Question: (c) Let N EN, N > 2 and consider a discrete time market model consisting of two assets: a risky one and a risk-free one.

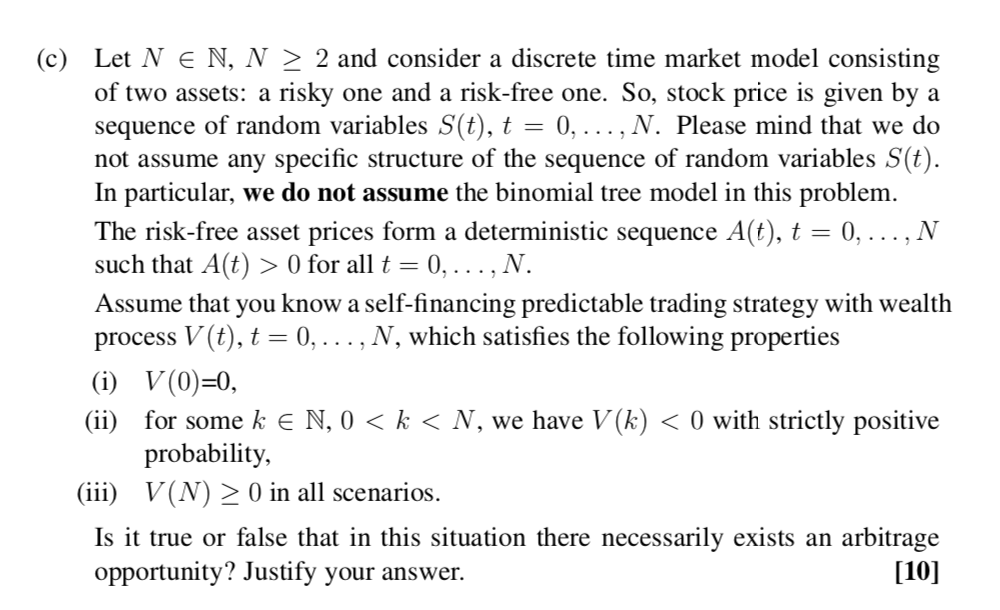

(c) Let N EN, N > 2 and consider a discrete time market model consisting of two assets: a risky one and a risk-free one. So, stock price is given by a sequence of random variables S(t), t = 0, ...,N. Please mind that we do not assume any specific structure of the sequence of random variables S(t). In particular, we do not assume the binomial tree model in this problem. The risk-free asset prices form a deterministic sequence At), t = 0, ...,N such that Alt) > 0 for all t = 0,...,N. Assume that you know a self-financing predictable trading strategy with wealth process V(t), t = 0, ...,N, which satisfies the following properties (i) V(0)=0, (ii) for some k E N, 0 0 in all scenarios. Is it true or false that in this situation there necessarily exists an arbitrage opportunity? Justify your answer. [10] (c) Let N EN, N > 2 and consider a discrete time market model consisting of two assets: a risky one and a risk-free one. So, stock price is given by a sequence of random variables S(t), t = 0, ...,N. Please mind that we do not assume any specific structure of the sequence of random variables S(t). In particular, we do not assume the binomial tree model in this problem. The risk-free asset prices form a deterministic sequence At), t = 0, ...,N such that Alt) > 0 for all t = 0,...,N. Assume that you know a self-financing predictable trading strategy with wealth process V(t), t = 0, ...,N, which satisfies the following properties (i) V(0)=0, (ii) for some k E N, 0 0 in all scenarios. Is it true or false that in this situation there necessarily exists an arbitrage opportunity? Justify your answer. [10]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts