Question: Hi, please list out the formulas where necessary , graphs where necessary , if the question doesnt require it, its fine not have it but

Hi, please list out the formulas where necessary , graphs where necessary , if the question doesnt require it, its fine not have it but please do put it down if it helps you to explain . If the answer is provided, its because I struggled to understand the answer, please dont just reproduce it, but rather explain it and list out the formulas used with explanations OF FORMULAS USED IN THE QUESTION , the procedure etc.Thank you!

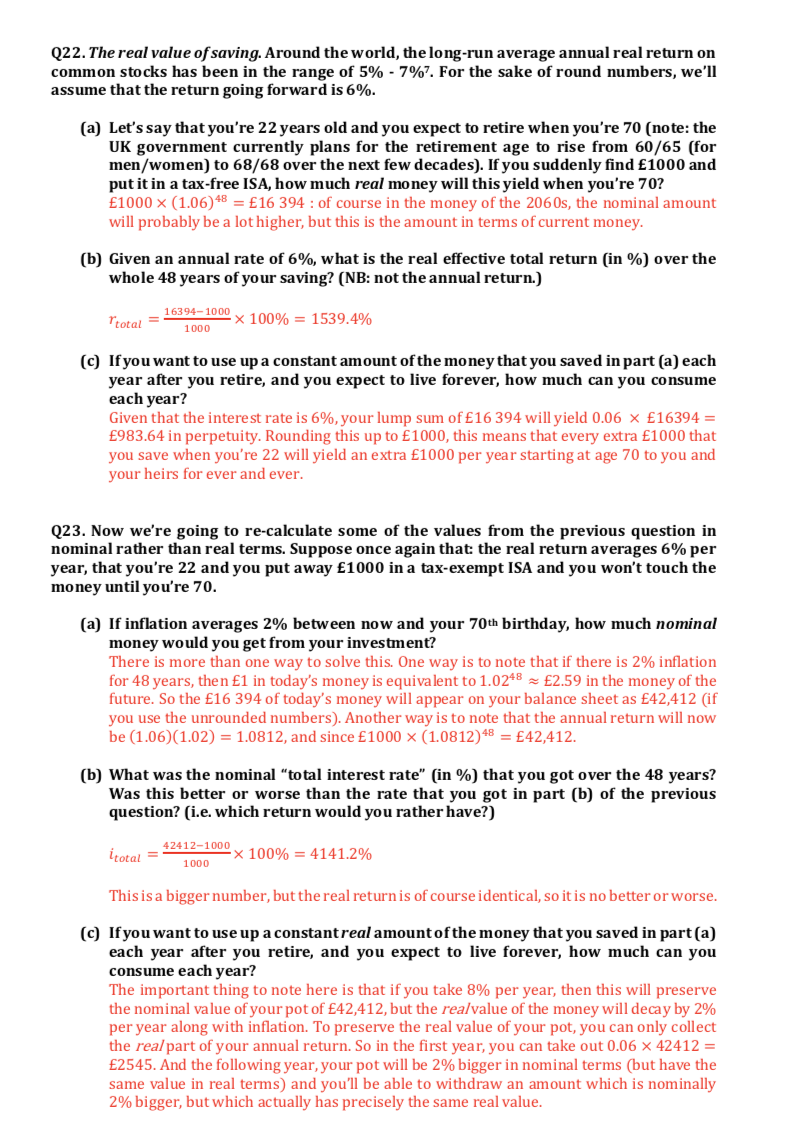

Q22. The real value of saving. Around the world, the long-run average annual real return on common stocks has been in the range of 5% - 7%%. For the sake of round numbers, we'll assume that the return going forward is 6%. (a) Let's say that you're 22 years old and you expect to retire when you're 70 (note: the UK government currently plans for the retirement age to rise from 60/65 (for men/women) to 68/68 over the next few decades). If you suddenly find $1000 and put it in a tax-free ISA, how much real money will this yield when you're 70? E1000 x (1.06) = $16 394 : of course in the money of the 2060s, the nominal amount will probably be a lot higher, but this is the amount in terms of current money. (b) Given an annual rate of 6%, what is the real effective total return (in %) over the whole 48 years of your saving? (NB: not the annual return.) total = 16394-1004 x 100% = 1539.4% 1000 (c) If you want to use up a constant amount of the money that you saved in part (a) each year after you retire, and you expect to live forever, how much can you consume each year? Given that the interest rate is 6%, your lump sum of $16 394 will yield 0.06 x E16394 = 1983.64 in perpetuity. Rounding this up to $1000, this means that every extra $1000 that you save when you're 22 will yield an extra $1000 per year starting at age 70 to you and your heirs for ever and ever. Q23. Now we're going to re-calculate some of the values from the previous question in nominal rather than real terms. Suppose once again that the real return averages 6% per year, that you're 22 and you put away $1000 in a tax-exempt ISA and you won't touch the money until you're 70. (a) If inflation averages 2% between now and your 70th birthday, how much nominal money would you get from your investment? There is more than one way to solve this. One way is to note that if there is 2% inflation for 48 years, then f1 in today's money is equivalent to 1.0248 = $2.59 in the money of the future. So the E16 394 of today's money will appear on your balance sheet as $42,412 (if you use the unrounded numbers). Another way is to note that the annual return will now be (1.06)(1.02) = 1.0812, and since 1000 x (1.0812)48 = $42,412. (b) What was the nominal "total interest rate" (in %) that you got over the 48 years? Was this better or worse than the rate that you got in part (b) of the previous question? (i.e. which return would you rather have?) itotal = 42412-1000 1000 -x 100% = 4141.2% This is a bigger number, but the real return is of course identical, so it is no better or worse. (c) If you want to use up a constantreal amount of the money that you saved in part (a) each year after you retire, and you expect to live forever, how much can you consume each year? The important thing to note here is that if you take 8% per year, then this will preserve the nominal value of your pot of $42,412, but the realvalue of the money will decay by 2% per year along with inflation. To preserve the real value of your pot, you can only collect the real part of your annual return. So in the first year, you can take out 0.06 x 42412 = E2545. And the following year, your pot will be 2% bigger in nominal terms (but have the same value in real terms) and you'll be able to withdraw an amount which is nominally 2% bigger, but which actually has precisely the same real value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts