Question: Calculate the experience modification rate. I have given you steps to help you. Thank you Step 1. Expected Losses Expected Loss Rate (ELR) is the

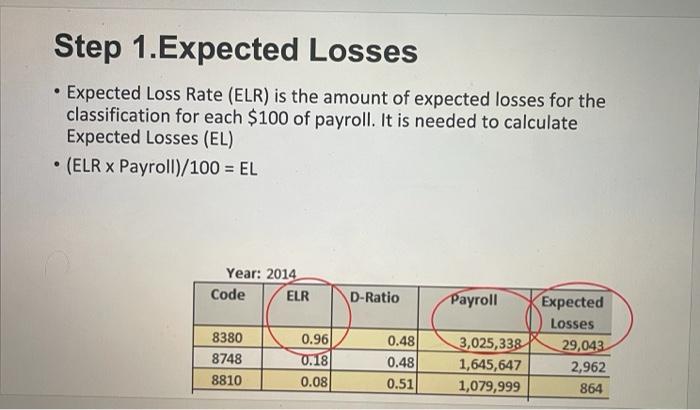

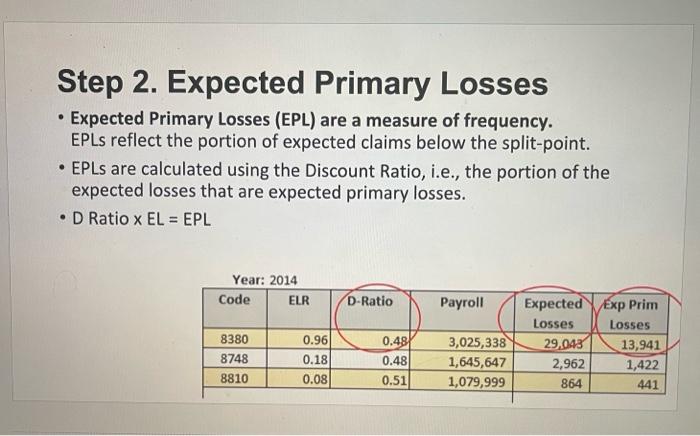

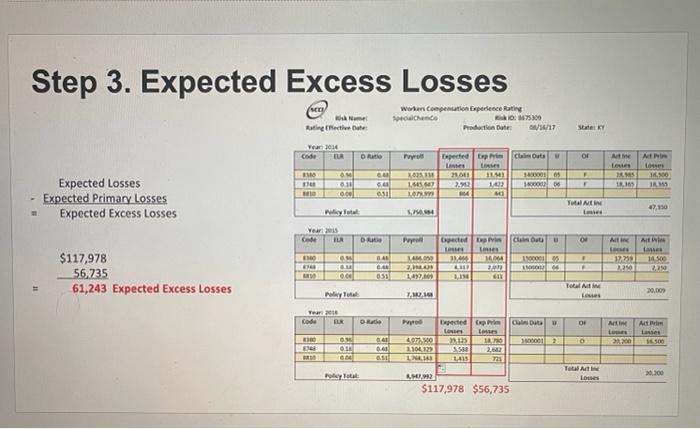

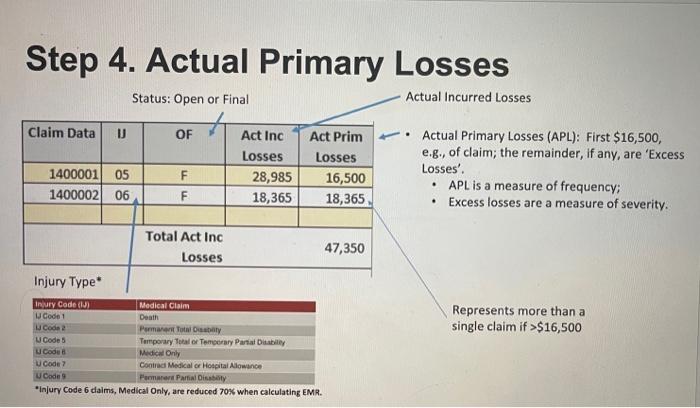

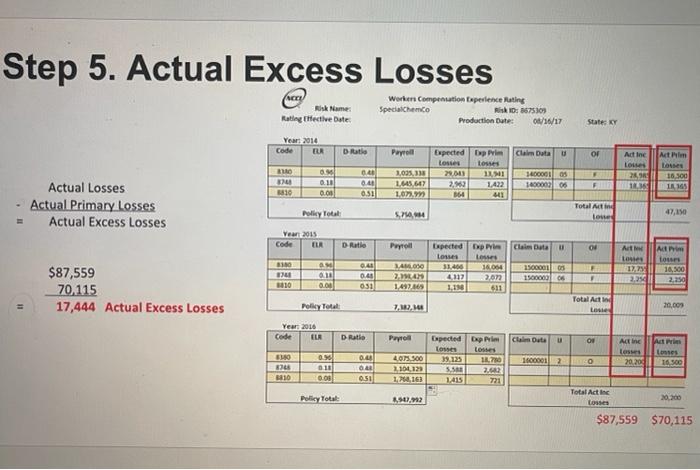

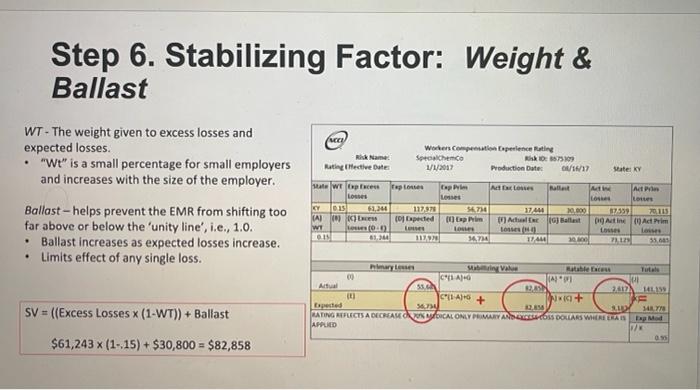

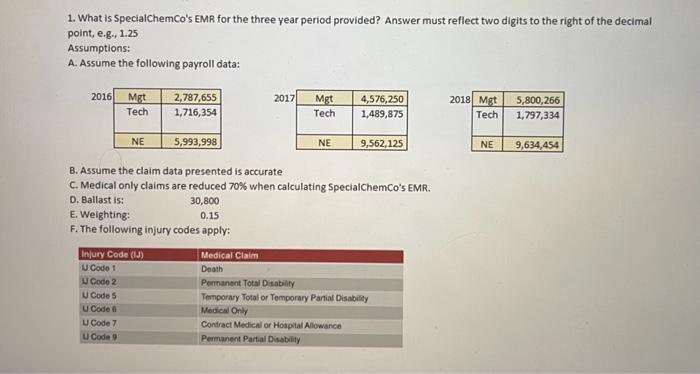

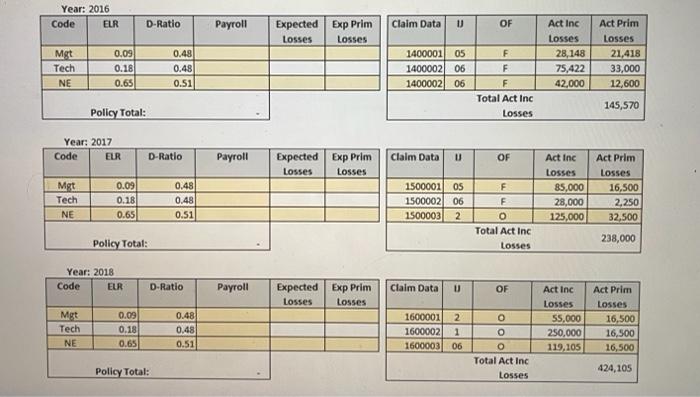

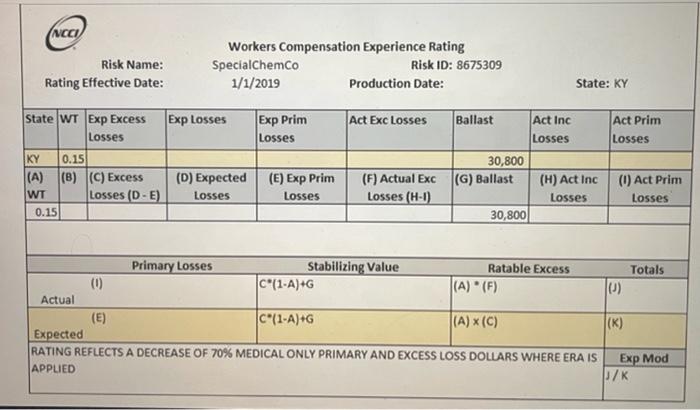

Step 1. Expected Losses Expected Loss Rate (ELR) is the amount of expected losses for the classification for each $100 of payroll. It is needed to calculate Expected Losses (EL) (ELRx Payroll)/100 = EL . Year: 2014 Code ELR D-Ratio 8380 8748 8810 0.96 0.18 0.08 0.48 0.48 0.51 Payroll Expected Losses 3,025,338 29,043 1,645,647 2,962 1,079,999 864 Step 2. Expected Primary Losses Expected Primary Losses (EPL) are a measure of frequency. EPLs reflect the portion of expected claims below the split-point. EPLs are calculated using the Discount Ratio, i.e., the portion of the expected losses that are expected primary losses. D Ratio x EL = EPL Year: 2014 Code ELR D-Ratio Payroll 8380 8748 8810 0.96 0.18 0.08 0.48 0.48 0.51 3,025,338 1,645,647 1,079,999 Expected Exp Prim Losses Losses 29,043 13,941 2,962 1,422 864 441 Step 3. Expected Excess Losses wme Rating the Workers Competion Experience Rating chance Production Date: 5.300 /11/17 Statek Year 2014 Code DRO Pro Espected top Clin Out of Net Me Lories ES MO 08 2101 2.1 14 3 1.6457 LOR 14.00 19 F 0.00! esil Expected Losses Expected Primary losses Expected Excess Losses Total 110 Year C IR Du Papa Expected Price Art ME 14 15 LOD LP 12219 2250 2.1 $117,978 56,735 61,243 Expected Excess Losses 20 GER 00 Total 20.00 Year 2018 Code Date pested Cauta OF Art L Act Les 0 On 0.41 04 6.30 407 110012 Ssa TO 2012 LA . Total 20.300 Loues LM992 $117,978 $56,735 Step 4. Actual Primary Losses Status: Open or Final Actual Incurred Losses Claim Data U OF 1400001 05 1400002 06 Act Inc Losses 28,985 18,365 Act Prim Losses 16,500 18,365 Actual Primary Losses (APL): First $16,500, e.g., of claim; the remainder, if any, are 'Excess Losses'. APL is a measure of frequency; Excess losses are a measure of severity. F F . Total Act Inc Losses 47,350 Injury Type Represents more than a single claim if >$16,500 Inury Code (I Medical Claim Code 1 Death Code 2 Parma Tabay u Code Temporary Toal of Temporary Partially u Code Medical Only Code Conrad Medical or Hospital Allowance Code Parmarar Partial Diably injury Code 6 claims, Medical Only, are reduced 70% when calculating EMR. Step 5. Actual Excess Losses ACRE Risk Name: Rating thective Dates Workers Compensation Baperience Rating Specialchemco isko: 3675309 Production Date: 08/16/17 State KY Year 2014 Code ER Date Payroll Claim Data or Actine Lowes 64 Expected DP Los Losses 29.08 1111 2.93 1.422 164 3.035,333 1.645 647 1.02. 0.10 0.00 Action Los 16.00 15 10000105 16000005 0.40 0.51 F 2. 1 3810 Actual Losses Actual Primary Losses Actual Excess Losses Policy Total S. Total Act in Low 47,150 Year 2015 Code D Rate Payroll Clai Duta od 10 Expected Dp Lones Los 31.466 16.064 4112 200 F Art Loss 12.23 2.25 AM 050 2.94 1.402.869 0.40 Act Lou 18,500 2,250 15000005 15000006 010 0.00 2010 $87,559 70.115 17,444 Actual Excess Losses 053 Polly Total 7.12.14 Total Acid Lose 20,00 Year 2016 Code ELA D Ratio Papel Cauta ov Actinc Less 20.20 04 Expected Expm Iones Los 39,125 1.70 SSM 2.62 1415 721 WP ses 16.500 096 010 0.00 16000012 BER 4.013.500 210412 1,264,161 1810 03 Policy Total: 90.92 Total Actine Los 20.00 $87,559 $70,115 Step 6. Stabilizing Factor: Weight & Ballast WT-The weight given to excess losses and expected losses. "Wt" is a small percentage for small employers and increases with the size of the employer. Ballast - helps prevent the EMR from shifting too far above or below the 'unity line', i.e., 1.0. Ballast increases as expected losses increase. Limits effect of any single loss. Worker compensation perience ting Rk Name: Specacheco 75109 Ratingtective Bates 1/1/2017 Production Dates 01/10/17 Mate Ky at we expertos Cup Ad Dames Act Los Los YDASI 61.244 117.891 5674 1744 10.000 117539 (AJ copected in Ada 16 Hallast Atin Act Prim WY Low (0.02 LO Les 011 11200 11.40 35,6 . VA athlete Totale 00 CHANG Atual IN 2012 1119 CHA) + NING HY RATING REFLECTS A DECREASE CALONLY PRIMARY AND CON DOLLARS WHAT FM APPUED SV = ((Excess Losses x (1-WT)) + Ballast 05 $61,243 x (1-15) +$30,800 = $82,858 1. What Is Specialchemco's EMR for the three year period provided? Answer must reflect two digits to the right of the decimal point, e.g., 1.25 Assumptions: A. Assume the following payroll data: 2016 2017 Mgt Tech 2,787,655 1,716,354 Mgt Tech 4,576,250 1,489,875 2018 Mgt Tech 5,800, 266 1,797,334 NE 5,993,998 NE 9,562,125 NE 9,634,454 B. Assume the claim data presented is accurate C. Medical only claims are reduced 70% when calculating SpecialChemCo's EMR. D. Ballast is: 30,800 E. Weighting: 0.15 F. The following injury codes apply: Injury Code (!) Code 1 Code 2 U Codes u Code U Code 7 U Code Medical Claim Death Permanent Total Disability Temporary Total or Temporary Partial Disability Medical Only Contract Medical or Hospital Allowance Permanent Partial Disability Year: 2016 Code ELR D-Ratio Payroll Claim Data U Expected Exp Prim Losses Losses OF Mgt Tech NE 0.09 0.18 0.65 0.48 0.48 0.51 1400001 1400002 140000206 &&& F F F Total Act Inc Losses Act Inc Losses 28,148 75,422 42,000 Act Prim Losses 21,418 33,000 12,600 145,570 Policy Total: Year: 2017 Code ELR D-Ratio Payroll Claim Data U OF Expected Exp Prim Losses Losses Mgt Tech NE 0.09 0.18 0.65 0.48 0.48 0.51 1500001 OS 1500002 06 1500003 2 F F O Total Act Inc Losses Act Inc Losses 85,000 28,000 125,000 Act Prim Losses 16,500 2,250 32.500 Policy Total: 238,000 Year: 2018 Code ELR D-Ratio Payroll Claim Data U OF Expected Exp Prim Losses Losses Mgt Tech NE 0.09 0.18 0.65 0.48 0.48 0.51 1600001 2 1600002 1 1600003 06 o o O Total Act Inc Losses Act Inc Losses 55,000 250.000 119,105 Act Prim Losses 16,500 16,500 16,500 Policy Total: 424,105 NCCI Risk Name: Rating Effective Date: Workers Compensation Experience Rating SpecialChemco Risk ID: 8675309 1/1/2019 Production Date: State: KY Exp Prim Losses Act Exc Losses Act Prim Losses State WT Exp Excess Exp Losses Losses KY 0.15 (A) (B) (C) Excess (D) Expected WT Losses (D-E) Losses 0.15 Ballast Act Inc Losses 30,800 (G) Ballast (H) Act Inc Losses 30,800 (E) Exp Prim Losses (F) Actual Exc Losses (H-1) (1) Act Prim Losses Primary Losses Stabilizing Value Ratable Excess Totals (0) C*(1-A)+G (A) (F) 0) Actual (E) C"(1-A)+G (A)*(C) (K) Expected RATING REFLECTS A DECREASE OF 70% MEDICAL ONLY PRIMARY AND EXCESS LOSS DOLLARS WHERE ERA IS Exp Mod APPLIED 1./K Step 1. Expected Losses Expected Loss Rate (ELR) is the amount of expected losses for the classification for each $100 of payroll. It is needed to calculate Expected Losses (EL) (ELRx Payroll)/100 = EL . Year: 2014 Code ELR D-Ratio 8380 8748 8810 0.96 0.18 0.08 0.48 0.48 0.51 Payroll Expected Losses 3,025,338 29,043 1,645,647 2,962 1,079,999 864 Step 2. Expected Primary Losses Expected Primary Losses (EPL) are a measure of frequency. EPLs reflect the portion of expected claims below the split-point. EPLs are calculated using the Discount Ratio, i.e., the portion of the expected losses that are expected primary losses. D Ratio x EL = EPL Year: 2014 Code ELR D-Ratio Payroll 8380 8748 8810 0.96 0.18 0.08 0.48 0.48 0.51 3,025,338 1,645,647 1,079,999 Expected Exp Prim Losses Losses 29,043 13,941 2,962 1,422 864 441 Step 3. Expected Excess Losses wme Rating the Workers Competion Experience Rating chance Production Date: 5.300 /11/17 Statek Year 2014 Code DRO Pro Espected top Clin Out of Net Me Lories ES MO 08 2101 2.1 14 3 1.6457 LOR 14.00 19 F 0.00! esil Expected Losses Expected Primary losses Expected Excess Losses Total 110 Year C IR Du Papa Expected Price Art ME 14 15 LOD LP 12219 2250 2.1 $117,978 56,735 61,243 Expected Excess Losses 20 GER 00 Total 20.00 Year 2018 Code Date pested Cauta OF Art L Act Les 0 On 0.41 04 6.30 407 110012 Ssa TO 2012 LA . Total 20.300 Loues LM992 $117,978 $56,735 Step 4. Actual Primary Losses Status: Open or Final Actual Incurred Losses Claim Data U OF 1400001 05 1400002 06 Act Inc Losses 28,985 18,365 Act Prim Losses 16,500 18,365 Actual Primary Losses (APL): First $16,500, e.g., of claim; the remainder, if any, are 'Excess Losses'. APL is a measure of frequency; Excess losses are a measure of severity. F F . Total Act Inc Losses 47,350 Injury Type Represents more than a single claim if >$16,500 Inury Code (I Medical Claim Code 1 Death Code 2 Parma Tabay u Code Temporary Toal of Temporary Partially u Code Medical Only Code Conrad Medical or Hospital Allowance Code Parmarar Partial Diably injury Code 6 claims, Medical Only, are reduced 70% when calculating EMR. Step 5. Actual Excess Losses ACRE Risk Name: Rating thective Dates Workers Compensation Baperience Rating Specialchemco isko: 3675309 Production Date: 08/16/17 State KY Year 2014 Code ER Date Payroll Claim Data or Actine Lowes 64 Expected DP Los Losses 29.08 1111 2.93 1.422 164 3.035,333 1.645 647 1.02. 0.10 0.00 Action Los 16.00 15 10000105 16000005 0.40 0.51 F 2. 1 3810 Actual Losses Actual Primary Losses Actual Excess Losses Policy Total S. Total Act in Low 47,150 Year 2015 Code D Rate Payroll Clai Duta od 10 Expected Dp Lones Los 31.466 16.064 4112 200 F Art Loss 12.23 2.25 AM 050 2.94 1.402.869 0.40 Act Lou 18,500 2,250 15000005 15000006 010 0.00 2010 $87,559 70.115 17,444 Actual Excess Losses 053 Polly Total 7.12.14 Total Acid Lose 20,00 Year 2016 Code ELA D Ratio Papel Cauta ov Actinc Less 20.20 04 Expected Expm Iones Los 39,125 1.70 SSM 2.62 1415 721 WP ses 16.500 096 010 0.00 16000012 BER 4.013.500 210412 1,264,161 1810 03 Policy Total: 90.92 Total Actine Los 20.00 $87,559 $70,115 Step 6. Stabilizing Factor: Weight & Ballast WT-The weight given to excess losses and expected losses. "Wt" is a small percentage for small employers and increases with the size of the employer. Ballast - helps prevent the EMR from shifting too far above or below the 'unity line', i.e., 1.0. Ballast increases as expected losses increase. Limits effect of any single loss. Worker compensation perience ting Rk Name: Specacheco 75109 Ratingtective Bates 1/1/2017 Production Dates 01/10/17 Mate Ky at we expertos Cup Ad Dames Act Los Los YDASI 61.244 117.891 5674 1744 10.000 117539 (AJ copected in Ada 16 Hallast Atin Act Prim WY Low (0.02 LO Les 011 11200 11.40 35,6 . VA athlete Totale 00 CHANG Atual IN 2012 1119 CHA) + NING HY RATING REFLECTS A DECREASE CALONLY PRIMARY AND CON DOLLARS WHAT FM APPUED SV = ((Excess Losses x (1-WT)) + Ballast 05 $61,243 x (1-15) +$30,800 = $82,858 1. What Is Specialchemco's EMR for the three year period provided? Answer must reflect two digits to the right of the decimal point, e.g., 1.25 Assumptions: A. Assume the following payroll data: 2016 2017 Mgt Tech 2,787,655 1,716,354 Mgt Tech 4,576,250 1,489,875 2018 Mgt Tech 5,800, 266 1,797,334 NE 5,993,998 NE 9,562,125 NE 9,634,454 B. Assume the claim data presented is accurate C. Medical only claims are reduced 70% when calculating SpecialChemCo's EMR. D. Ballast is: 30,800 E. Weighting: 0.15 F. The following injury codes apply: Injury Code (!) Code 1 Code 2 U Codes u Code U Code 7 U Code Medical Claim Death Permanent Total Disability Temporary Total or Temporary Partial Disability Medical Only Contract Medical or Hospital Allowance Permanent Partial Disability Year: 2016 Code ELR D-Ratio Payroll Claim Data U Expected Exp Prim Losses Losses OF Mgt Tech NE 0.09 0.18 0.65 0.48 0.48 0.51 1400001 1400002 140000206 &&& F F F Total Act Inc Losses Act Inc Losses 28,148 75,422 42,000 Act Prim Losses 21,418 33,000 12,600 145,570 Policy Total: Year: 2017 Code ELR D-Ratio Payroll Claim Data U OF Expected Exp Prim Losses Losses Mgt Tech NE 0.09 0.18 0.65 0.48 0.48 0.51 1500001 OS 1500002 06 1500003 2 F F O Total Act Inc Losses Act Inc Losses 85,000 28,000 125,000 Act Prim Losses 16,500 2,250 32.500 Policy Total: 238,000 Year: 2018 Code ELR D-Ratio Payroll Claim Data U OF Expected Exp Prim Losses Losses Mgt Tech NE 0.09 0.18 0.65 0.48 0.48 0.51 1600001 2 1600002 1 1600003 06 o o O Total Act Inc Losses Act Inc Losses 55,000 250.000 119,105 Act Prim Losses 16,500 16,500 16,500 Policy Total: 424,105 NCCI Risk Name: Rating Effective Date: Workers Compensation Experience Rating SpecialChemco Risk ID: 8675309 1/1/2019 Production Date: State: KY Exp Prim Losses Act Exc Losses Act Prim Losses State WT Exp Excess Exp Losses Losses KY 0.15 (A) (B) (C) Excess (D) Expected WT Losses (D-E) Losses 0.15 Ballast Act Inc Losses 30,800 (G) Ballast (H) Act Inc Losses 30,800 (E) Exp Prim Losses (F) Actual Exc Losses (H-1) (1) Act Prim Losses Primary Losses Stabilizing Value Ratable Excess Totals (0) C*(1-A)+G (A) (F) 0) Actual (E) C"(1-A)+G (A)*(C) (K) Expected RATING REFLECTS A DECREASE OF 70% MEDICAL ONLY PRIMARY AND EXCESS LOSS DOLLARS WHERE ERA IS Exp Mod APPLIED 1./K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts