Question: Buff Tech, Inc. sells computer components and plans to borrow some money to expand. The company has a 12/31 year-end. After reading about earnings management

Buff Tech, Inc. sells computer components and plans to borrow some money to expand. The company has a 12/31 year-end. After reading about earnings management (refer back to Chapter 4), Bucky, the owner has decided he should try to accelerate some sales to improve his financial statement ratios. He has called his best customers and asked them to make their usual January purchases and take delivery of the goods by December 31. He told the customers he would allow them until the end of February to pay for the purchases, just as if they had made the purchases in January.

Note: For revenue recognition purposes, the performance obligation was satisfied by 12/31.

Question:

What are the ethical implications of this plan? What ratios will be improved by accelerating these sales? What about future implications?

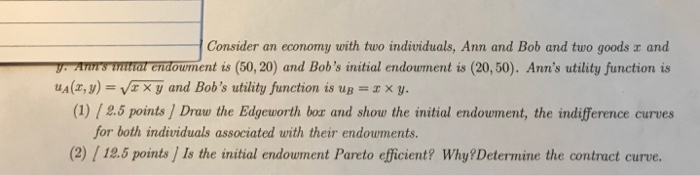

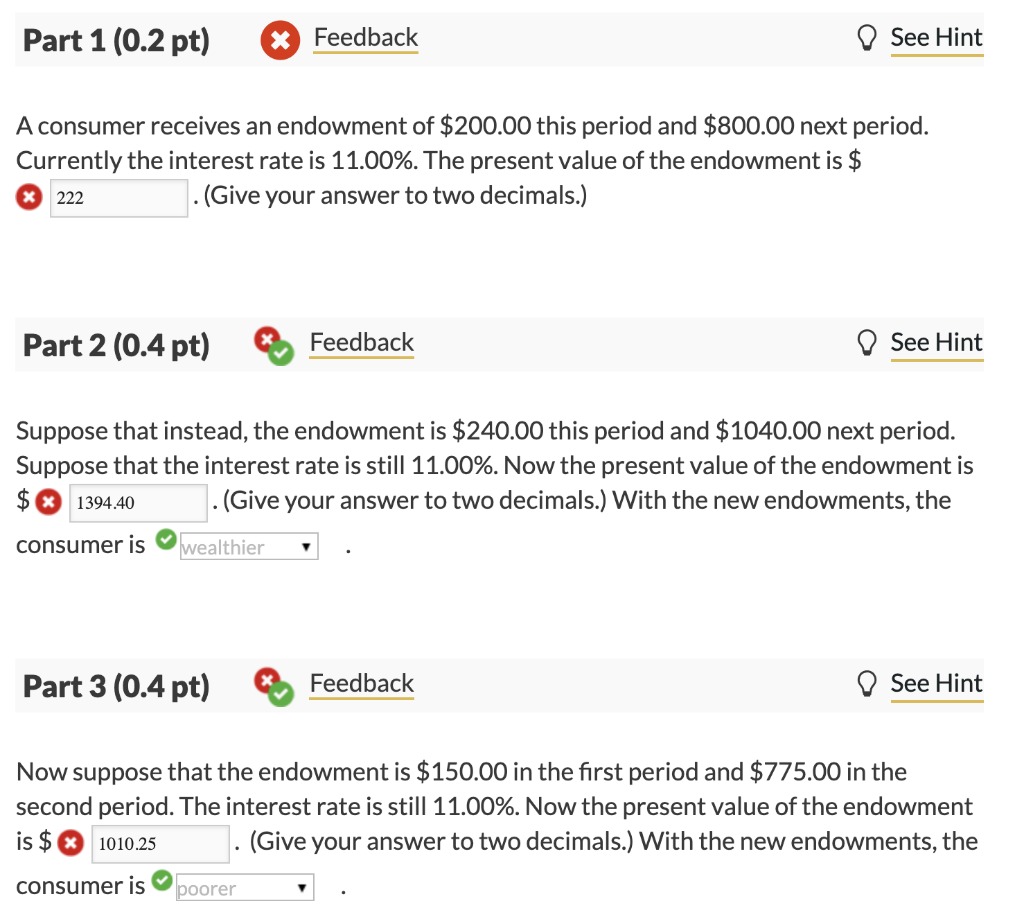

Consider an economy with two individuals, Ann and Bob and two goods r and J. Ann's initial endowment is (50, 20) and Bob's initial endowment is (20,50). Ann's utility function is uA(I, y) = Vx x y and Bob's utility function is up = x x y. (1) / 2.5 points ] Draw the Edgeworth bor and show the initial endowment, the indifference curves for both individuals associated with their endowments. (2) / 12.5 points ) Is the initial endowment Pareto efficient? Why? Determine the contract curve.Part 1 (0.2 pt) X Feedback See Hint A consumer receives an endowment of $200.00 this period and $800.00 next period. Currently the interest rate is 11.00%. The present value of the endowment is $ X 222 . (Give your answer to two decimals.) Part 2 (0.4 pt) Feedback See Hint Suppose that instead, the endowment is $240.00 this period and $1040.00 next period. Suppose that the interest rate is still 11.00%. Now the present value of the endowment is $ x 1394.40 . (Give your answer to two decimals.) With the new endowments, the consumer is " wealthier Part 3 (0.4 pt) Feedback See Hint Now suppose that the endowment is $150.00 in the first period and $775.00 in the second period. The interest rate is still 11.00%. Now the present value of the endowment is $ x 1010.25 . (Give your answer to two decimals.) With the new endowments, the consumer is poorerI FOIMS Which term refers to the sale of stocks and bonds to raise money? A. debt finance for stocks and equity finance for bonds OB. debt finance Oc. equity finance for stocks and debt finance for bonds OD. debt-equity finance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts