Question: Please DONT FORGET TO READ MY COMMENT - Read the case study provided below in the five pictures on the topic - Best Buy: Creating

Please DONT FORGET TO READ MY COMMENT -

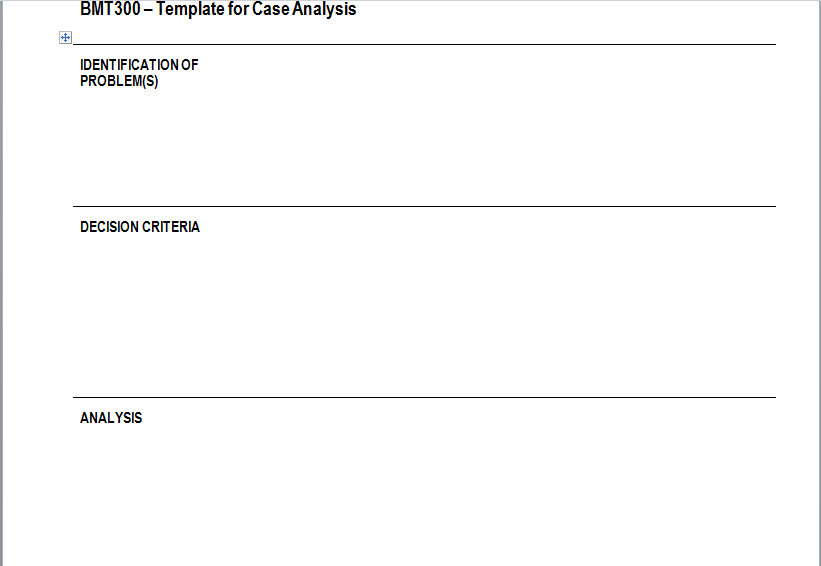

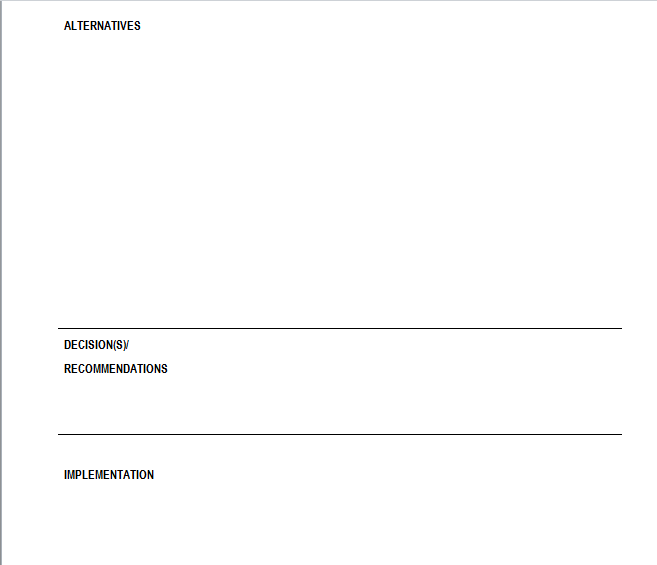

Read the case study provided below in the five pictures on the topic - Best Buy: Creating a Winning Customer Experience in Consumer Electronic and then by the help of case analysis template -Ensure you fill out the six sections of the template:

Identification of Problem(s), Decision Criteria, Analysis, Alternatives, Decision(s)/Recommendations and Implementation.

The main aim is to complete the case analysis template which you can see in the last two pictures please help in this .

CASE STUDY -

\f\f1. Improving the In-Store Experience (Leveraging Physical Assets) One way that Best Buy could wrest the initiative back from companies such as Amazon was to improve the customer experience by leveraging its privileged assets, which included physical showrooms, Geek Squad service, and sales associates ("Blue Shirts"). This initiative would address the competitive threats faced by the company and also issues relevant to millennials through its focus on service. Matching Customers With Products Studies showed that consumers expected sales associates to demonstrate their expertise to complement the information consumers could get online. 8 Consumers also expected sales associates to know their preferences and past purchases. More than two-thirds of customers (69 percent) expected associates to carry a mobile device for real-time information on products, inventory, return policy, warranty information, past purchases made by the consumer, and product recommendations. The message was clear: sales associates had to be experts and advisors, not merely sales people (see Exhibit 6). Millennials felt overwhelmed by the sheer amount of online information and the dizzying array of available products and services. Therefore, they expected sales associates to help them with their purchase decisions, especially after they had narrowed down their choices with online research. Best Buy could become the preferred consumer choice by intelligently matching customers with products. One way to achieve this was by leveraging the expertise of the Blue Shirts. Profiles of selected Blue Shirts could be placed on digital assets along with information on their domain expertise, store location, and their contact details. Customers could search Blue Shirts based on their expertise and location, and send questions to them. The idea was to create a more personal relationship with millennial customers while generating sales and service leads at the same time. To achieve this, Best Buy would have to invest in training its salesforce to ensure superior product knowledge across platforms. The Blue Shirts also needed access to customer information to improve conversion. Although 70 percent of people who entered Best Buy came with the intent to buy, only 46 percent of them ended up buying a product or service, resulting in 24 percent in lost opportunities in-store. However, Best Buy would need to determine what percentage of the Blue Shirts qualified for such training and estimate training costs. Another option was to replicate the in-store sales experience online. Inquiring about customers' preferences as they conducted online searches could generate a shortlist of best product candidates. This would enable customers to discover the perfect product for their needs. The in-store experience could be augmented with product information from online resources, including ratings and reviews aggregated from social media, competitor stores, and third-party experts such as customers who had already bought the product. Data showed that offering product reviews produced an average increase of 18 percent in sales. Fifty-eight percent of consumers preferred sites that offered reviews, and 63 percent were more likely to buy from a site that offered user reviews.store at an average salary of $50,000. 3. Innovating on the Business Model (Rent-to-Own Model) Millennial customers were increasingly shifting from a product ownership to a product sharing mindset. The desire for convenience and lower disposable income fueled the rental culture exemplified by the emergence of services such as Zipcar (car-renting), Spotify (music), Uber (ride-sharing), AirBob (home rentals), Rent-the- Runway (fashion), and Divvy Bike (bike-sharing). Millennials liked the rental model because it made the latest products and gadgets more affordable and allowed them to try out a product before committing to a purchase. Page 10 of 12 Best Buy: Creating a Winning Customer Experience in Consumer Electronics SSAGE businesscases SAGE SAGE Business Cases (@2017 Kellogg School of Management, Northwestern University Best Buy saw an opportunity to create a rent-to-own (RTO) model that would take advantage of its extensive physical presence and would be difficult for Amazon to replicate. It could rent consumer electronics, specifically smartphones. With service providers such as Verizon and AT&T looking to move away from phone subsidies and leaving customers to independently acquire their own devices, Best Buy could step into the void. It could offer the latest, most popular smartphones for a monthly rental fee, with an option to buy the phone at any time during or after the rental period. The RTO arrangement would involve leasing an electronics product to a customer, who would make monthly payments in exchange for immediate access to the product. The RTO lease would also include a purchase provision that would allow the customer to own the product after a predetermined number of payments had been made to the retailer. The RTO model would be particularly attractive to customers with poor credit, because credit checks were not required for an RTO lease. It would also benefit customers on tight budgets who could not afford to pay upfront for high-end smartphones. The RTO model for smartphones would work as follows: Customers could lease a high-end smartphone such as the Apple iphone 6 or the Samsung Galaxy S6 (with a retail price of $649) for a monthly fee of $30 with a minimum term of 12 months. After the minimum term, customers would have three options: (1) buy the leased phone for $499; (2) continue leasing the phone for $30/month; or (3) return the leased phone to Best Buy. It was estimated that 25 percent of customers would buy the phone, 25 percent would return the phone, and the remaining 50 percent would keep leasing the phone for an average of 24 months, after which they would retum the phone to Best Buy. Best Buy would sell the returned used phones in the secondary market at the depreciated price. The new phones would cost Best Buy an average of $599 to acquire. The depreciated value of the phones that Best Buy could realize was estimated at $449 at the end of 12 months and $249 at the end of 18 months. Due to the risky nature of the customers who would be attracted to the RTO arrangement, it was estimated that 20 percent of the phones rented under this arrangement would be lost to defaults. In the case of a default, Best Buy would need to write off the entire cost of buying the phone. Best Buy estimated that 0.5 million customers would sign up for the RTO model in the first year, 1 million in the second year, and 2 million in the third year. Best Buy would apply an annual discount rate of 12 percent to calculate the net present value of the cash flows from the RTO model.Abstract After a successful run for many years as a resilient consumer electronics giant, Best Buy was under intense pressure at the end of 2014. Even as competitors like Circuit City melted away, Best Buy had been able to withstand the onslaught of online behemoth Amazon and discount retailers like Target and Walmart. However, its competitive position was threatened as online shopping became more popular, particularly among millennial customers. With a new leadership team, Best Buy had recently undertaken bold initiatives to expand and refine its online presence and position itself for success. These initiatives had produced encouraging results, but Best Buy needed to do more to stem the loss of market share to Amazon and to become more relevant to millennial customers. To address these challenges, Best Buy approached the Kellogg School of Management to solicit ideas from student teams by sponsoring a Business Challenge competition. The teams came up with several strategic initiatives. Best Buy needed to evaluate these initiatives on two criteria: First, how well did these initiatives leverage Best Buy's privileged physical assets (stores, salespeople, and Geek Squad services staff) to create a winning customer experience? Second, how effective would these initiatives be in attracting and retaining millennial customers? Case At the end of 2014, Best Buy was one of the largest retailers in the United States, with over 1,400 domestic stores, a strong web presence, and a trusted brand name. Best Buy had held its own against the onslaught of e-commerce while many other electronics retailers such as Circuit City had gone out of business. Over the past few years, however, Best Buy's performance had flagged. The retail market was experiencing a rapid shift toward online shopping, epitomized by the rise of Amazon. Customers would visit physical consumer electronics stores such as Best Buy to try out products but end up buying from online retailers. This practice, called "showrooming," was a significant threat to Best Buy. The company had responded by offering a price-matching guarantee in 2013. Although the price-matching guarantee had reduced the threat from showrooming, Best Buy had to contend with lower profit margins and the continued perception that Amazon offered lower prices and more choice. Best Buy was also challenged by the growing influence of millennials, who preferred to shop online and had much higher expectations for a physical retail store experience. The millennial segment was growing in size and importance, but it was underrepresented in Best Buy's customer base. Best Buy needed to improve its appeal to millennials by creating an online as well as offline customer experience that would exceed their expectations. Under the leadership of recently appointed CEO Hubert Joly, Best Buy had taken the initiative to win in the changing marketplace. For all the strength of online players such as Amazon, Best Buy had powerful physical assets such as its stores, its vast employee base, and its Geek Squad service operation. How could the company leverage these privileged assets to create a winning customer experience? How could it improve its relevance and appeal to millennials? Best Buy had recently sponsored a business challenge competition at the Kellogg School of Management at Northwestern University. The company received recommendations from three winning student teams who suggested strategic initiatives in three areas-improving the in- store experience, enhancing the ownership experience, and offering a rent-to-own model. Although all these initiatives sounded promising, Best Buy needed to decide which would best deliver on its strategic objectives.BMTBDD Template for Case Analysis IDENTIFICATION OF PROBLEMS} DECISION CRITERIA ANALYSIS \f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts