Question: ( c ) On 1 January 2 0 2 2 , Blue Ltd sold equipment to Green Ltd for ( $ 8 0

c On January Blue Ltd sold equipment to Green Ltd for $ This had originally cost Blue Ltd $ and had a carrying amount at the time of sale of $ Both entities charge depreciation at a rate of pa straightline.

d On January Green Ltd sold an item of inventories to Blue Ltd for use as machinery. This item cost Green Ltd $ and was sold to Blue Ltd for $ Blue Ltd depreciated the item at pa straightline.

e On June half of the goodwill was written off because of an impairment test.

f On February Blue Ltd paid an interim dividend of $ Blue Ltd declared a final dividend of $ in June that is still to be paid. Shareholder approval is not required in relation to dividends.

g In March Green Ltd made an interest free loan of $ to Blue Ltd that remains outstanding at June

h The tax rate is

On June the trial balances of Green Ltd and Blue Ltd were as follows:

Required

Prepare the consolidated financial statements for Green Ltd for June Show all workings.

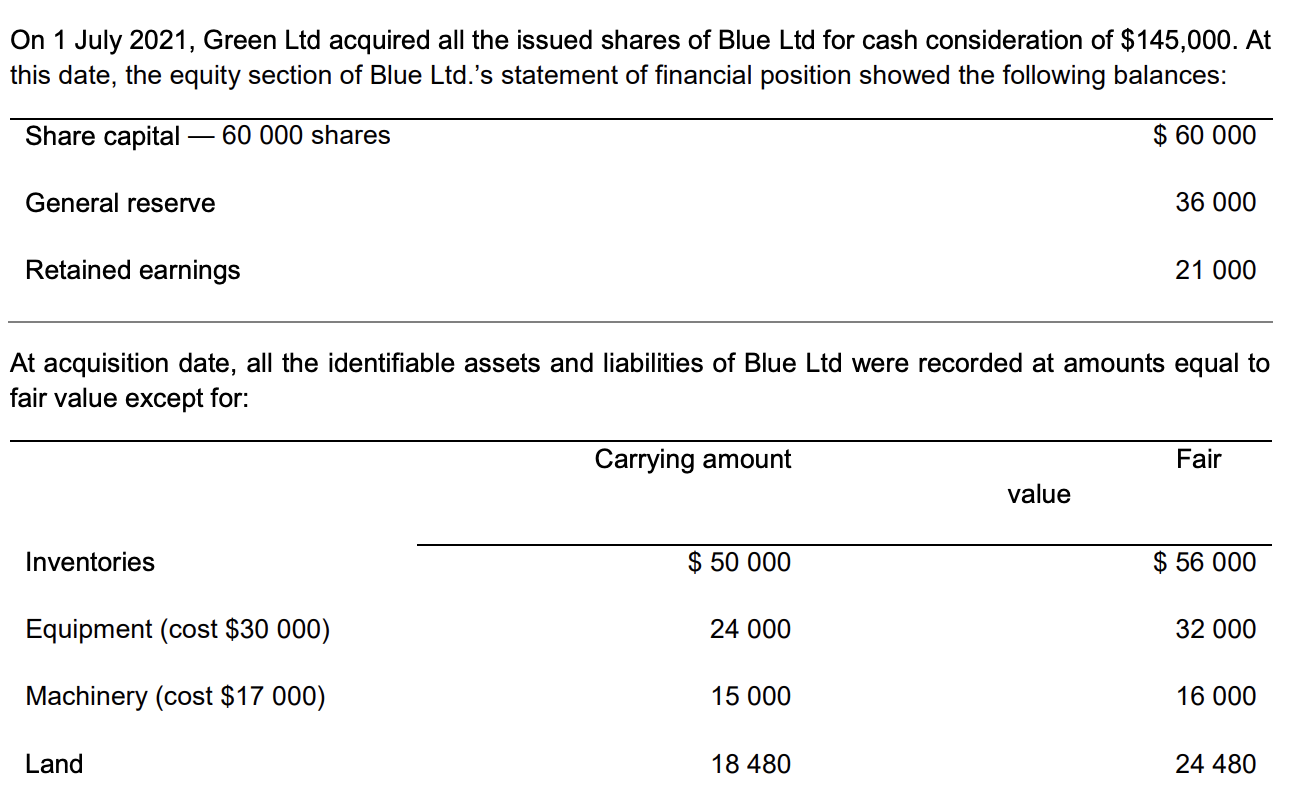

Calculate the acquisition analysis at st July

Prepare consolidation journal entries at June

Prepare a consolidation worksheet at June

Prepare consolidated financial statements at June

Write a report about the consolidation process as per AASB Discuss the three adjusting journal entries required for the preparation of consolidated financial statements. Explain all intragroup entries a b mathrmcmathrmdmathrme and g in your answer, discussing the realisation of profits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock