Question: Lovett Ltd. operates in Alberta (a province that does not have PST or HST) and sells only fully taxable and GST exempt supplies. Lovett Ltd.

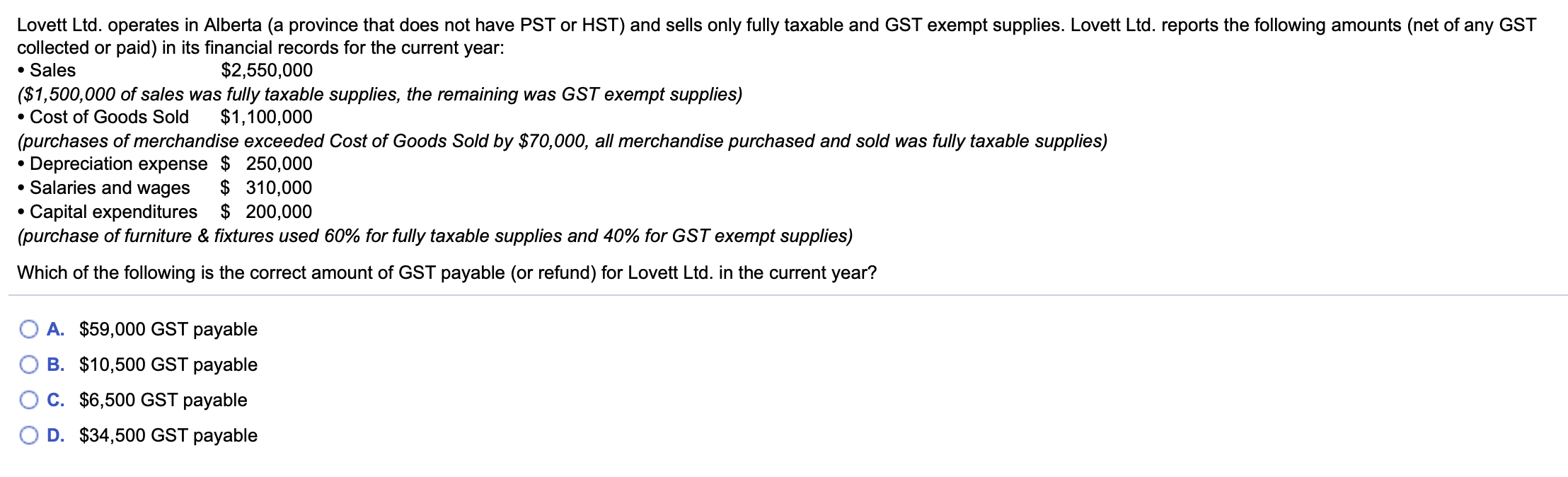

Lovett Ltd. operates in Alberta (a province that does not have PST or HST) and sells only fully taxable and GST exempt supplies. Lovett Ltd. reports the following amounts (net of any GST collected or paid) in its financial records for the current year: Sales $2,550,000 ($1,500,000 of sales was fully taxable supplies, the remaining was GST exempt supplies) Cost of Goods Sold $1,100,000 (purchases of merchandise exceeded Cost of Goods Sold by $70,000, all merchandise purchased and sold was fully taxable supplies) Depreciation expense $ 250,000 Salaries and wages $ 310,000 Capital expenditures $ 200,000 (purchase of furniture & fixtures used 60% for fully taxable supplies and 40% for GST exempt supplies) Which of the following is the correct amount of GST payable (or refund) for Lovett Ltd. in the current year? A. $59,000 GST payable B. $10,500 GST payable C. $6,500 GST payable D. $34,500 GST payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts