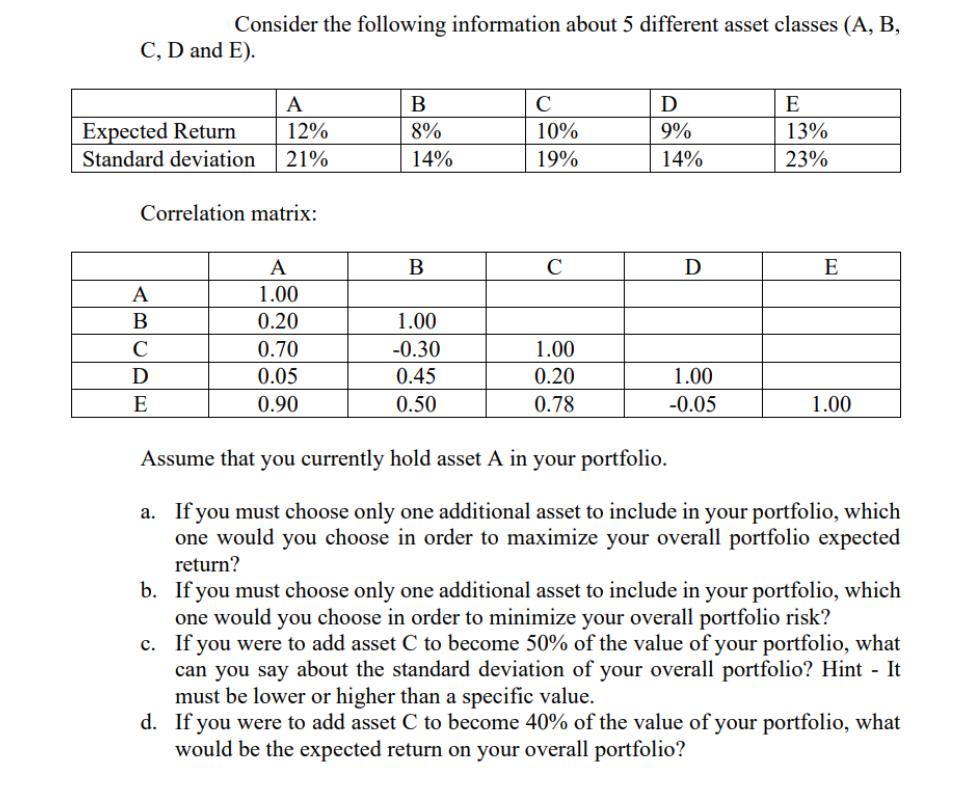

Question: C, D and E). Consider the following information about 5 different asset classes (A, B, A Expected Return 12% Standard deviation 21% Correlation matrix:

C, D and E). Consider the following information about 5 different asset classes (A, B, A Expected Return 12% Standard deviation 21% Correlation matrix: ABCDE E A 1.00 0.20 0.70 0.05 0.90 B 8% 14% B 1.00 -0.30 0.45 0.50 C 10% 19% C 1.00 0.20 0.78 D 9% 14% D 1.00 -0.05 E 13% 23% E 1.00 Assume that you currently hold asset A in your portfolio. a. If you must choose only one additional asset to include in your portfolio, which one would you choose in order to maximize your overall portfolio expected return? b. If you must choose only one additional asset to include in your portfolio, which one would you choose in order to minimize your overall portfolio risk? c. If you were to add asset C to become 50% of the value of your portfolio, what can you say about the standard deviation of your overall portfolio? Hint - It must be lower or higher than a specific value. d. If you were to add asset C to become 40% of the value of your portfolio, what would be the expected return on your overall portfolio?

Step by Step Solution

There are 3 Steps involved in it

a To maximize the expected return of the portfolio you would choose Asset E with an expected retur... View full answer

Get step-by-step solutions from verified subject matter experts