Question: both questions please and thanks The expected return for Skyview Aerospace Inc. is 24.60% with the expected probabilities below. What is the standard deviation for

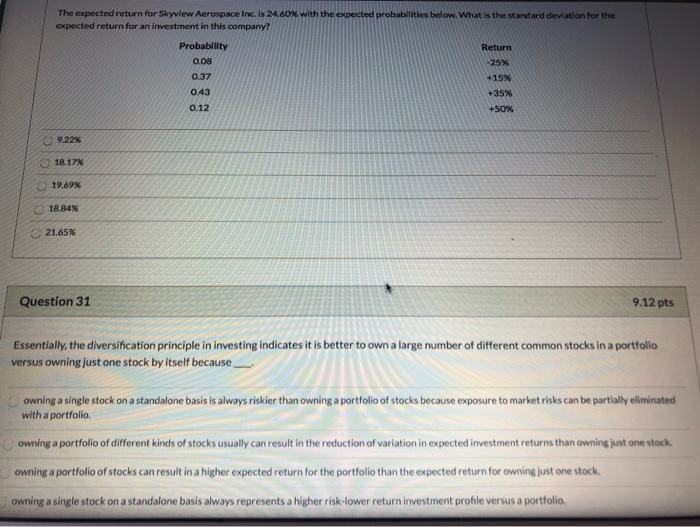

The expected return for Skyview Aerospace Inc. is 24.60% with the expected probabilities below. What is the standard deviation for the expected return for an investment in this company? Probability Return 0.08 0.37 +15% 0.43 +35% 0.12 +50% 9.22% 18.17% 19.69% 18.84% 21.65% Question 31 9.12 pts Essentially, the diversification principle in investing indicates it is better to own a large number of different common stocks in a portfolio versus owning just one stock by itself because owning a single stock on a standalone basis is always riskier than owning a portfolio of stocks because exposure to market risks can be partially eliminated with a portfolio owning a portfolio of different kinds of stocks usually can result in the reduction of variation in expected investment returns than owning just one stock owning a portfolio of stocks can result in a higher expected return for the portfolio than the expected return for owning just one stock. owning a single stock on a standalone basis always represents a higher risk-lower return investment profile versus a portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts