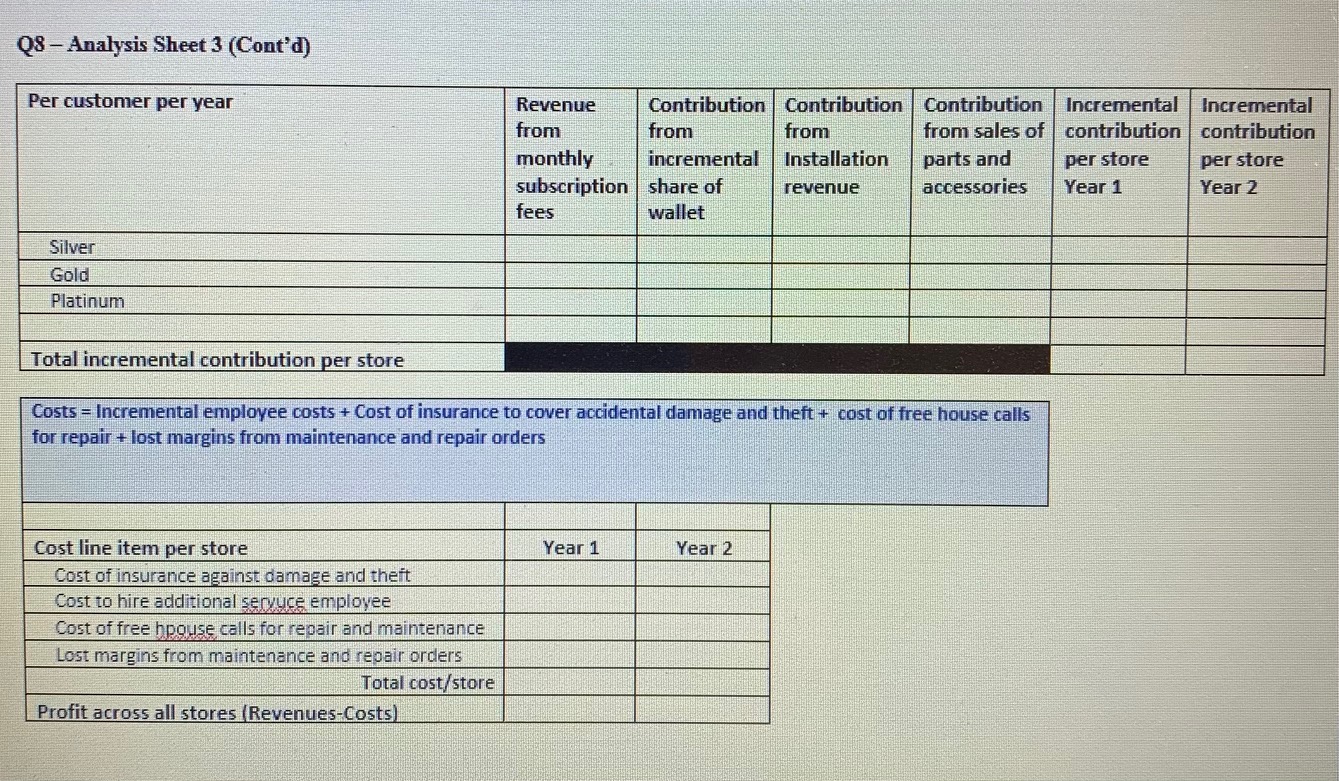

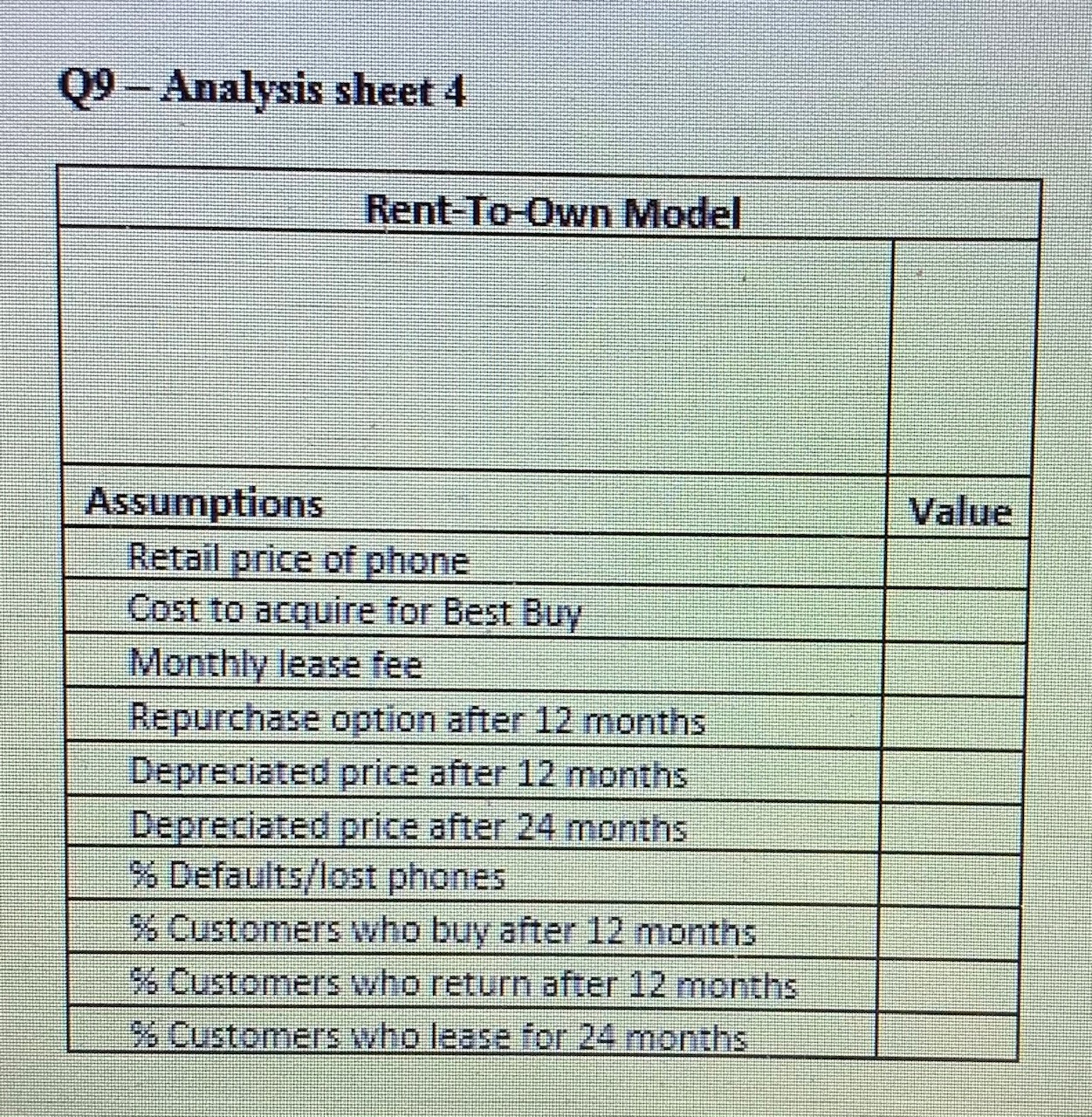

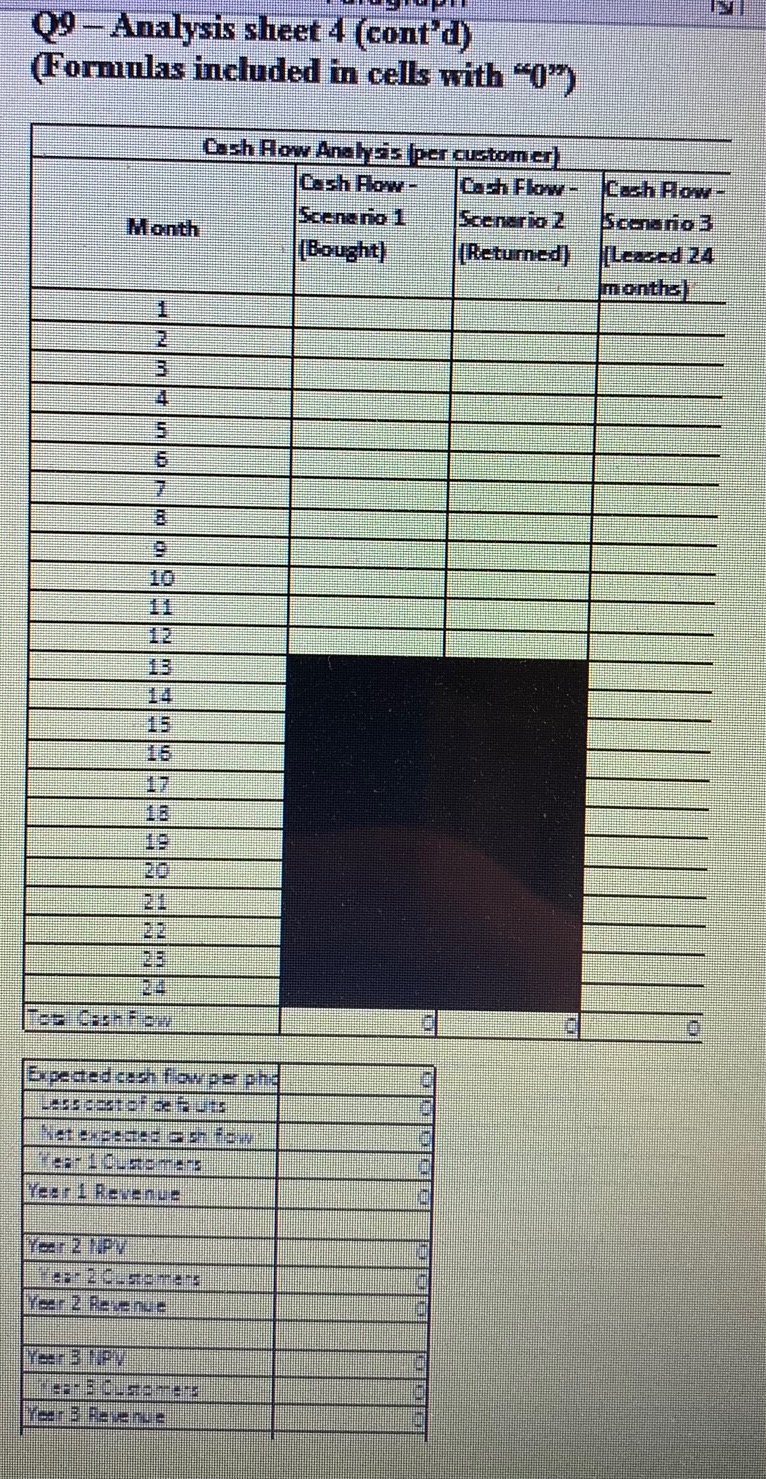

Question 5 Strategic Initiatives Assessment: Pros and Cons Strategic Initiative Pros Cons Improve In-Store Experience (Leverage physical assets) etc Enhance Ownership Experience etc etc Innovate the Business Model etc etcQ6 Analysis sheet - 1 Financial Analysis: Matching Customers with Products Year Year Assumptions 1 2 Salesforce size Sales staff to be trained Training cost/salesperson Cost of mobile device/salesperson Best Buy revenue Revenues Sales Increase Profit margin Costs Training costs Cost of upgrading online system Mobile devices Cost on CMS (Content Management System) Total Costs Profit (Revenue-Costs)Q7 Analysis Sheet - 2 Creating Stores within a Store Assumptions Value Number of BB stores Pilot stores number Traffic/store # of SWS in each BB store SWS area per BB Store (Sq ft) Sales Associates training Cost per store One-time costs to setup SWS per BB store Leasing fee collected per month SWS traffic fee collected per person exploring SWS customer cross buying accessories Incremental revenue due to SWS Average increase in spend on purchase of accessories per person Profit margin on incremental revenue % Profit margin for accessories $% Revenues SWS Leasing Fee revenue 5WS traffic fee revenue Cross-selling accessories Profit from products sold in SWS Total revenue from pilot project Costs Set up cost Training cost Total Cost of the Pilot Profit (Revenue-Costs) for 10%% of stores Profit ( Revenue-Costs) for all storesQ8 - Analysis Sheet 3 Best Buy 360 Initiative Program Tier Assumptions and known facts Silver Gold Platinum Total Store Number of customers enrolled in Year 1 Number of customers per store in Year 1 Number of customers enrolled in Year 2 Number of customers per store in Year 2 Losceemental sales due to increased share of wallet Subscription revenues from annual membership fees Profit margin of products sold in Store Annual cost of third party insurance for accidental damage and theft Discount on installation of products bought outside Best Buy Number of Installation Work Orders for products bought outside Best BUY Revenues from sales of parts and accessories during installation and repair Margin on sales of parts and accessories Installation charges per work order Cost to Best Buy per installation work order of customers buying installation services (pre-BB360) Profit margin of installation work orders [ pre-86360) cost to hire one additional service employee/store Total number of stores Profit of BB360 = Revenue from BB360 - Cost of implementation and operation - lost revenues due to migration of traditional customers to 88360 Revenues = Revenue from monthly membership fees + Incremental contribution from increased sales + Incremental contribution from installation services for outside products + Increemental contribution from sales of parts and accessoriesQ8 - Analysis Sheet 3 (Cont'd) Per customer per year Revenue Contribution Contribution Contribution Incremental Incremental from from from from sales of contribution contribution monthly incremental Installation parts and per store per store subscription share of revenue accessories Year 1 Year 2 fees wallet Silver Gold Platinum Total incremental contribution per store Costs = Incremental employee costs + Cost of insurance to cover accidental damage and theft + cost of free house calls for repair + lost margins from maintenance and repair orders Cost line item per store Year 1 Year 2 Cost of insurance against damage and theft Cost to hire additional seryuce employee Cost of free hpouse calls for repair and maintenance Lost margins from maintenance and repair orders Total cost/store Profit across all stores (Revenues-Costs)Q9 - Analysis sheet 4 Rent-To-Own Model Assumptions Value Retail price of phone Cost to acquire for Best Buy Monthly lease fee Repurchase option after 12 months Depreciated price after 12 months Depreciated price after 24 months 9% Defaults/lost phones 36 Customers who buy after 12 months 36 Customers who return after 12 months 9% Customers who lease for 24 monthsQ9 - Analysis sheet 4 (cont'd) (Formulas included in cells with "(") Cash How Analys' (per custom er) Cash Row - Cash Flow - Cash How - Month Scene no 1 Scenario 2 Scenario 3 [Bought) [Returned) Leased 24 months s flow pao phy Year 1 Revenue Year 2 HPV Year 2 Revenue Year B Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts