Question: Both are part of same question, So please EXPLAIN BOTH parts ANSWER IS PROVIDED IN TABLE just after example i was only able to understand

Both are part of same question, So please EXPLAIN BOTH parts

ANSWER IS PROVIDED IN TABLE just after example

i was only able to understand the 1st coloum of of first table( i have marked it 1st with pencil)

i cannot understand rest can you help

please help with detail

if i understand i will give like kindly explain both and in detail, i am just starting the chapter so i am starting from basic

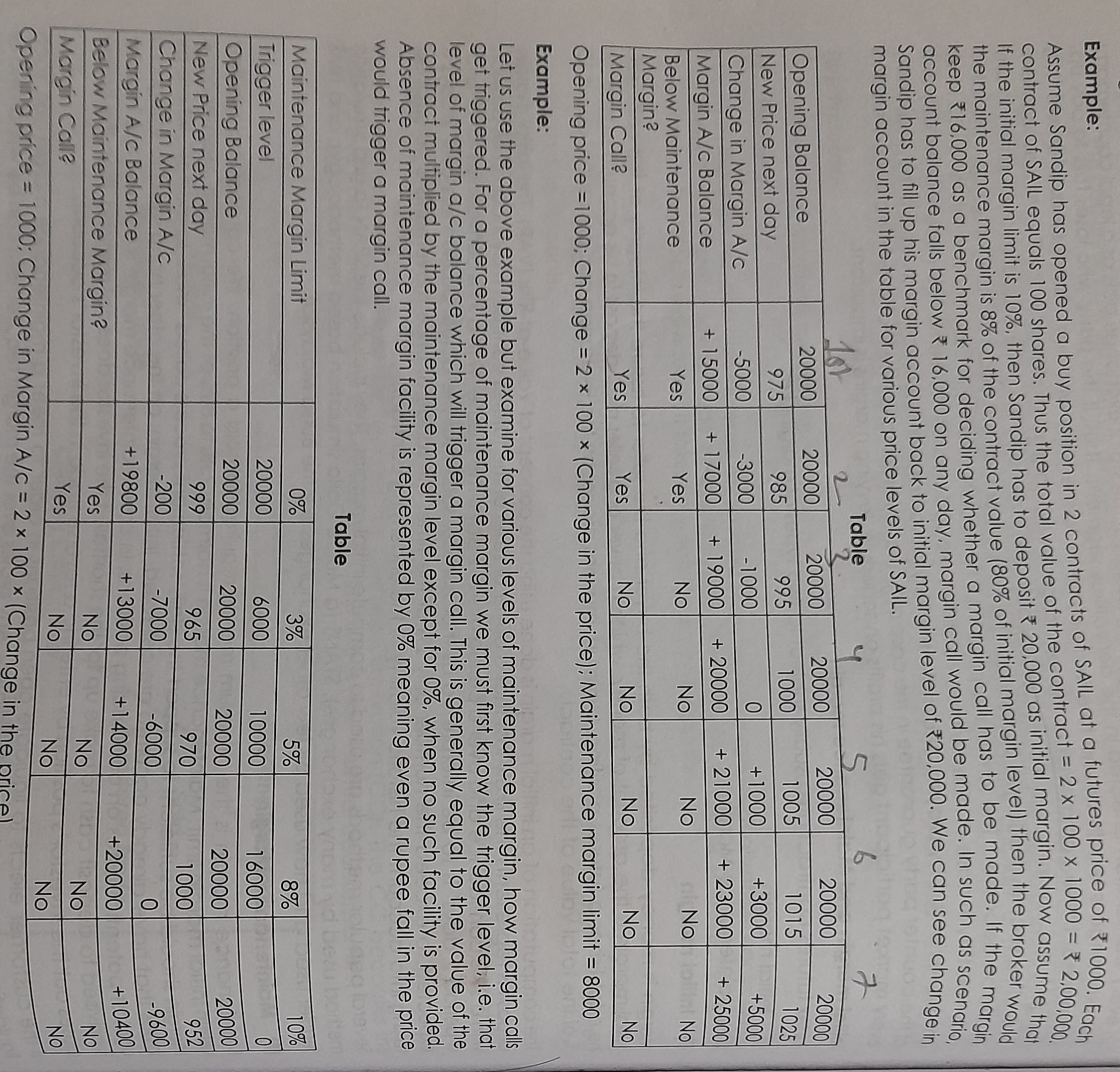

Example: Assume Sandip has opened a buy position in 2 contracts of SAlL at a futures price of 1000. Each contract of SAIL equals 100 shares. Thus the total value of the contract =21001000=2,00,000, If the initial margin limit is 10%, then Sandip has to deposit 20,000 as initial margin. Now assume that the maintenance margin is 8% of the contract value (80% of initial margin level) then the broker would keep 16,000 as a benchmark for deciding whether a margin call has to be made. If the margin account balance falls below 16,000 on any day, margin call would be made. In such as scenario, Sandip has to fill up his margin account back to initial margin level of 20,000. We can see change in marain account in the table for various price levels of SAIL. Opening price =1000; Change =2100( Change in the price ); Maintenance margin limit =8000 Example: Let us use the above example but examine for various levels of maintenance margin, how margin calls get triggered. For a percentage of maintenance margin we must first know the trigger level, i.e. that level of margin a/c balance which will trigger a margin call. This is generally equal to the value of the contract multiplied by the maintenance margin level except for 0%, when no such facility is provided. Absence of maintenance margin facility is represented by 0% meaning even a rupee fall in the price would trigger a margin call. Table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts