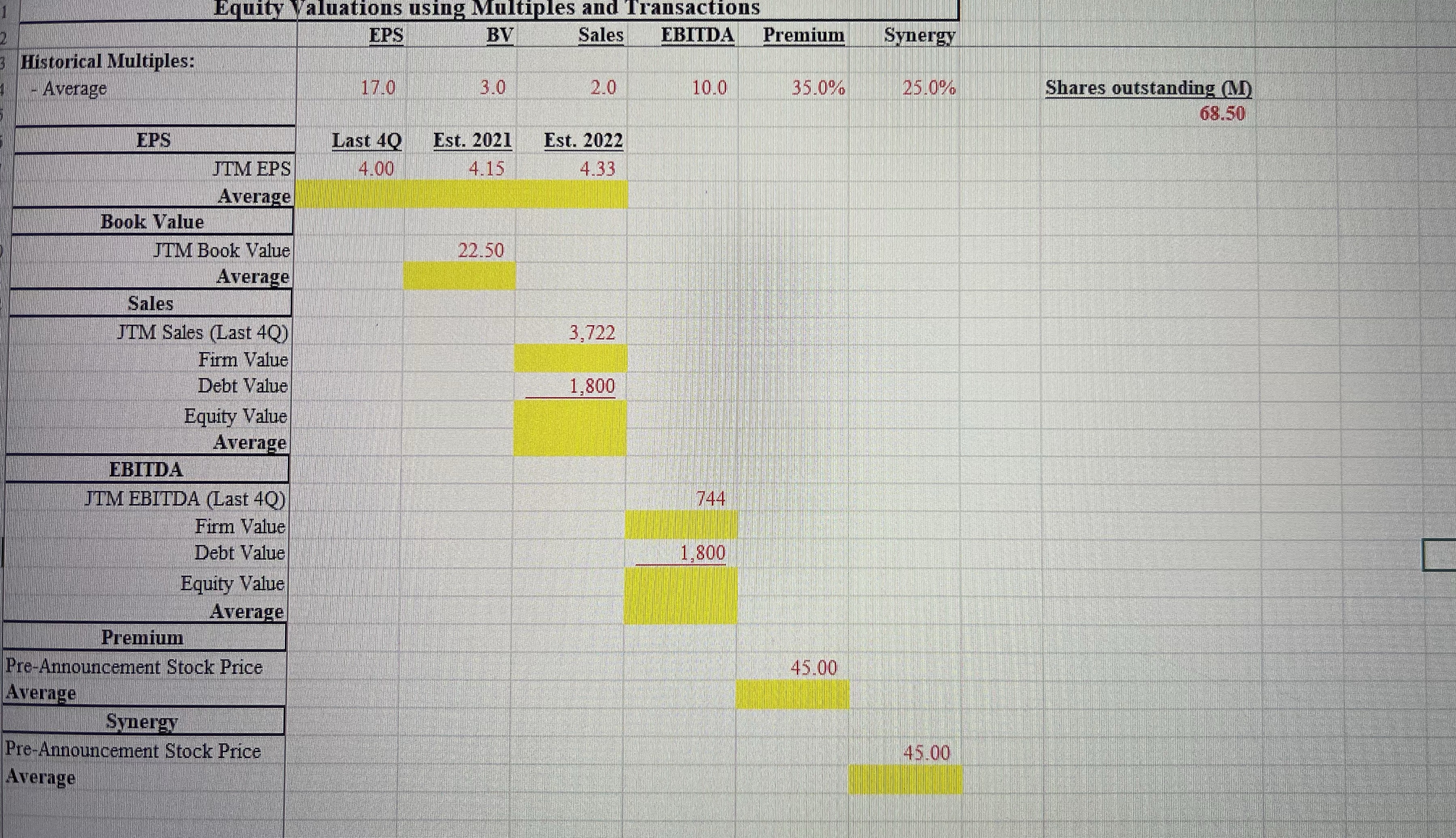

Question: -Calculate shared price estimates using EPS, Sales, EBITDA, premiums, and synergies.?-apply the weights used in the document to the six factors above to come up

-Calculate shared price estimates using EPS, Sales, EBITDA, premiums, and synergies.?-apply the weights used in the document to the six factors above to come up with a weighted price per share. - use the dividend payments and projected growth rates provided to calculate the DDM-based prices per share for three firms. *the template contains all the data you need to complete the assignment**

Equity Valuations using Multiples and Transactions EPS BV Sales EBITDA Premium Synergy Historical Multiples: Average 170 3.0 2.0 10 0 35.0% 25.0% Shares outstanding (M) 68.50 EPS Last 40 Est. 2021 Est. 2022 JTM EPS 4.00 4.15 4.33 Average Book Value JTM Book Value 22.50 Average Sales JTM Sales (Last 4Q) 3,722 Firm Value Debt Value 1,800 Equity Value Average EBITDA JTM EBITDA (Last 4Q) 744 Firm Value Debt Value 1,800 Equity Value Average Premium Pre-Announcement Stock Price 45.00 Average Synergy Pre-Announcement Stock Price 45.00 Average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts