Question: Bond Yield (1)Based on the attached chart,which bond is premium bond? a) Treasury Note Tn1 b)Treasury Note Tn2 c) Treasury Bond Tb d) Municipal bond

Bond Yield

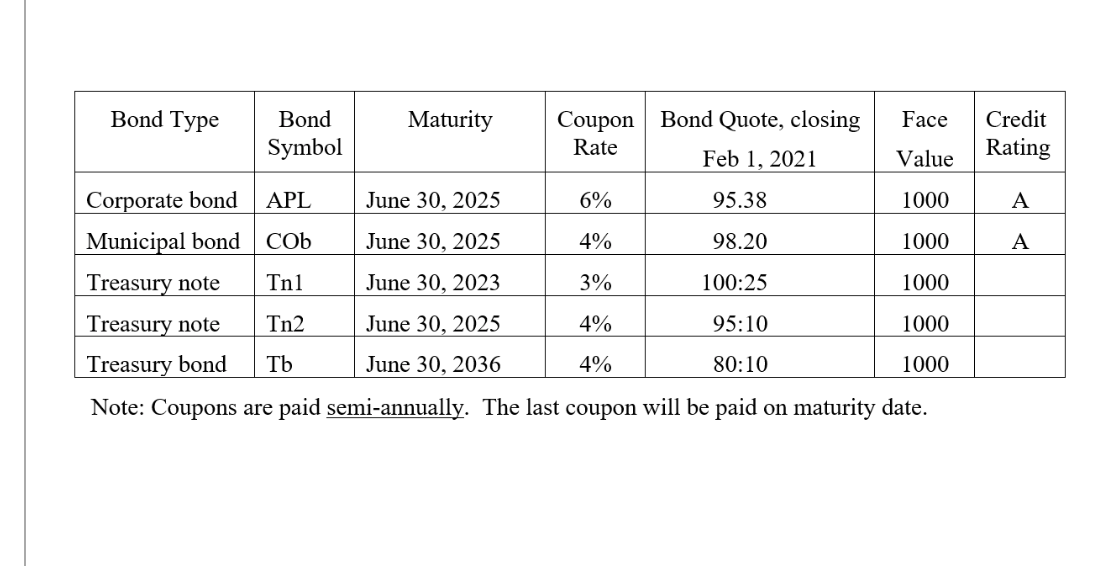

(1)Based on the attached chart,which bond is premium bond?

a) Treasury Note Tn1

b)Treasury Note Tn2

c) Treasury Bond Tb

d) Municipal bond COb

e) Corporate bond APL

(2) Calculatecurrent yieldof Bond APL based on the closing quote on Feb 1, 2021.

(3) Calculatecredit spreadof Bond APL based on the closing quote on Feb 1, 2021.

(4)Assume that all three rating agencies decide tochangeBond APL's rating to "High Yield" category, how would such change in rating affect Bond APL'scredit spread?

a)Credit spread would widen

b)Credit spread would tighten and narrow

c)There should be no impact on credit spread

d)None of the answers are correct.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts