Question: Brotherly Co. has a potential new project that is expected to generate annual revenues of $262,100. with variable costs of $144.000, and fixed costs of

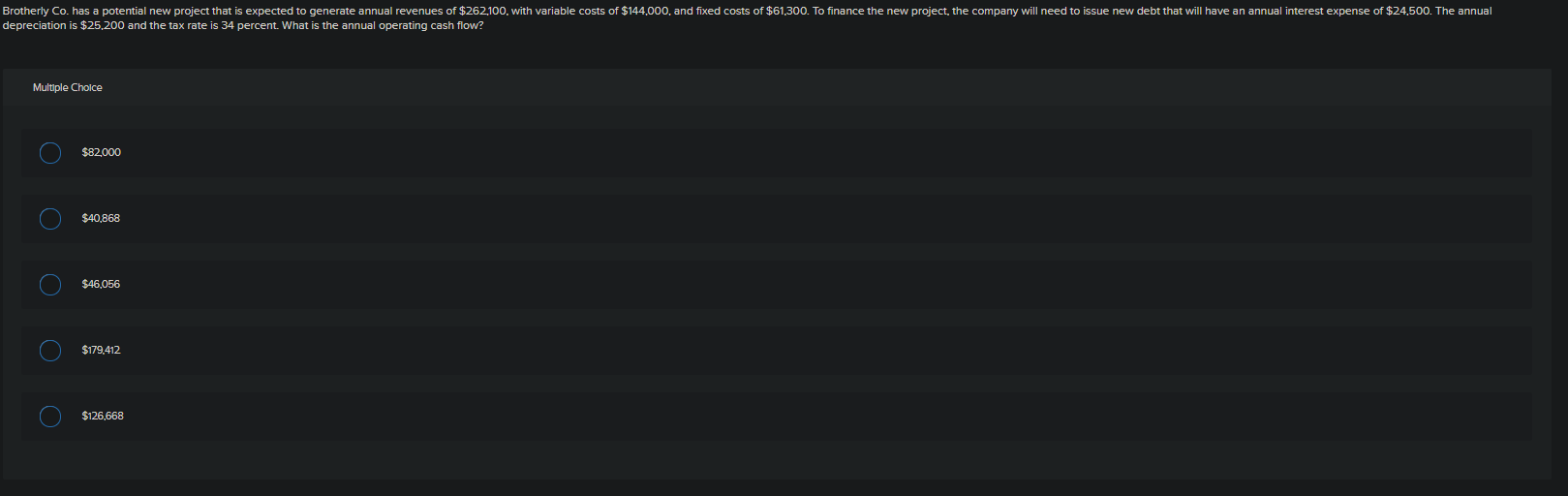

Brotherly Co. has a potential new project that is expected to generate annual revenues of $262,100. with variable costs of $144.000, and fixed costs of $61,300. To finance the new project, the company will need to issue new debt that will have an annual interest expense of $24.500. The annual depreciation is $25,200 and the tax rate is 34 percent. What is the annual operating cash flow? Multiple Choice $82,000 $40,868 $46,056 $179,412 $126,668 Brotherly Co. has a potential new project that is expected to generate annual revenues of $262,100. with variable costs of $144.000, and fixed costs of $61,300. To finance the new project, the company will need to issue new debt that will have an annual interest expense of $24.500. The annual depreciation is $25,200 and the tax rate is 34 percent. What is the annual operating cash flow? Multiple Choice $82,000 $40,868 $46,056 $179,412 $126,668

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts