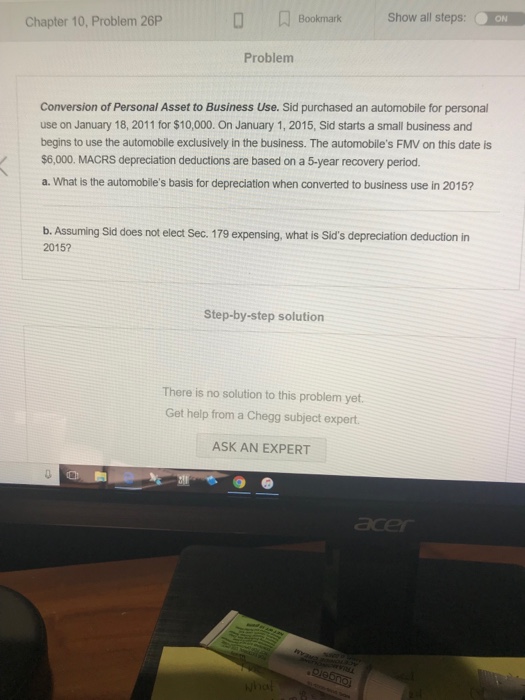

Question: Bookmark Show all steps: ON Chapter 10, Problem 26P Problem Conversion of Personal Asset to Business Use. Sid purchased an automobile for personal use on

Bookmark Show all steps: ON Chapter 10, Problem 26P Problem Conversion of Personal Asset to Business Use. Sid purchased an automobile for personal use on January 18, 2011 for $10,000. On January 1, 2015, Sid starts a small business and begins to use the automobile exclusively in the business. The automobile's FMV on this date is $6,000. MACRS depreciation deductions are based on a 5-year recovery period a. What is the automobile's basis for depreciation when converted to business use in 2015? b. Assuming Sid does not elect Sec. 179 expensing, what is Sid's depreciation deduction in 2015? Step-by-step solution There is no solution to this problem yet. Get help from a Chegg subject expert ASK AN EXPERT ace

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts