Question: C csepub.com/exercise/users/problem_sets/71646 #11 Over the past six months, Six Flags conducted a marketing study on Improving their park experience. The study cost $3.00 million and

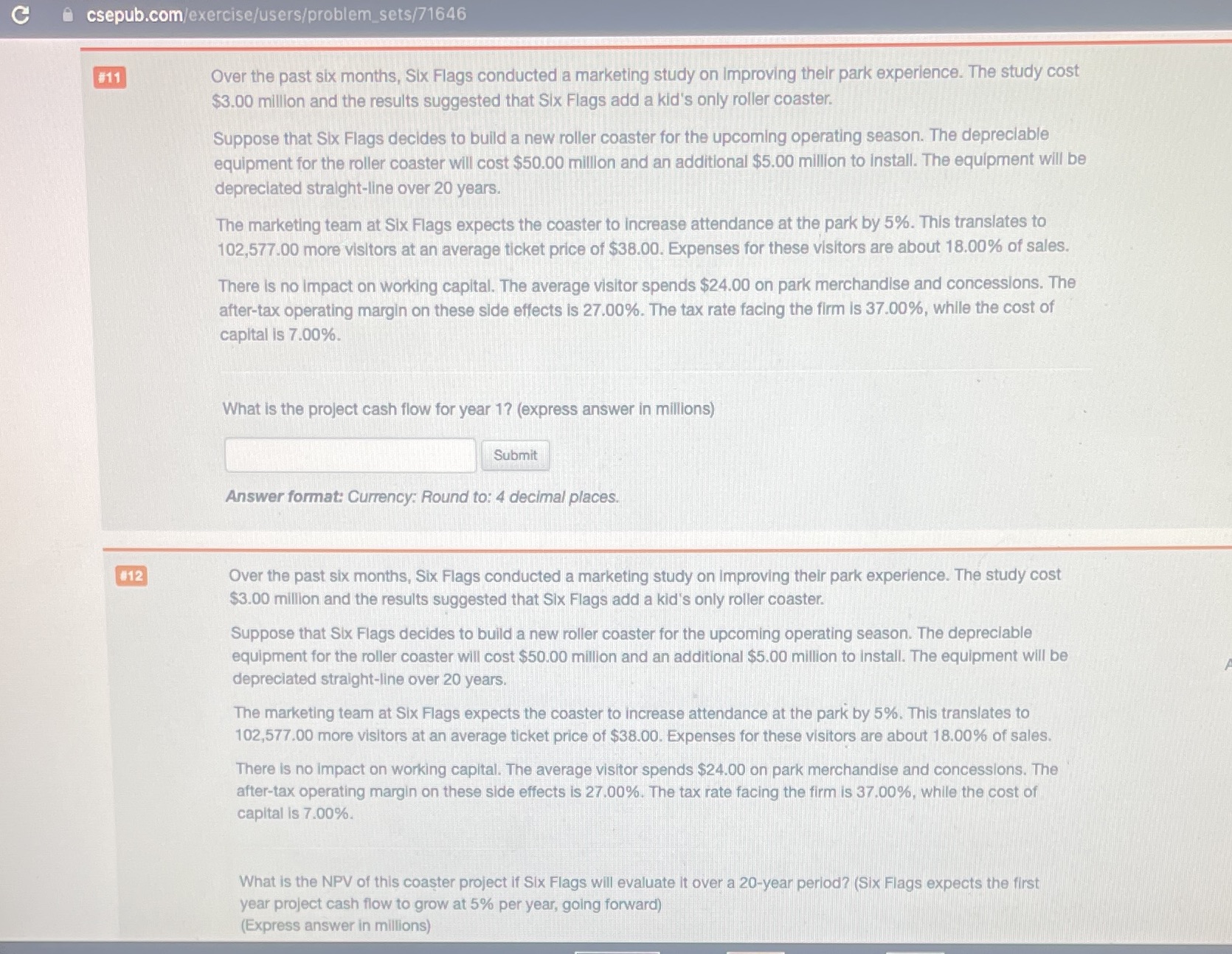

C csepub.com/exercise/users/problem_sets/71646 #11 Over the past six months, Six Flags conducted a marketing study on Improving their park experience. The study cost $3.00 million and the results suggested that Six Flags add a kid's only roller coaster. Suppose that Six Flags decides to build a new roller coaster for the upcoming operating season. The depreciable equipment for the roller coaster will cost $50.00 million and an additional $5.00 million to install. The equipment will be depreciated straight-line over 20 years. The marketing team at Six Flags expects the coaster to increase attendance at the park by 5%. This translates to 102,577.00 more visitors at an average ticket price of $38.00. Expenses for these visitors are about 18.00% of sales. There is no Impact on working capital. The average visitor spends $24.00 on park merchandise and concessions. The after-tax operating margin on these side effects is 27.00%. The tax rate facing the firm is 37.00%, while the cost of capital is 7.00%. What is the project cash flow for year 1? (express answer in millions) Submit Answer format: Currency: Round to: 4 decimal places. #12 Over the past six months, Six Flags conducted a marketing study on improving their park experience. The study cost $3.00 million and the results suggested that Six Flags add a kid's only roller coaster. Suppose that Six Flags decides to build a new roller coaster for the upcoming operating season. The depreciable equipment for the roller coaster will cost $50.00 million and an additional $5.00 million to install. The equipment will be depreciated straight-line over 20 years. The marketing team at Six Flags expects the coaster to increase attendance at the park by 5%. This translates to 102,577.00 more visitors at an average ticket price of $38.00. Expenses for these visitors are about 18.00% of sales. There is no impact on working capital. The average visitor spends $24.00 on park merchandise and concessions. The after-tax operating margin on these side effects is 27.00%. The tax rate facing the firm is 37.00%, while the cost of capital Is 7.00%. What is the NPV of this coaster project if Six Flags will evaluate it over a 20-year period? (Six Flags expects the first year project cash flow to grow at 5% per year, going forward) (Express answer in millions)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts