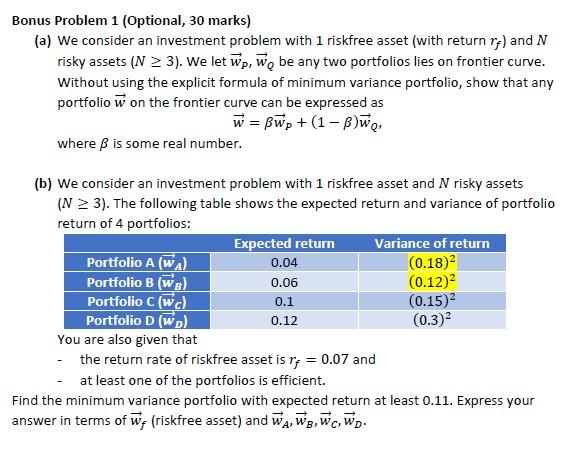

Question: Bonus Problem 1 (Optional, 30 marks) (a) We consider an investment problem with 1 riskfree asset (with return rf) and N risky assets (N >

Bonus Problem 1 (Optional, 30 marks) (a) We consider an investment problem with 1 riskfree asset (with return rf) and N risky assets (N > 3). We let p, we be any two portfolios lies on frontier curve. Without using the explicit formula of minimum variance portfolio, show that any portfolio w on the frontier curve can be expressed as w = Bp + (1 - B) where is some real number. (b) We consider an investment problem with 1 riskfree asset and N risky assets (N = 3). The following table shows the expected return and variance of portfolio return of 4 portfolios: Expected return Variance of return Portfolio A (WA) 0.04 (0.182 Portfolio B (WB) 0.06 (0.12) Portfolio C(wc (0.15) Portfolio D (wo) 0.12 (0.3) You are also given that - the return rate of riskfree asset is ra = 0.07 and at least one of the portfolios is efficient. Find the minimum variance portfolio with expected return at least 0.11. Express your answer in terms of W, (riskfree asset) and W, Ws, c, W. 0.1 Bonus Problem 1 (Optional, 30 marks) (a) We consider an investment problem with 1 riskfree asset (with return rf) and N risky assets (N > 3). We let p, we be any two portfolios lies on frontier curve. Without using the explicit formula of minimum variance portfolio, show that any portfolio w on the frontier curve can be expressed as w = Bp + (1 - B) where is some real number. (b) We consider an investment problem with 1 riskfree asset and N risky assets (N = 3). The following table shows the expected return and variance of portfolio return of 4 portfolios: Expected return Variance of return Portfolio A (WA) 0.04 (0.182 Portfolio B (WB) 0.06 (0.12) Portfolio C(wc (0.15) Portfolio D (wo) 0.12 (0.3) You are also given that - the return rate of riskfree asset is ra = 0.07 and at least one of the portfolios is efficient. Find the minimum variance portfolio with expected return at least 0.11. Express your answer in terms of W, (riskfree asset) and W, Ws, c, W. 0.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts