Question: c . Should this project be undertaken? - Select - If so , should the firm do the mitigation? IRR when mitigation costs are included

c Should this project be undertaken?

Select

If so should the firm do the mitigation? IRR when mitigation costs are included in the analysis. when mitigation costs are not included in the analysis. NPV when mitigation costs are included in the analysis. mitigation costs are not included in the analysis. when mitigation costs are not included in the analysis.

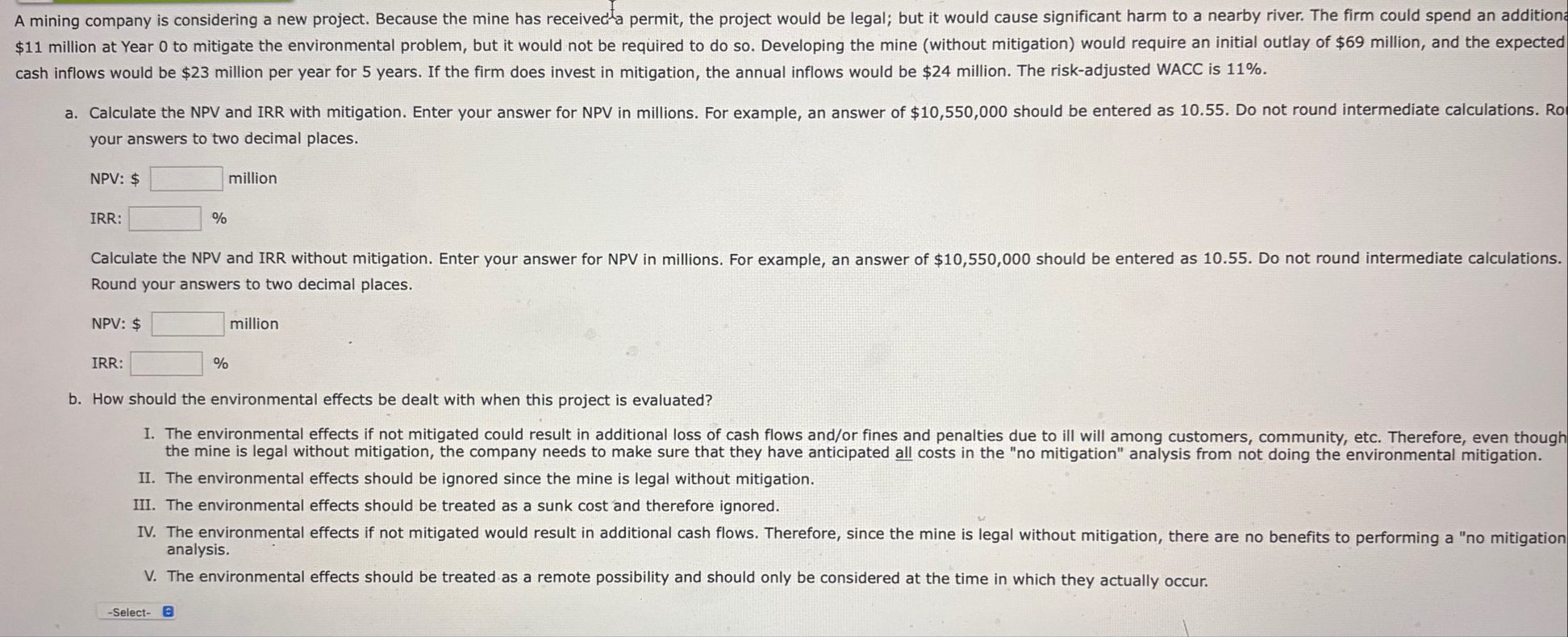

cash inflows would be $ million per year for years. If the firm does invest in mitigation, the annual inflows would be $ million. The riskadjusted WACC is your answers to two decimal places.

NPV: million

IRR: Round your answers to two decimal places.

NPV: $ million

IRR:

b How should the environmental effects be dealt with when this project is evaluated?

II The environmental effects should be ignored since the mine is legal without mitigation.

III. The environmental effects should be treated as a sunk cost and therefore ignored. analysis.

V The environmental effects should be treated as a remote possibility and should only be considered at the time in which they actually occur.

c Should this project be undertaken?

Select

If so should the firm do the mitigation? IRR when mitigation costs are included in the analysis. when mitigation costs are not included in the analysis. NPV when mitigation costs are included in the analysis. mitigation costs are not included in the analysis. when mitigation costs are not included in the analysis.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock