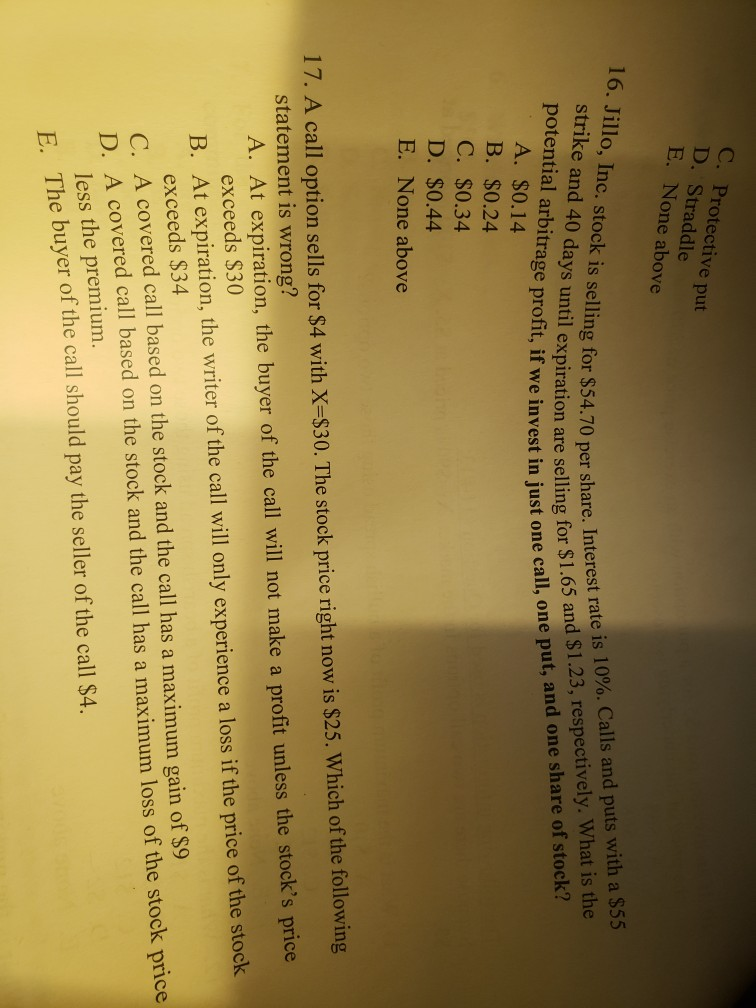

Question: C. Protective put D. Straddle E. None above 16. Jillo, Inc. stock is selling for $54.70 pe strike and 40 days until expiration are sen.

C. Protective put D. Straddle E. None above 16. Jillo, Inc. stock is selling for $54.70 pe strike and 40 days until expiration are sen. potential arbitrage profit, if we invest in jy of $54.70 per share. Interest rate is 10%. Calls and puts with a $55 piration are selling for $1.65 and $1.23, respectively. What is the vest in just one call, one put, and one share of stock? A. $0.14 B. $0.24 C. $0.34 D. $0.44 E. None above 17. A call option sells for $4 with X=$30. The stock price right now is $25. Which of the following statement is wrong? A. At expiration, the buyer of the call will not make a profit unless the stock's price, exceeds $30 B. At expiration, the writer of the call will only experience a loss if the price of the stock exceeds $34 C. A covered call based on the stock and the call has a maximum gain of $9 D. A covered call based on the stock and the call has a maximum loss of the stock price less the premium. The buyer of the call should pay the seller of the call $4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts