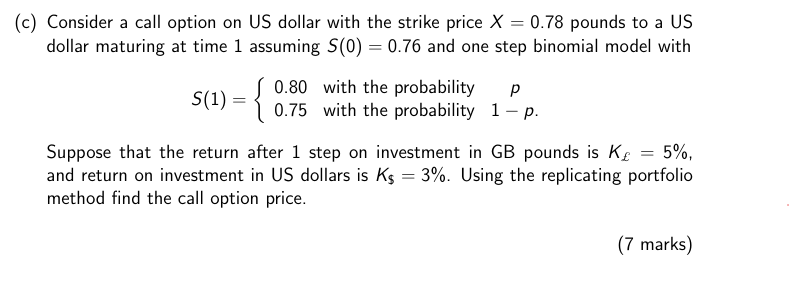

Question: ( c ) Consider a call option o n U S dollar with the strike price x = 0 . 7 8 pounds t o

Consider a call option dollar with the strike price pounds

dollar maturing time assuming and one step binomial model with

Suppose that the return after step investment pounds

and return investment dollars Using the replicating portfolio

method find the call option price.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock