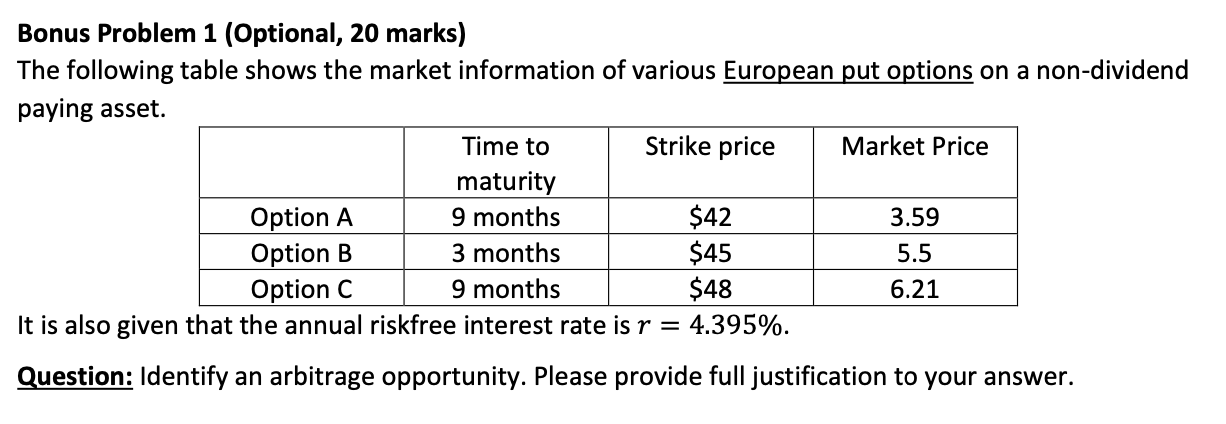

Question: Bonus Problem 1 (Optional, 20 marks) The following table shows the market information of various European put options on a non-dividend paying asset. Time to

Bonus Problem 1 (Optional, 20 marks) The following table shows the market information of various European put options on a non-dividend paying asset. Time to Strike price Market Price maturity Option A 9 months $42 3.59 Option B 3 months $45 5.5 Option C 9 months 6.21 It is also given that the annual riskfree interest rate is r = 4.395%. $48 Question: Identify an arbitrage opportunity. Please provide full justification to your answer. Bonus Problem 1 (Optional, 20 marks) The following table shows the market information of various European put options on a non-dividend paying asset. Time to Strike price Market Price maturity Option A 9 months $42 3.59 Option B 3 months $45 5.5 Option C 9 months 6.21 It is also given that the annual riskfree interest rate is r = 4.395%. $48 Question: Identify an arbitrage opportunity. Please provide full justification to your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts