Question: Bob Ross Inc. is considering adding some automatic equipment to its production facilities. An investment of $250,000 will produce an initial annual benefit of $50,000,

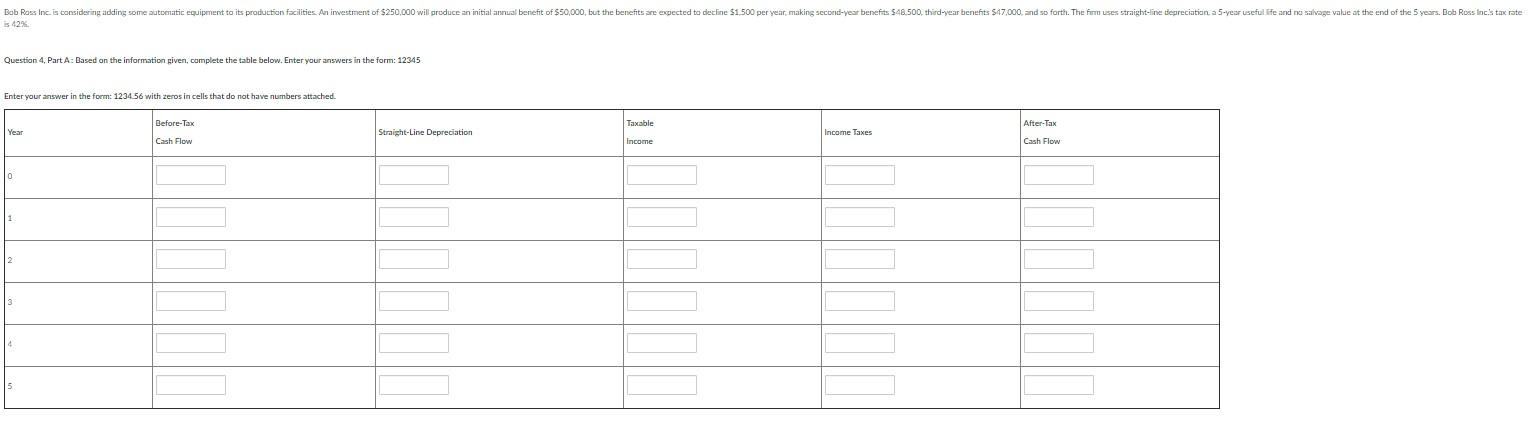

Bob Ross Inc. is considering adding some automatic equipment to its production facilities. An investment of $250,000 will produce an initial annual benefit of $50,000, but the benefits are expected to decline $1.500 per year, making second-year benefits 548.500 third-year benefits $17,000, and so forth. The form uses straight-line depreciation a 5-year useful life and no salvage value at the end of the years. Bob Ross inc's tax rate is 42% Question 4, Part A: Based on the information given, complete the table below. Enter your answers in the form: 12345 Enter your answer in the form: 1234.56 with zeros in cells that do not have numbers attached. Before-Tex Taxable After-Tax Straight-Line Depreciation Income Taxes Cash Flow Income Cash Flow lo Bob Ross Inc. is considering adding some automatic equipment to its production facilities. An investment of $250,000 will produce an initial annual benefit of 550,000, but the benefits are expected to decline $1.500 per year, making second-year benefits 548.500. third-year benefits $47,000and so forth. The firm uses straight-line depreciation a 5-year useful life and no salvage value at the end of the years. Bob Ross Inc.'s tax rate Question 4. Part : Based on the information found in Part A and assuming an after-tax MARR of 10%, provide the formula to find the after-tax NPW of the project. Make sure to provide all function notation. Bob Rass Inc. is considering adding some automatic equipment to its production facilities. An investment of $250,000 will produce an initial annual benefit of $50,000, but the benefits are expected to decline 51.500 per year, making second-year benefits 548.500, third-year benefits $47.000, and so forth. The firm uses straight-line depreciation a 5-year useful life and na salvage value at the end of the 5 years. Bob Ross Inc.'s tax rate 42% Question 4, Part C: What is the after-tax NPW of this project? Bob Ross Inc. is considering adding some automatic equipment to its production facilities. An investment of $250,000 will produce an initial annual benefit of $50,000, but the benefits are expected to decline $1.500 per year, making second-year benefits $48.500, third-year benefits $17.000. and so forth. The firm uses straight-line depreciation, a 5-year useful life and co salvage value at the end of the years. Bob Ross Inc.'s tax rate is 42% Question 4. Part D: Should this project be funded? Why or why not? Bob Ross Inc. is considering adding some automatic equipment to its production facilities. An investment of $250,000 will produce an initial annual benefit of $50,000, but the benefits are expected to decline $1.500 per year, making second-year benefits 548.500 third-year benefits $17,000, and so forth. The form uses straight-line depreciation a 5-year useful life and no salvage value at the end of the years. Bob Ross inc's tax rate is 42% Question 4, Part A: Based on the information given, complete the table below. Enter your answers in the form: 12345 Enter your answer in the form: 1234.56 with zeros in cells that do not have numbers attached. Before-Tex Taxable After-Tax Straight-Line Depreciation Income Taxes Cash Flow Income Cash Flow lo Bob Ross Inc. is considering adding some automatic equipment to its production facilities. An investment of $250,000 will produce an initial annual benefit of 550,000, but the benefits are expected to decline $1.500 per year, making second-year benefits 548.500. third-year benefits $47,000and so forth. The firm uses straight-line depreciation a 5-year useful life and no salvage value at the end of the years. Bob Ross Inc.'s tax rate Question 4. Part : Based on the information found in Part A and assuming an after-tax MARR of 10%, provide the formula to find the after-tax NPW of the project. Make sure to provide all function notation. Bob Rass Inc. is considering adding some automatic equipment to its production facilities. An investment of $250,000 will produce an initial annual benefit of $50,000, but the benefits are expected to decline 51.500 per year, making second-year benefits 548.500, third-year benefits $47.000, and so forth. The firm uses straight-line depreciation a 5-year useful life and na salvage value at the end of the 5 years. Bob Ross Inc.'s tax rate 42% Question 4, Part C: What is the after-tax NPW of this project? Bob Ross Inc. is considering adding some automatic equipment to its production facilities. An investment of $250,000 will produce an initial annual benefit of $50,000, but the benefits are expected to decline $1.500 per year, making second-year benefits $48.500, third-year benefits $17.000. and so forth. The firm uses straight-line depreciation, a 5-year useful life and co salvage value at the end of the years. Bob Ross Inc.'s tax rate is 42% Question 4. Part D: Should this project be funded? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts