Question: Buff Tech, Inc. sells computer components and plans to borrow some money to expand. The company has a 12/31 year-end. After reading about earnings management

Buff Tech, Inc. sells computer components and plans to borrow some money to expand. The company has a 12/31 year-end. After reading about earnings management (refer back to Chapter 4), Bucky, the owner has decided he should try to accelerate some sales to improve his financial statement ratios. He has called his best customers and asked them to make their usual January purchases and take delivery of the goods by December 31. He told the customers he would allow them until the end of February to pay for the purchases, just as if they had made the purchases in January.

Note: For revenue recognition purposes, the performance obligation was satisfied by 12/31.

Question:

What are the ethical implications of this plan? What ratios will be improved by accelerating these sales? What about future implications?

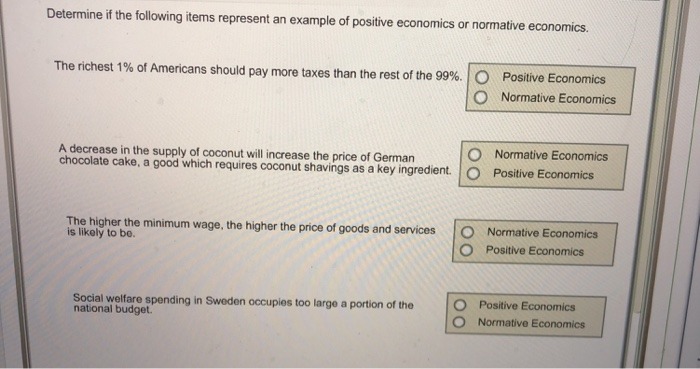

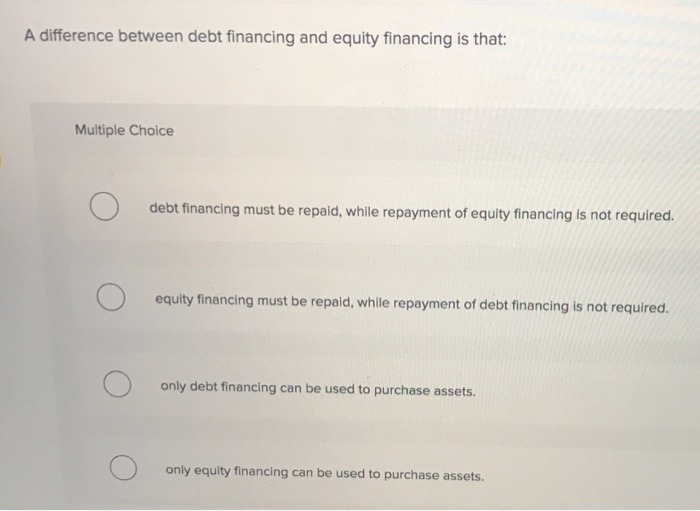

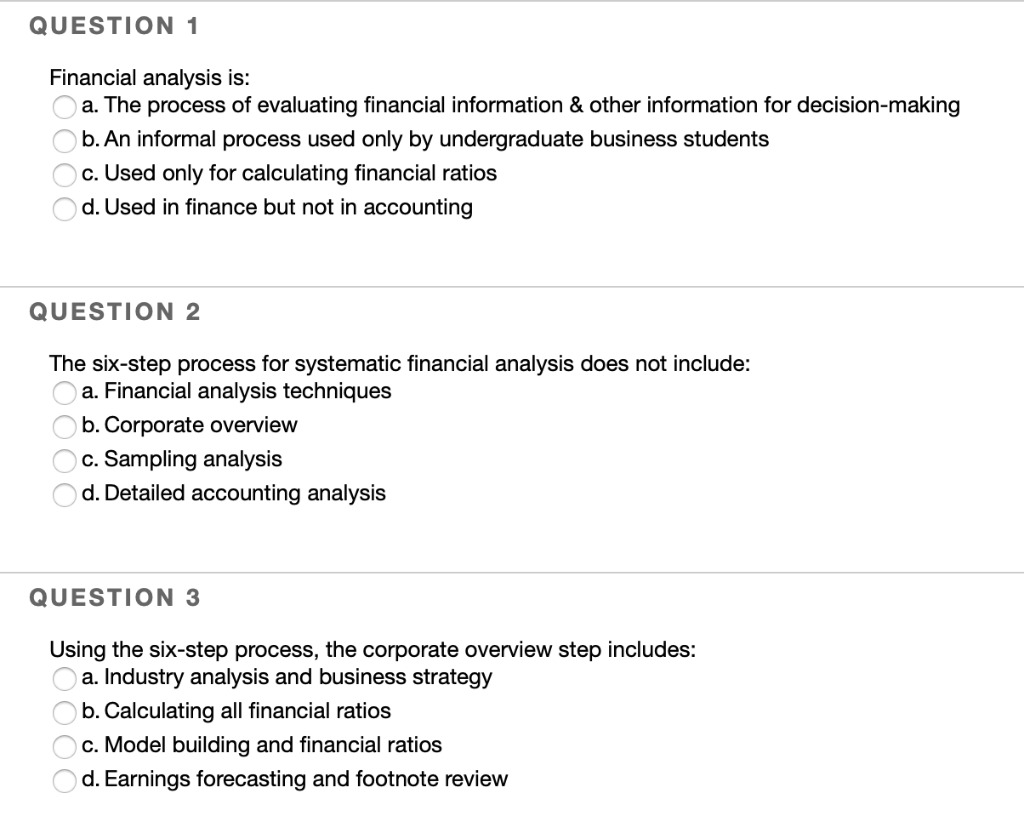

Determine if the following items represent an example of positive economics or normative economics. The richest 1% of Americans should pay more taxes than the rest of the 99%. O Positive Economics O Normative Economics O A decrease in the supply of coconut will increase the price of German Normative Economics chocolate cake, a good which requires coconut shavings as a key ingredient O Positive Economics The higher the minimum wage, the higher the price of goods and services Normative Economics is likely to bo. OO Positive Economics Social welfare spending in Sweden occupies too large a portion of the O Positive Economics national budget. O Normative EconomicsA difference between debt financing and equity financing is that: Multiple Choice O debt financing must be repaid, while repayment of equity financing is not required. O equity financing must be repaid, while repayment of debt financing is not required. O only debt financing can be used to purchase assets. O only equity financing can be used to purchase assets.QUESTION 1 Financial analysis is: if a. The process of evaluating financial information 3. other information for decision-making 7\" b. An informal process used only by undergraduate business students 75 c. Used only for calculating nancial ratios 5; d. Used in finance but not in accounting QUESTION 2 The six-step process for systematic financial analysis does not include: \"i\"? a. Financial analysis techniques \"f\" b. Corporate overview 'f\" c. Sampling analysis f\"- d. Detailed accounting analysis QUESTION 3 Using the six-step process, the corporate overview step includes: \"f\" a. Industry analysis and business strategy \"T'- b. Calculating all nancial ratios \"f\" c. Model building and financial ratios "f d. Earnings forecasting and footnote review

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts