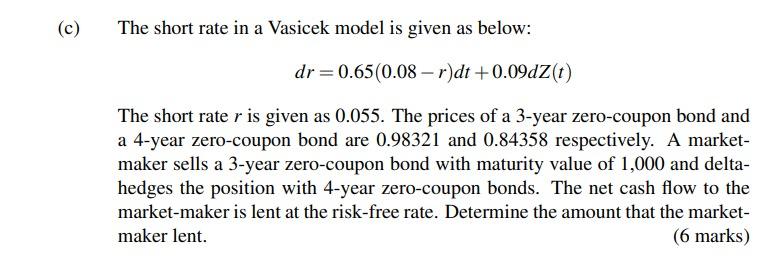

Question: (c) The short rate in a Vasicek model is given as below: dr = 0.65(0.08 - r)dt +0.09dZ(1) The short rate r is given as

(c) The short rate in a Vasicek model is given as below: dr = 0.65(0.08 - r)dt +0.09dZ(1) The short rate r is given as 0.055. The prices of a 3-year zero-coupon bond and a 4-year zero-coupon bond are 0.98321 and 0.84358 respectively. A market- maker sells a 3-year zero-coupon bond with maturity value of 1,000 and delta- hedges the position with 4-year zero-coupon bonds. The net cash flow to the market-maker is lent at the risk-free rate. Determine the amount that the market- maker lent. (6 marks) (c) The short rate in a Vasicek model is given as below: dr = 0.65(0.08 - r)dt +0.09dZ(1) The short rate r is given as 0.055. The prices of a 3-year zero-coupon bond and a 4-year zero-coupon bond are 0.98321 and 0.84358 respectively. A market- maker sells a 3-year zero-coupon bond with maturity value of 1,000 and delta- hedges the position with 4-year zero-coupon bonds. The net cash flow to the market-maker is lent at the risk-free rate. Determine the amount that the market- maker lent. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts