Question: both please Question 8 (1 point) It is March 23. A packer in the U.S. enters into a long live cattle futures contract when the

both please

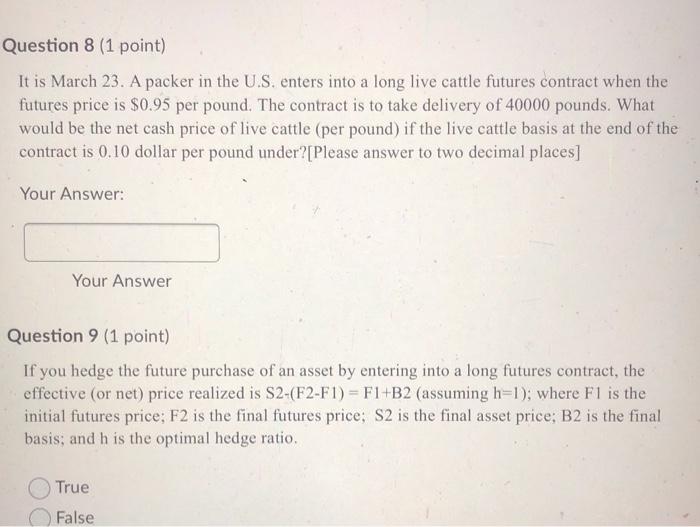

both please Question 8 (1 point) It is March 23. A packer in the U.S. enters into a long live cattle futures contract when the futures price is $0.95 per pound. The contract is to take delivery of 40000 pounds. What would be the net cash price of live cattle (per pound) if the live cattle basis at the end of the contract is 0.10 dollar per pound under?[Please answer to two decimal places] Your Answer: Your Answer Question 9 (1 point) If you hedge the future purchase of an asset by entering into a long futures contract, the effective (or net) price realized is S2-(F2-F1)= F1+B2 (assuming h=1); where F1 is the initial futures price; F2 is the final futures price; S2 is the final asset price; B2 is the final basis; and h is the optimal hedge ratio. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts