Question: c. Consider a firm that is expected to pay a dividend of ( $ 1.50 ) per share one year from today. Additional future dividends

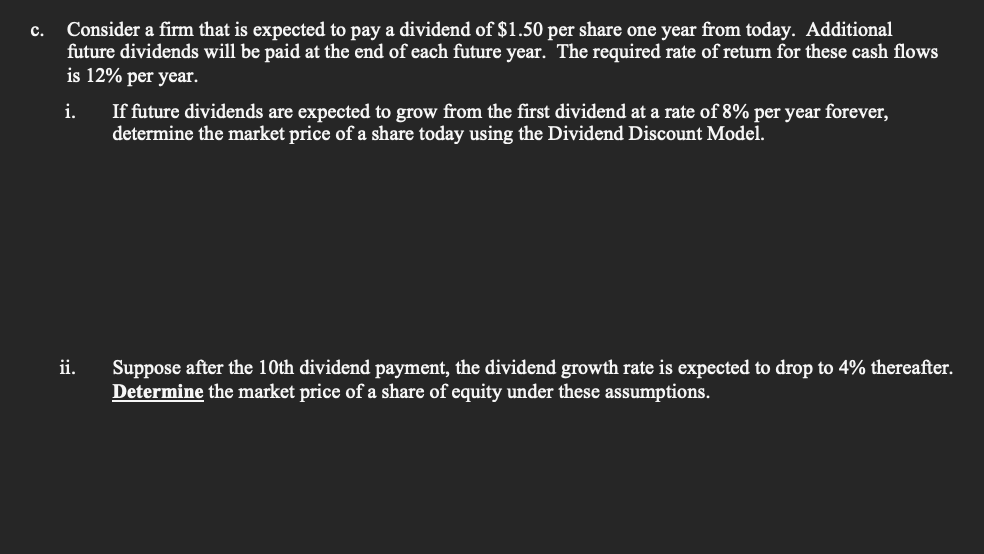

c. Consider a firm that is expected to pay a dividend of \\( \\$ 1.50 \\) per share one year from today. Additional future dividends will be paid at the end of each future year. The required rate of return for these cash flows is \12 per year. i. If future dividends are expected to grow from the first dividend at a rate of \8 per year forever, determine the market price of a share today using the Dividend Discount Model. ii. Suppose after the 10th dividend payment, the dividend growth rate is expected to drop to \4 thereafter. Determine the market price of a share of equity under these assumptions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock