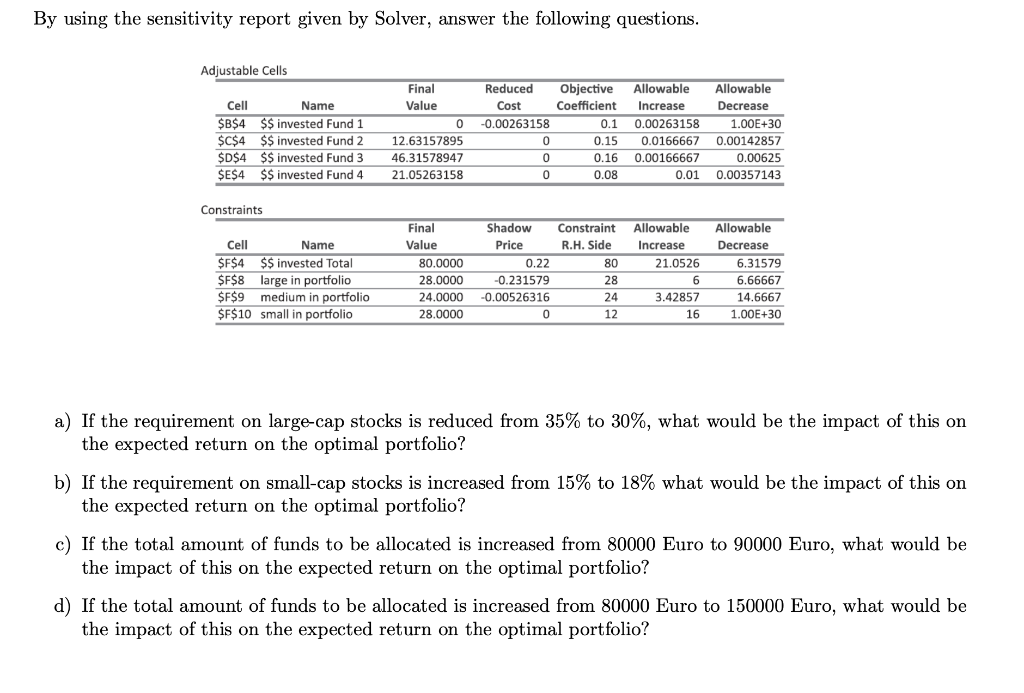

Question: By using the sensitivity report given by Solver, answer the following questions. Adjustable Cells Cell Name $B$4 $$ invested Fund 1 $C$4 $$ invested Fund

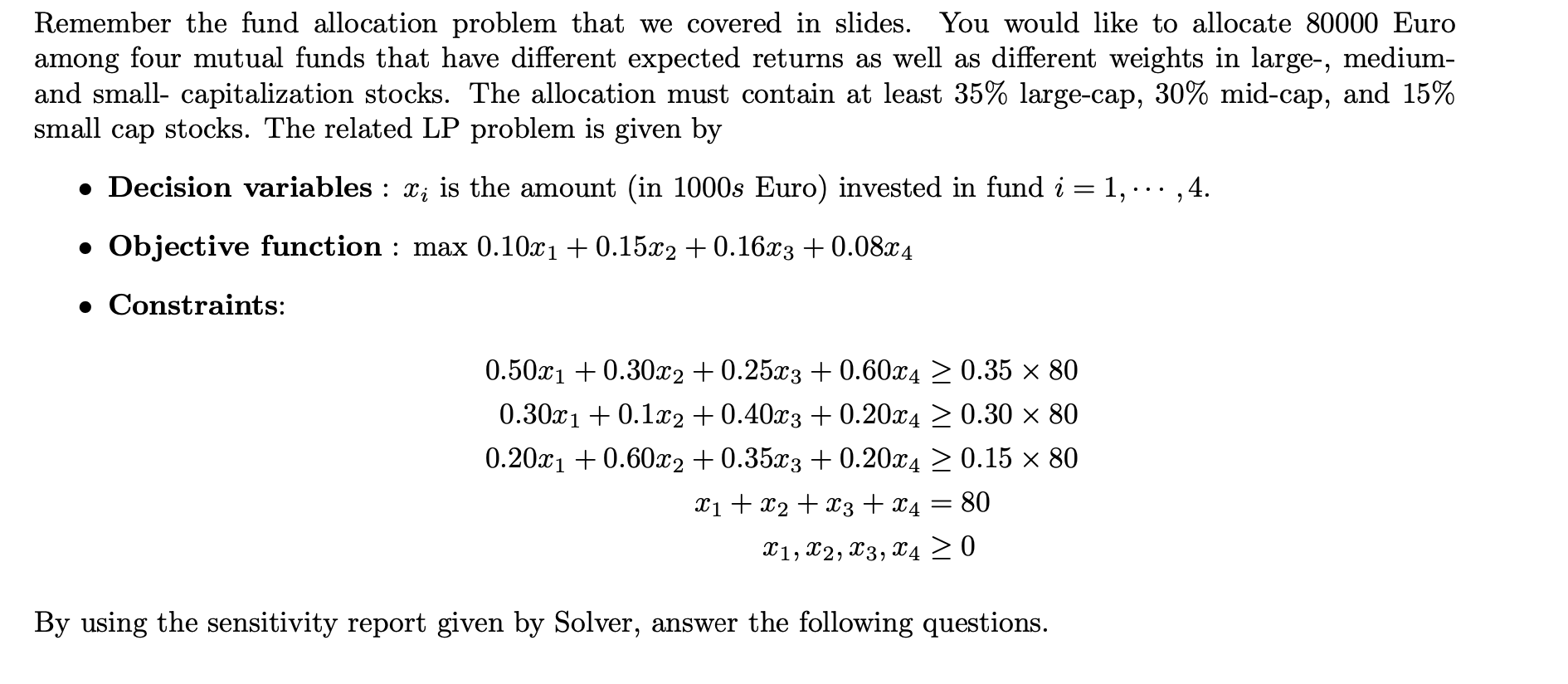

By using the sensitivity report given by Solver, answer the following questions. Adjustable Cells Cell Name $B$4 $$ invested Fund 1 $C$4 $$ invested Fund 2 $D$4 $$ invested Fund 3 $E$4 $$ invested Fund 4 Final Value 0 12.63157895 46.31578947 21.05263158 Reduced Cost -0.00263158 0 0 0 Objective Coefficient 0.1 0.15 0.16 0.08 Allowable Increase 0.00263158 0.0166667 0.00166667 0.01 Allowable Decrease 1.00E+30 0.00142857 0.00625 0.00357143 Constraints Cell Name $F$4 $$ invested Total $F$8 large in portfolio $F$9 medium in portfolio $F$10 small in portfolio Final Value 80.0000 28.0000 24.0000 28.0000 Shadow Constraint Price R.H. Side 0.22 80 -0.231579 28 -0.00526316 24 0 12 Allowable Increase 21.0526 6 3.42857 16 Allowable Decrease 6.31579 6.66667 14.6667 1.00E+30 a) If the requirement on large-cap stocks is reduced from 35% to 30%, what would be the impact of this on the expected return on the optimal portfolio? b) If the requirement on small-cap stocks is increased from 15% to 18% what would be the impact of this on the expected return on the optimal portfolio? c) If the total amount of funds to be allocated is increased from 80000 Euro to 90000 Euro, what would be the impact of this on the expected return on the optimal portfolio? d) If the total amount of funds to be allocated is increased from 80000 Euro to 150000 Euro, what would be the impact of this on the expected return on the optimal portfolio? Remember the fund allocation problem that we covered in slides. You would like to allocate 80000 Euro among four mutual funds that have different expected returns as well as different weights in large-, medium- and small- capitalization stocks. The allocation must contain at least 35% large-cap, 30% mid-cap, and 15% small cap stocks. The related LP problem is given by Decision variables : Xi is the amount (in 1000s Euro) invested in fund i = 1, ... ,4. - Objective function : max 0.10x1 + 0.15x2 + 0.16x3 + 0.08x4 Constraints: 0.50x1 + 0.30x2 + 0.25x3 + 0.60X4 0.35 x 80 0.30x1 + 0.1x2 + 0.40x3 + 0.2024 > 0.30 x 80 0.20x1 + 0.60x2 + 0.35x3 + 0.2024 > 0.15 x 80 X1 + x2 + x3 + x4 = 80 X1, X2, X3, X4 > 0 By using the sensitivity report given by Solver, answer the following questions. By using the sensitivity report given by Solver, answer the following questions. Adjustable Cells Cell Name $B$4 $$ invested Fund 1 $C$4 $$ invested Fund 2 $D$4 $$ invested Fund 3 $E$4 $$ invested Fund 4 Final Value 0 12.63157895 46.31578947 21.05263158 Reduced Cost -0.00263158 0 0 0 Objective Coefficient 0.1 0.15 0.16 0.08 Allowable Increase 0.00263158 0.0166667 0.00166667 0.01 Allowable Decrease 1.00E+30 0.00142857 0.00625 0.00357143 Constraints Cell Name $F$4 $$ invested Total $F$8 large in portfolio $F$9 medium in portfolio $F$10 small in portfolio Final Value 80.0000 28.0000 24.0000 28.0000 Shadow Constraint Price R.H. Side 0.22 80 -0.231579 28 -0.00526316 24 0 12 Allowable Increase 21.0526 6 3.42857 16 Allowable Decrease 6.31579 6.66667 14.6667 1.00E+30 a) If the requirement on large-cap stocks is reduced from 35% to 30%, what would be the impact of this on the expected return on the optimal portfolio? b) If the requirement on small-cap stocks is increased from 15% to 18% what would be the impact of this on the expected return on the optimal portfolio? c) If the total amount of funds to be allocated is increased from 80000 Euro to 90000 Euro, what would be the impact of this on the expected return on the optimal portfolio? d) If the total amount of funds to be allocated is increased from 80000 Euro to 150000 Euro, what would be the impact of this on the expected return on the optimal portfolio? Remember the fund allocation problem that we covered in slides. You would like to allocate 80000 Euro among four mutual funds that have different expected returns as well as different weights in large-, medium- and small- capitalization stocks. The allocation must contain at least 35% large-cap, 30% mid-cap, and 15% small cap stocks. The related LP problem is given by Decision variables : Xi is the amount (in 1000s Euro) invested in fund i = 1, ... ,4. - Objective function : max 0.10x1 + 0.15x2 + 0.16x3 + 0.08x4 Constraints: 0.50x1 + 0.30x2 + 0.25x3 + 0.60X4 0.35 x 80 0.30x1 + 0.1x2 + 0.40x3 + 0.2024 > 0.30 x 80 0.20x1 + 0.60x2 + 0.35x3 + 0.2024 > 0.15 x 80 X1 + x2 + x3 + x4 = 80 X1, X2, X3, X4 > 0 By using the sensitivity report given by Solver, answer the following questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts