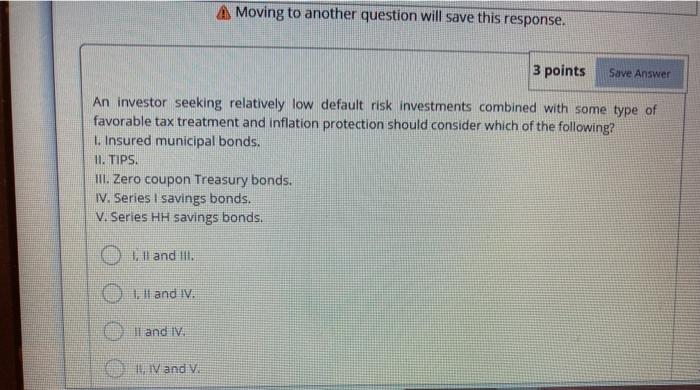

Question: both answered pls A Moving to another question will save this response. 3 points Save Answer An investor seeking relatively low default risk investments combined

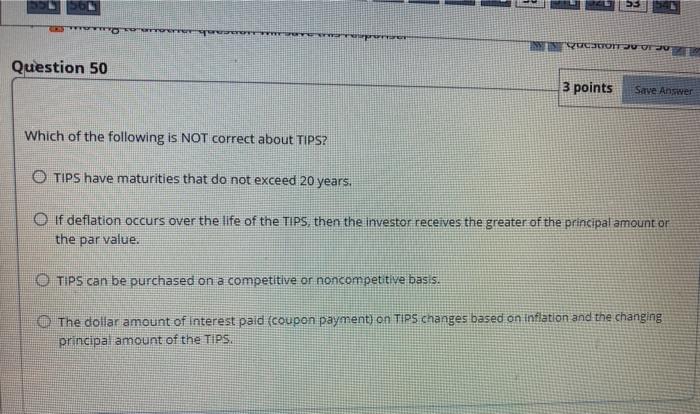

A Moving to another question will save this response. 3 points Save Answer An investor seeking relatively low default risk investments combined with some type of favorable tax treatment and inflation protection should consider which of the following? 1. Insured municipal bonds. 11. TIPS. III. Zero coupon Treasury bonds. IV. Series I savings bonds. V. Series HH savings bonds. Oil and III. 01.ll and IV. I and IV. O , Vand V. Www DUTOITU Question 50 3 points Save Answer Which of the following is NOT correct about TIPS? O TIPS have maturities that do not exceed 20 years. If deflation occurs over the life of the TIPS, then the investor receives the greater of the principal amount or the par value. O TIPS can be purchased on a competitive or noncompetitive basis. The dollar amount of interest paid (coupon payment) on TIPS changes based on inflation and the changing principal amount of the TIPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts