Question: Bonds Valuation: Term Structure of Interest Rates inflation to decrease. The shape of the yield curve depends on expectations about future inflation and the effects

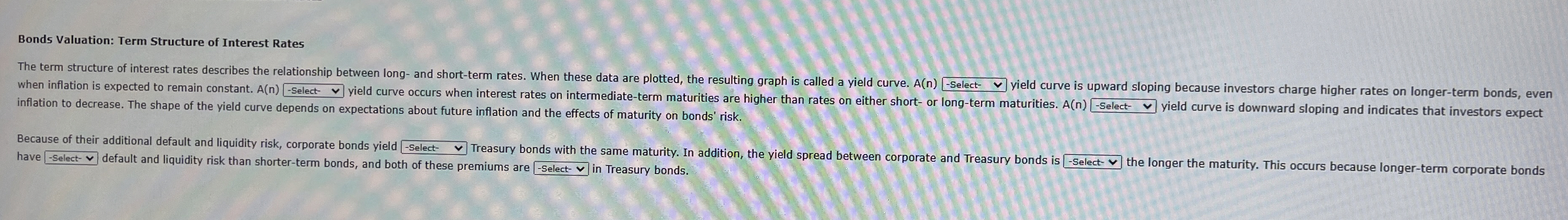

Bonds Valuation: Term Structure of Interest Rates inflation to decrease. The shape of the yield curve depends on expectations about future inflation and the effects of maturity on bonds' risk.

Because of their additional default and liquidity risk, corporate bonds yield Treasury bonds with the same maturity. In addition, the yield spread between corporate and Treasury bonds is default and liquidity risk than shorterterm bonds, and both of these premiums are Select in Treasury bonds. the longer the maturity. This occurs because longerterm corporate bondsBonds Valuation: Term Structure of Interest Rates inflation to decrease. The shape of the yield curve depends on expectations about future inflation and the effects of maturity on bonds' risk.

Because of their additional default and liquidity risk, corporate bonds yield Treasury bonds with the same maturity. In addition, the yield spread between corporate and Treasury bonds is default and liquidity risk than shorterterm bonds, and both of these premiums are Select in Treasury bonds. the longer the maturity. This occurs because longerterm corporate bonds

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock