Question: Buff Tech, Inc. sells computer components and plans to borrow some money to expand. The company has a 12/31 year-end. After reading about earnings management

Buff Tech, Inc. sells computer components and plans to borrow some money to expand. The company has a 12/31 year-end. After reading about earnings management (refer back to Chapter 4), Bucky, the owner has decided he should try to accelerate some sales to improve his financial statement ratios. He has called his best customers and asked them to make their usual January purchases and take delivery of the goods by December 31. He told the customers he would allow them until the end of February to pay for the purchases, just as if they had made the purchases in January.

Note: For revenue recognition purposes, the performance obligation was satisfied by 12/31.

Question:

What are the ethical implications of this plan? What ratios will be improved by accelerating these sales? What about future implications?

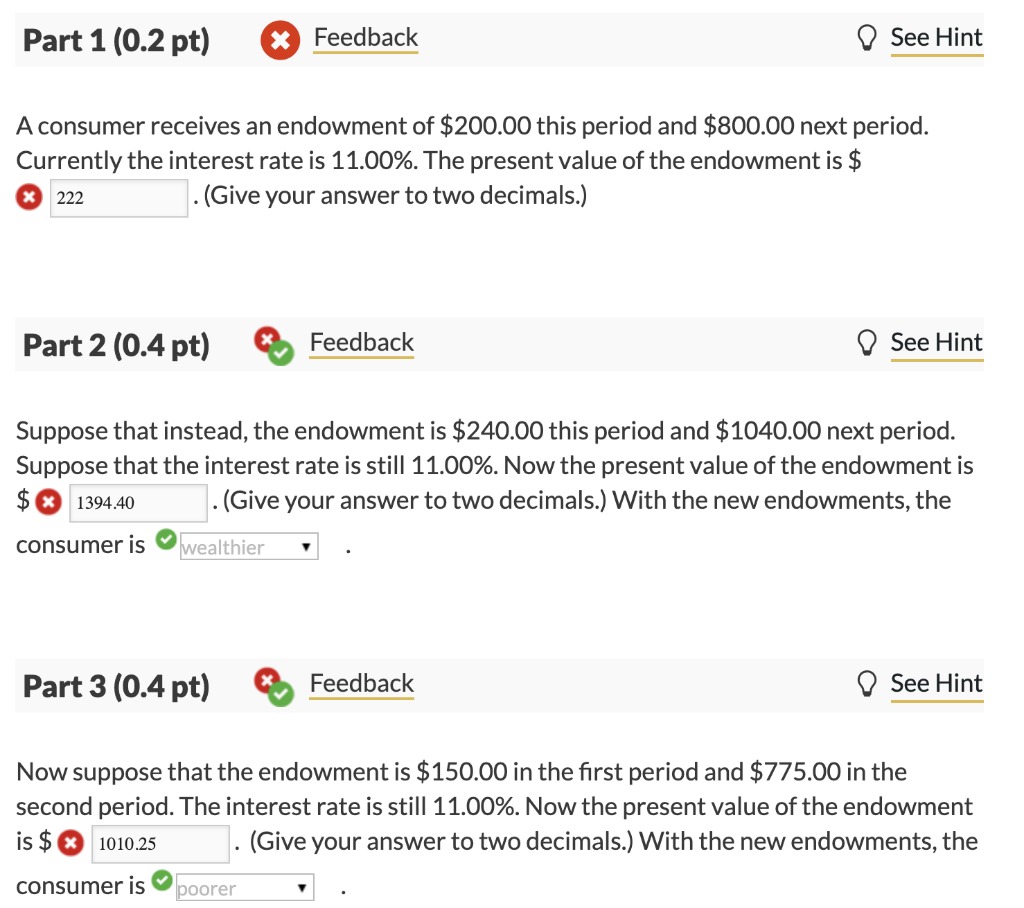

Part 1 (0.2 pt) X Feedback See Hint A consumer receives an endowment of $200.00 this period and $800.00 next period. Currently the interest rate is 11.00%. The present value of the endowment is $ X 222 . (Give your answer to two decimals.) Part 2 (0.4 pt) Feedback See Hint Suppose that instead, the endowment is $240.00 this period and $1040.00 next period. Suppose that the interest rate is still 11.00%. Now the present value of the endowment is $ x 1394.40 . (Give your answer to two decimals.) With the new endowments, the consumer is " wealthier Part 3 (0.4 pt) Feedback See Hint Now suppose that the endowment is $150.00 in the first period and $775.00 in the second period. The interest rate is still 11.00%. Now the present value of the endowment is $ x 1010.25 . (Give your answer to two decimals.) With the new endowments, the consumer is poorer3. Draw an Edgeworth Box diagram with an initial endowment. Show the gains from trade relative to this endowment point assuming that each person has normal shaped indifference curves. Show the Pareto Efficient points that are within the region of gains from trade relative to the initial endowment. Make sure that your initial endowment point is not Pareto Efficient 64-475091194124319148610021576 MINDTAP ST 260-002 Homework #2 &Dun Today In 11 PM CST Activity Information Q What is the lots endowment at these 10 universities? (to 1 decimal) They union represent 2:3%% of the 435 colleges and universities surveyed. What peromage of the total Mil] billion is endow ments is held by Base 10 um i. The Wal Street Journal reported that over a recent five-month period, a downturn in the moonging how arup Baller amount of the decing in the total endow ints held by Pose 10 universites (to the seerest billor]? of the reps you would mapact price The isput in the box baice see proded, but may be me 10 MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts