Question: Bridge Corp. operates in Alberta (a province that does not have PST or HST) and sells only fully taxable and zero-rated supplies. Bridge Corp. reports

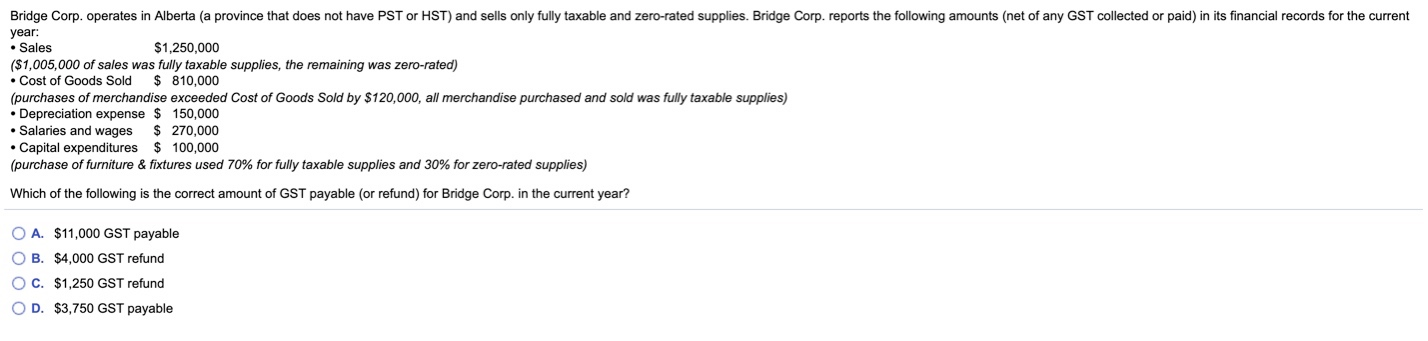

Bridge Corp. operates in Alberta (a province that does not have PST or HST) and sells only fully taxable and zero-rated supplies. Bridge Corp. reports the following amounts (net of any GST collected or paid) in its financial records for the current year: Sales $1,250,000 ($1,005,000 of sales was fully taxable supplies, the remaining was zero-rated) Cost of Goods Sold $ 810,000 (purchases of merchandise exceeded Cost of Goods Sold by $120,000, all merchandise purchased and sold was fully taxable supplies) Depreciation expense $ 150,000 Salaries and wages $ 270,000 Capital expenditures $ 100,000 (purchase of furniture & fixtures used 70% for fully taxable supplies and 30% for zero-rated supplies) Which of the following is the correct amount of GST payable (or refund) for Bridge Corp. in the current year? O A. $11,000 GST payable OB. $4,000 GST refund OC. $1,250 GST refund OD. $3,750 GST payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts