Question: C. A construction company signed a contract for a project with 2-month duration. The payment arrangements are as follows: The owner pays an advance

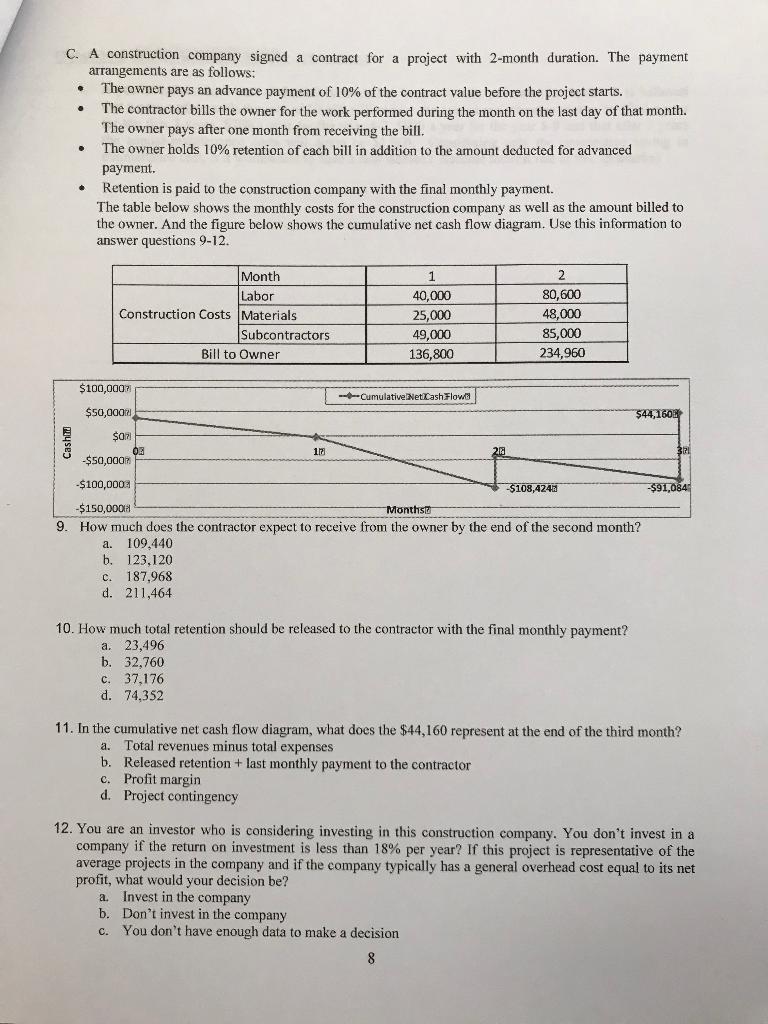

C. A construction company signed a contract for a project with 2-month duration. The payment arrangements are as follows: The owner pays an advance payment of 10% of the contract value before the project starts. The contractor bills the owner for the work performed during the month on the last day of that month. The owner pays after one month from receiving the bill. The owner holds 10% retention of each bill in addition to the amount deducted for advanced payment. Retention is paid to the construction company with the final monthly payment. The table below shows the monthly costs for the construction company as well as the amount billed to the owner. And the figure below shows the cumulative net cash flow diagram. Use this information to answer questions 9-12. . Month Labor Construction Costs Materials $100,0007 $50,000 $07 03 Subcontractors C. 187,968 d. 211,464 Bill to Owner 17 1 40,000 25,000 49,000 136,800 --Cumulative NetCash Flow 2 80,600 48,000 85,000 234,960 -$50,000 -$100,000 -$150,000 Months 9. How much does the contractor expect to receive from the owner by the end of the second month? a. 109,440 b. 123,120 -$108,424 10. How much total retention should be released to the contractor with the final monthly payment? a. 23,496 b. 32,760 C. 37,176 d. 74,352 b. Released retention + last monthly payment to the contractor c. Profit margin d. Project contingency $44,160 -$91,084 11. In the cumulative net cash flow diagram, what does the $44,160 represent at the end of the third month? a. Total revenues minus total expenses 12. You are an investor who is considering investing in this construction company. You don't invest in a company if the return on investment is less than 18% per year? If this project is representative of the average projects in the company and if the company typically has a general overhead cost equal to its net profit, what would your decision be? a. Invest in the company b. Don't invest in the company C. You don't have enough data to make a decision 8

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts