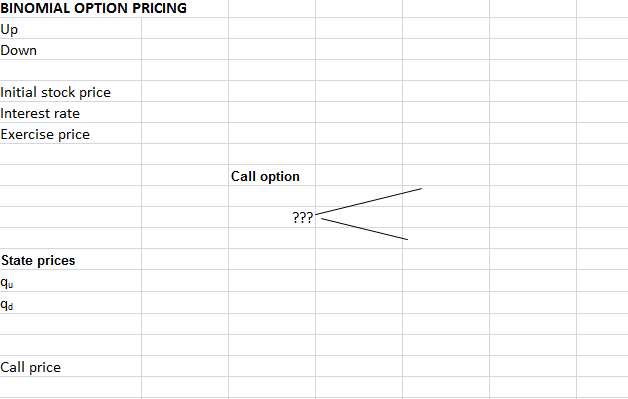

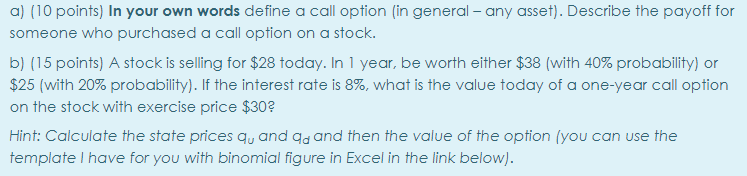

Question: BINOMIAL OPTION PRICING Up Down Initial stock price Interest rate Exercise price Call option ??? State prices qu ad Call price a) (10 points) In

BINOMIAL OPTION PRICING Up Down Initial stock price Interest rate Exercise price Call option ??? State prices qu ad Call price a) (10 points) In your own words define a call option (in general - any asset). Describe the payoff for someone who purchased a call option on a stock. b) (15 points) A stock is selling for $28 today. In 1 year, be worth either $38 (with 40% probability) or $25 (with 20% probability). If the interest rate is 8%, what is the value today of a one-year call option on the stock with exercise price $30? Hint: Calculate the state prices qy and qd and then the value of the option (you can use the template I have for you with binomial figure in Excel in the link below)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts